Question: Can someone help solve this while showing all yoir work and calculations. I especially need to know the calculations for the Expected project net income

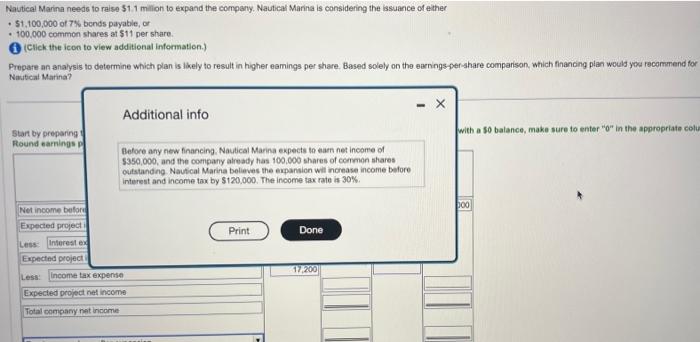

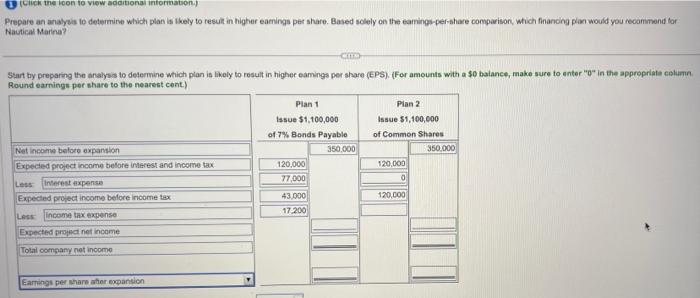

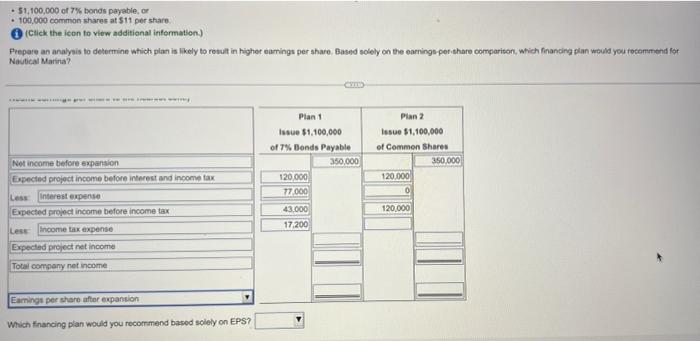

Nautical Marina needs to raise 51.1millo to expand the company. Nautical Marina is considering the issuance of ether - 51,100,000 of 7% bends payatile, or - 100,000 common shares at $11 per share. (1) (Click the icon to view additional information.) Prepare an analysis to determine which plan is likely to result in higher eamings per share. Based solely on the earningsper-share comparison, which finanong plan would you recommend for Nastical Marina? Additional info Stant by preparing 4 Round earnings p Before any new financing. Nautical Marina expects to eam net income of 5350,000 , and the company already has 100,000 shares of common shares cutstanding. Nautical Marina believes the expansion wil norease income belore interest and income tax by $120.000. The income tax rate is 30%. Prepare an anayes to determine which plan is thely to result in highter eamings pat share. Based sclely on the eamings-per-share comparison, which financing plan would you recontmend tor Nastical Marina? Sart by preparing the analyss to determine which plan is likely to result in higher eamings per share (EPS). (For amounts with a $0 baiance, make sure to enter "0" in the appropriate esturnn. - 51,100,000 of 7% bonds payable, or - 100,000 common shares at 511 per share (1) (Ctick the icon to viow additional information) Prepare an analysis to deterrine which plat is likely to rotut in highot aarings per share. Based solely on the earnings por share comparison, which financing plan wrould you totommend for Nasical Marina? Which finanding plan would you recommend based sovey on tror

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts