Question: Can someone help with part 3 in R? How do I set up the one way Anova and whats the coding used for this problem.

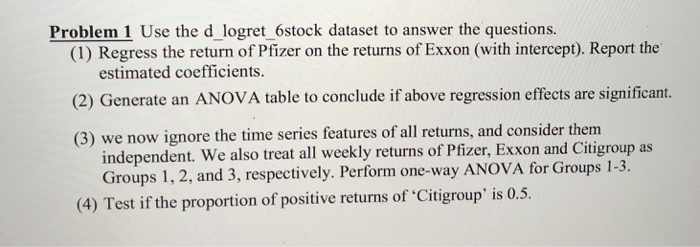

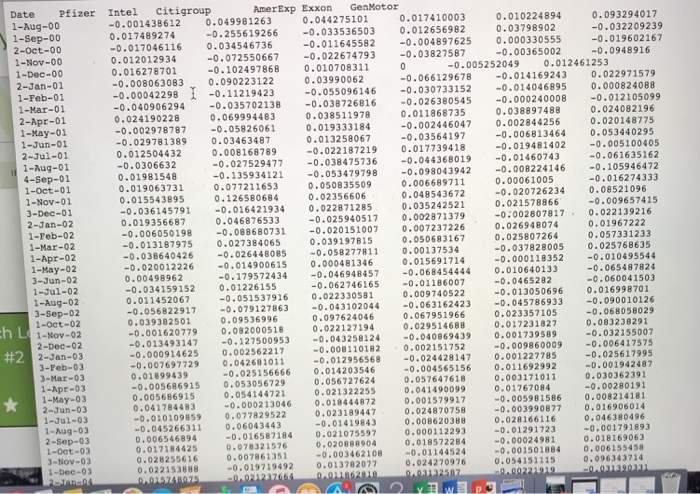

Problem 1 Use the d_logret_6stock dataset to answer the questions. (1) Regress the return of Pfizer on the returns of Exxon (with intercept). Report the estimated coefficients (2) Generate an ANOVA table to conclude if above regression effects are significant. (3) we now ignore the time series features of all returns, and consider them independent. We also treat all weekly returns of Pfizer, Exxon and Citigroup as Groups 1, 2, and 3, respectively. Perform one-way ANOVA for Groups 1-3. (4) Test if the proportion of positive returns of Citigroup' is 0.5. Problem 1 Use the d_logret_6stock dataset to answer the questions. (1) Regress the return of Pfizer on the returns of Exxon (with intercept). Report the estimated coefficients (2) Generate an ANOVA table to conclude if above regression effects are significant. (3) we now ignore the time series features of all returns, and consider them independent. We also treat all weekly returns of Pfizer, Exxon and Citigroup as Groups 1, 2, and 3, respectively. Perform one-way ANOVA for Groups 1-3. (4) Test if the proportion of positive returns of Citigroup' is 0.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts