Question: can someone help please? this formula is not working, is there something wrong with it? Finance Depreciation Schedules - Excel X FILE HOME INSERT PAGE

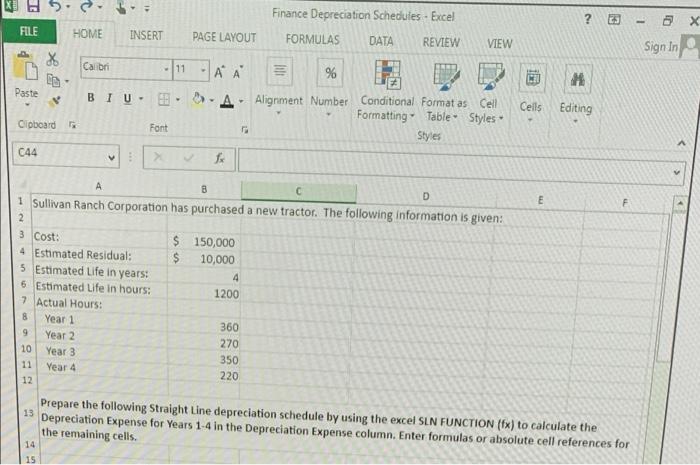

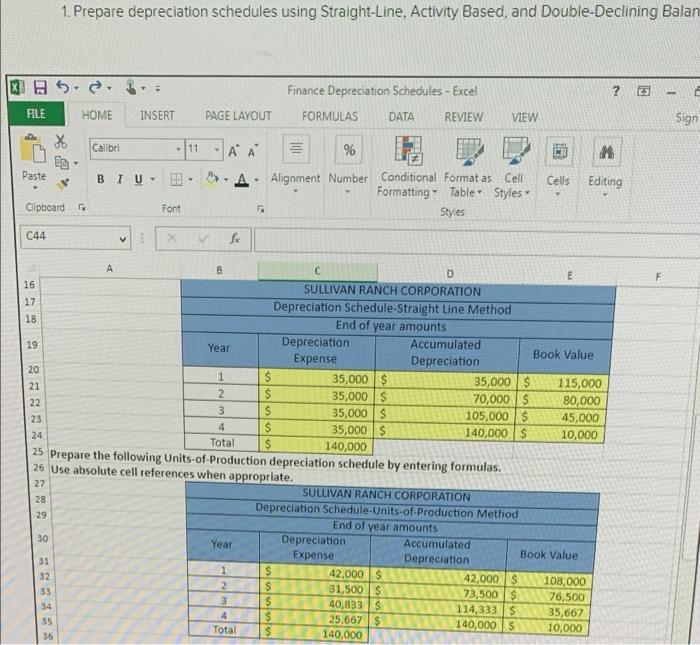

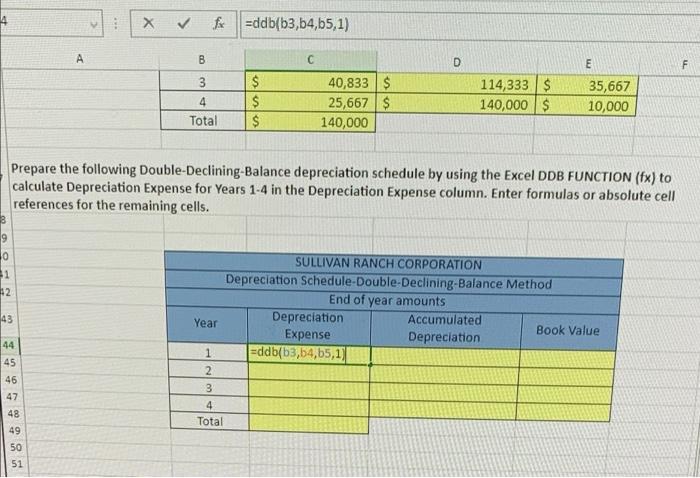

Finance Depreciation Schedules - Excel X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign in X Calibri -11 i M Paste > BIU- AA % D.A. Alignment Number Conditional Format as Cell Formatting Table Styles Styles Ceils Editing Clipboard Font 044 f E F > 3 Cost: D 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 2 $ 150,000 4 Estimated Residual: $ 10,000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 Year 2 270 10 Year 3 350 11 Year 4 220 12 360 9 13 Prepare the following Straight Line depreciation schedule by using the excel SIN FUNCTION (fx) to calculate the Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 14 15 1. Prepare depreciation schedules using Straight-Line, Activity Based, and Double-Declining Balan XS. ? 1 Finance Depreciation Schedules - Excel FORMULAS DATA REVIEW FILE HOME INSERT PAGE LAYOUT VIEW Sign X Calibri 11 A A 10 % Paste BIU Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font C44 f F A B D E 16 SULLIVAN RANCH CORPORATION 17 Depreciation Schedule Straight Line Method 18 End of year amounts 19 Year Depreciation Accumulated Book Value Expense Depreciation 20 1 $ 35,000 $ 35,000 $ 115,000 21 2 $ 35,000 $ 70,000 S 22 80,000 3 $ 35,000$ 105,000 23 45,000 4 $ 35,000 $ 140,000 $ 24 10,000 Total $ 140,000 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. 27 SULLIVAN RANCH CORPORATION 28 Depreciation Schedule-Units-of-Production Method 29 End of year amounts 30 Year Depreciation Accumulated Expense Book Value 31 Depreciation 1 $ 42,000$ 32 42,000S 108,000 2 $ 33 31,500S 73,500 $ 76,500 3 $ 40,833 S 34 114,3335 4 $ 35,667 35 25,667 $ 140,000 S Total $ 10,000 36 140,000 lo =ddb(b3, b4,b5,1) A 8 B D E F 3 ulus $ $ $ 4 Total 40,833 $ 25,667 $ 140,000 114,333$ 140,000 $ 35,667 10,000 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 0 1 12 43 44 45 46 47 48 49 50 51 SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Accumulated Year Book Value Expense Depreciation 1 =ddb(63,64,65,1) 2 3 4 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts