Question: Can someone help with closing entry for this question? Presented below is the December 31 trial balance of Wildhorse Boutique. WILDHORSE BOUTIQUE TRIAL BALANCE DECEMBER

Can someone help with closing entry for this question?

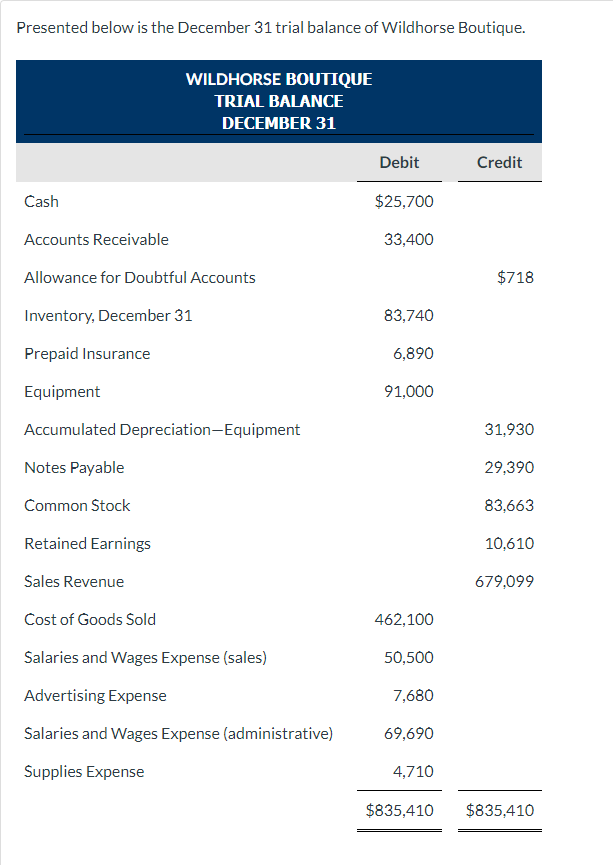

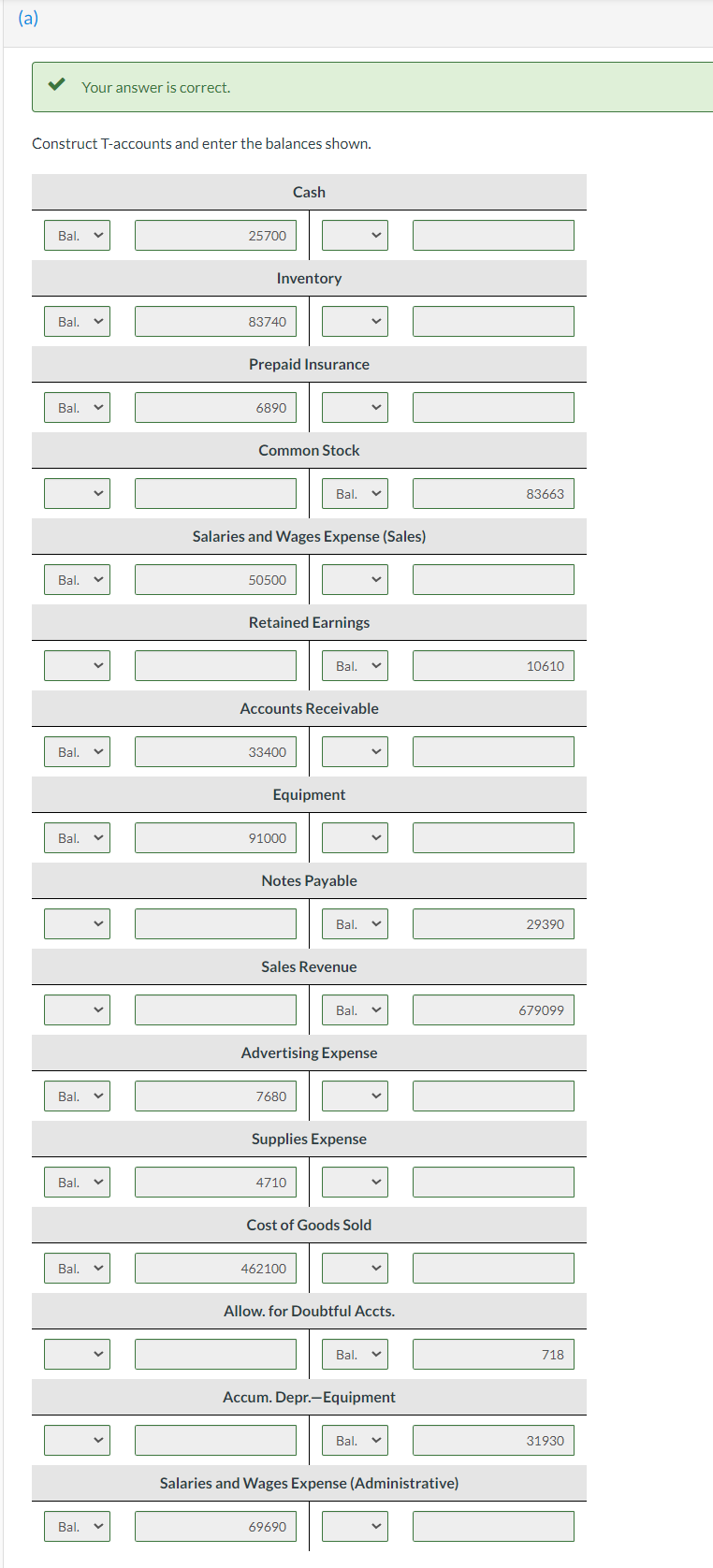

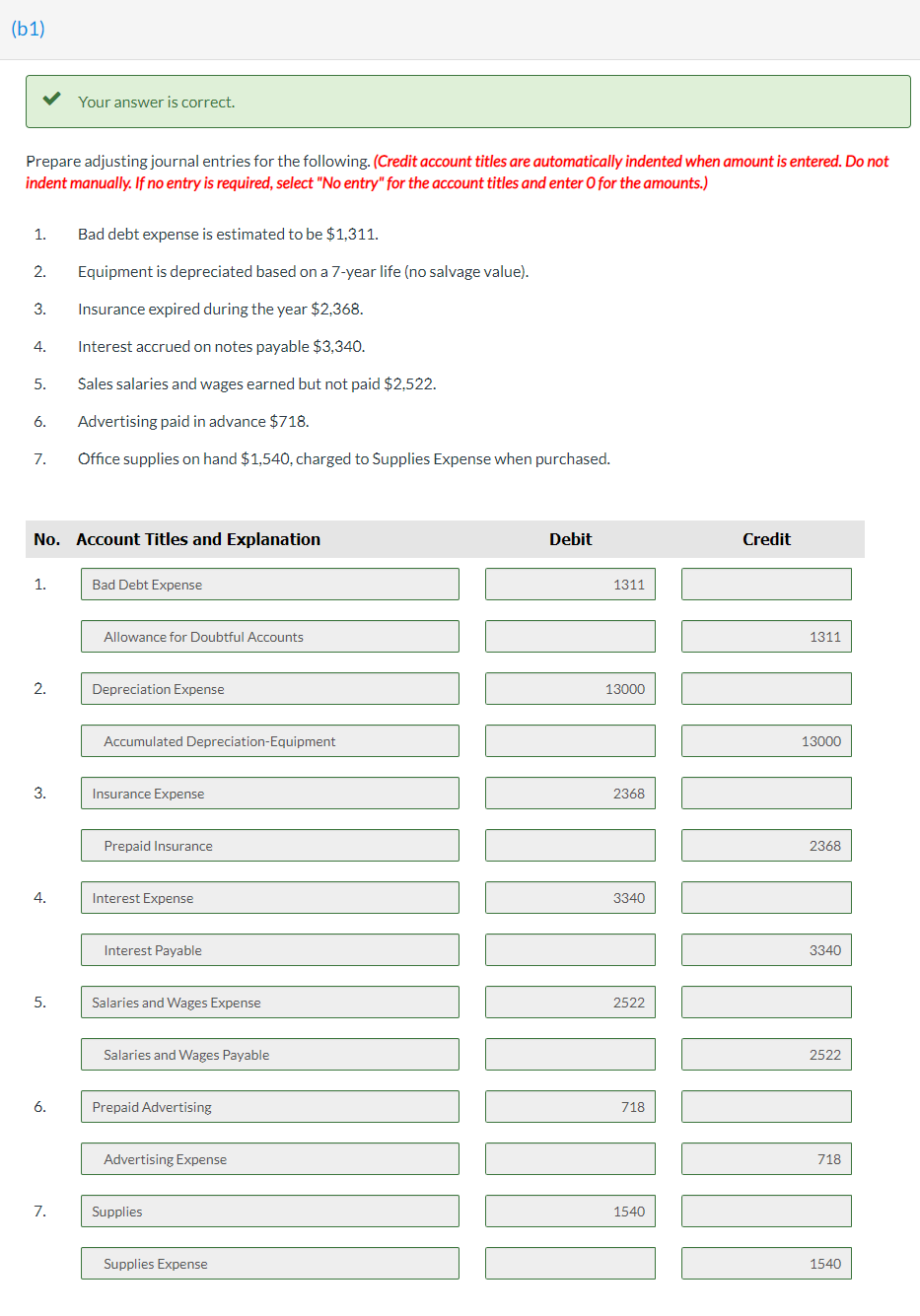

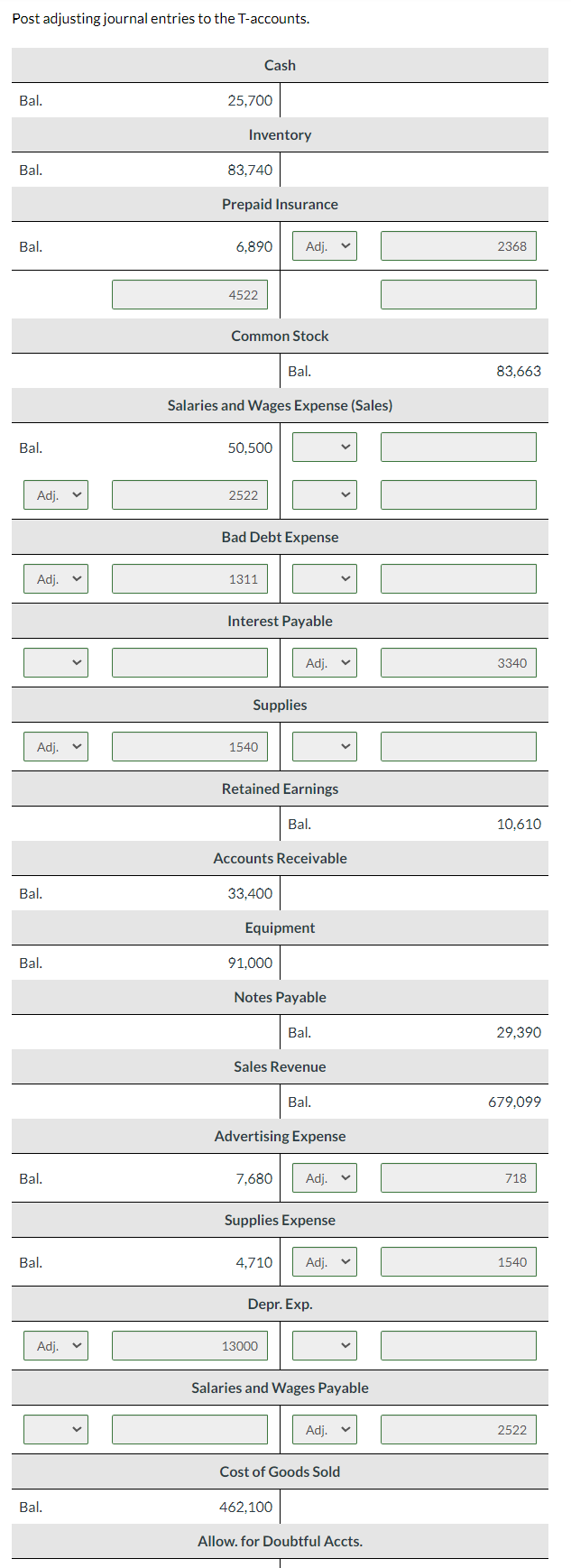

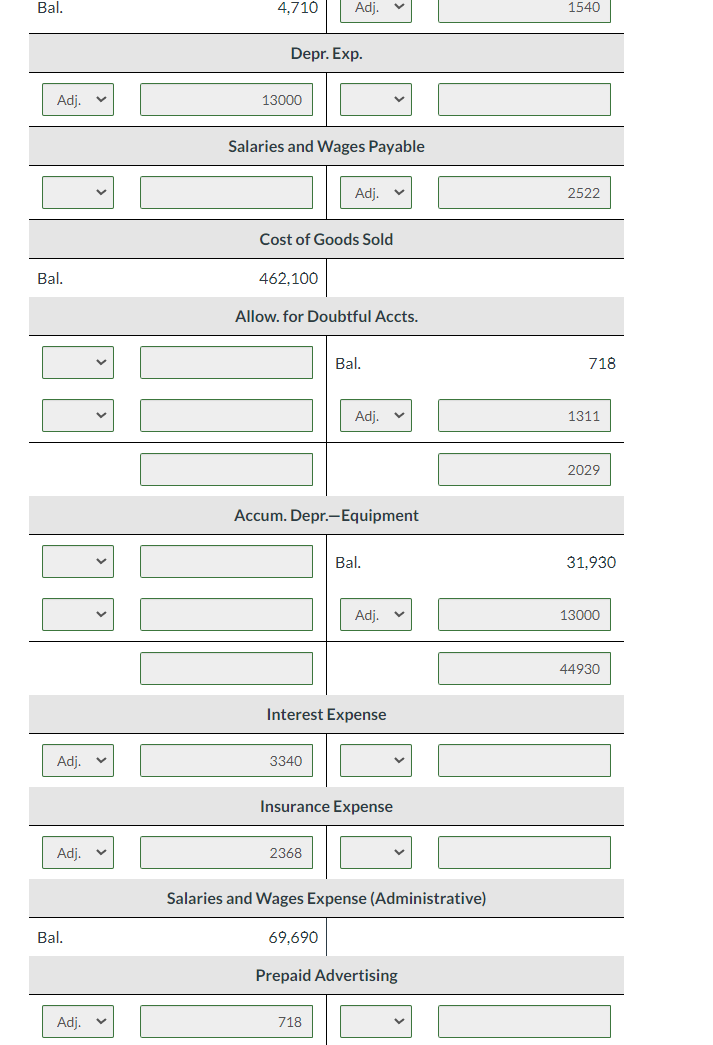

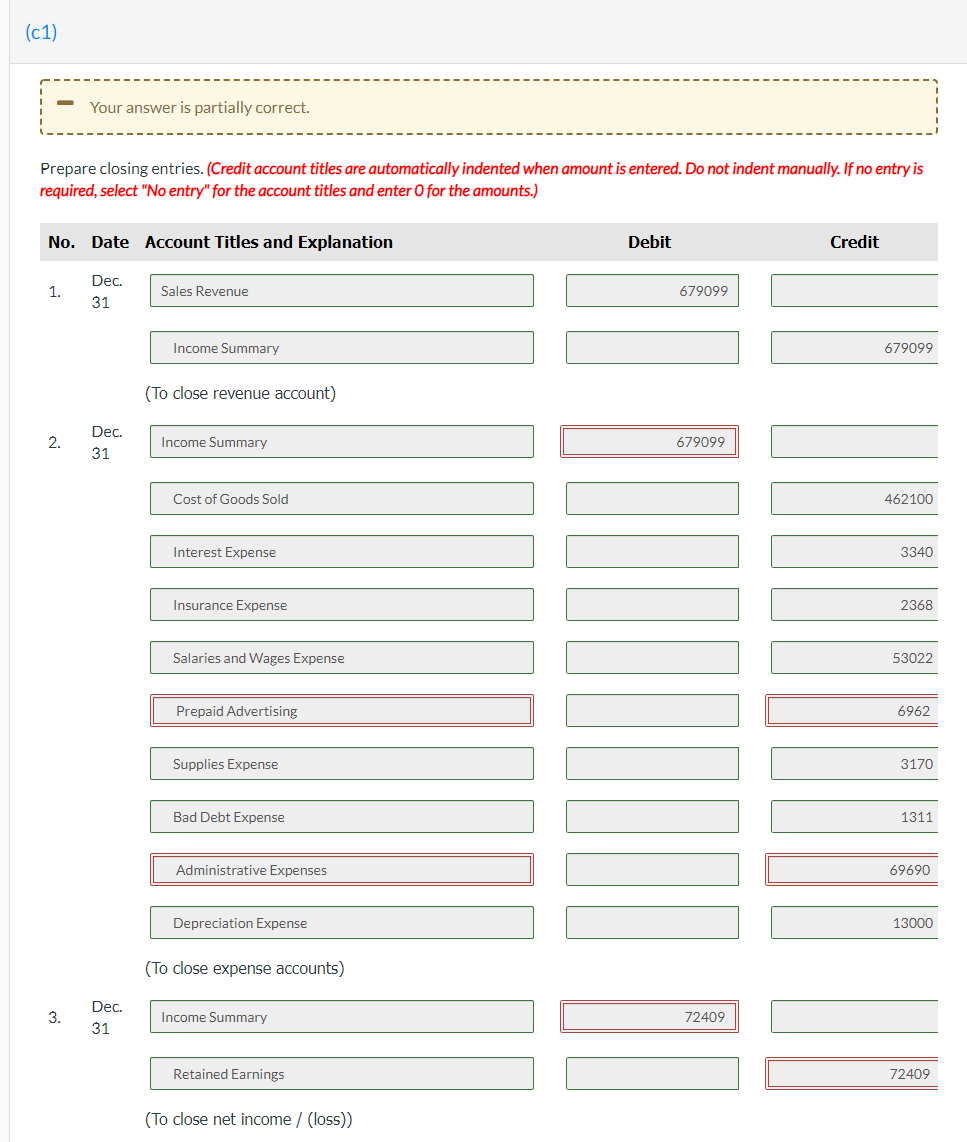

Presented below is the December 31 trial balance of Wildhorse Boutique. WILDHORSE BOUTIQUE TRIAL BALANCE DECEMBER 31 Debit Credit Cash $25,700 Accounts Receivable 33,400 Allowance for Doubtful Accounts $718 Inventory, December 31 83,740 Prepaid Insurance 6,890 Equipment 91,000 31,930 Accumulated Depreciation-Equipment Notes Payable Common Stock 29,390 83,663 Retained Earnings 10,610 Sales Revenue 679,099 Cost of Goods Sold 462,100 Salaries and Wages Expense (sales) 50,500 Advertising Expense 7,680 Salaries and Wages Expense administrative) 69,690 Supplies Expense 4,710 $835,410 $835,410 (a) Your answer is correct. Construct T-accounts and enter the balances shown. Cash Bal. 25700 Inventory Bal. 83740 Prepaid Insurance Bal. 6890 Common Stock Bal. 83663 Salaries and Wages Expense (Sales) Bal. 50500 Retained Earnings Bal. 10610 Accounts Receivable Bal. 33400 Equipment Bal. 91000 Notes Payable Bal. 29390 Sales Revenue Bal. 679099 Advertising Expense Bal. 7680 Supplies Expense Bal. 4710 Cost of Goods Sold Bal. 462100 Allow. for Doubtful Accts. Bal. 718 Accum. Depr.-Equipment Bal. 31930 Salaries and Wages Expense (Administrative) Bal. 69690 (51) Your answer is correct. Prepare adjusting journal entries for the following. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) 1. Bad debt expense is estimated to be $1,311. 2. Equipment is depreciated based on a 7-year life (no salvage value). 3. 3. Insurance expired during the year $2.368. 4 Interest accrued on notes payable $3,340. 5. Sales salaries and wages earned but not paid $2,522. 6. Advertising paid in advance $718. 7. Office supplies on hand $1,540, charged to Supplies Expense when purchased. No. Account Titles and Explanation Debit Credit 1. Bad Debt Expense 1311 Allowance for Doubtful Accounts 1311 2. Depreciation Expense 13000 Accumulated Depreciation Equipment 13000 3. Insurance Expense 2368 Prepaid Insurance 2368 4. Interest Expense 3340 Interest Payable 3340 5. Salaries and Wages Expense 2522 Salaries and Wages Payable 2522 6. Prepaid Advertising 718 Advertising Expense 718 7. Supplies 1540 Supplies Expense 1540 Post adjusting journal entries to the T-accounts. Cash Bal. 25,700 Inventory Bal. 83.740 Prepaid Insurance Bal. 6,890 Adj. 2368 4522 Common Stock Bal. 83.663 Salaries and Wages Expense (Sales) Bal. 50,500 7 Adj. 2522 Bad Debt Expense Adj. 1311 Interest Payable Adj. 3340 Supplies Adj. 1540 Re Earnings Bal. 10,610 Accounts Receivable Bal. 33,400 Equipment Bal. 91.000 Notes Payable Bal. 29,390 Sales Revenue Bal. 679,099 Advertising Expense Bal. 7.680 Adj. 718 Supplies Expense Bal. 4,710 Adj. 1540 Depr. Exp. Adj. 13000 Salaries and Wages Payable Adj. V 2522 Cost of Goods Sold Bal. 462,100 Allow. for Doubtful Accts. Bal. 4,710 > Adj. 1540 Depr. Exp. Adj. 13000 Salaries and Wages Payable Adj. 2522 Cost of Goods Sold Bal. 462.100 Allow. for Doubtful Accts. Bal. 718 Adj. 1311 2029 Accum. Depr.-Equipment Bal. 31,930 Adj. 13000 44930 Interest Expense Adj. 3340 Insurance Expense Adj. 2368 Salaries and Wages Expense (Administrative) Bal. 69,690 Prepaid Advertising Adj. V 718 (c1) Your answer is partially correct. Prepare closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) No. Date Account Titles and Explanation Debit Credit Dec. 1. Sales Revenue 679099 31 Income Summary 679099 (To close revenue account) 2. Dec. 31 Income Summary 679099 Cost of Goods Sold 462100 ADA Interest Expense 3340 Insurance Expense 2368 Salaries and Wages Expense 53022 Prepaid Advertising 6962 Supplies Expense 3170 Bad Debt Expense 1311 Administrative Expenses 69690 Depreciation Expense 13000 (To close expense accounts) 3. Dec. 31 Income Summary 72409 I! Retained Earnings 72409 (To close net income / (loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts