Question: Can someone help with the following problem. I need it in the next couple of days. Holmes has developed chocolate marbles. The product will be

Can someone help with the following problem. I need it in the next couple of days.

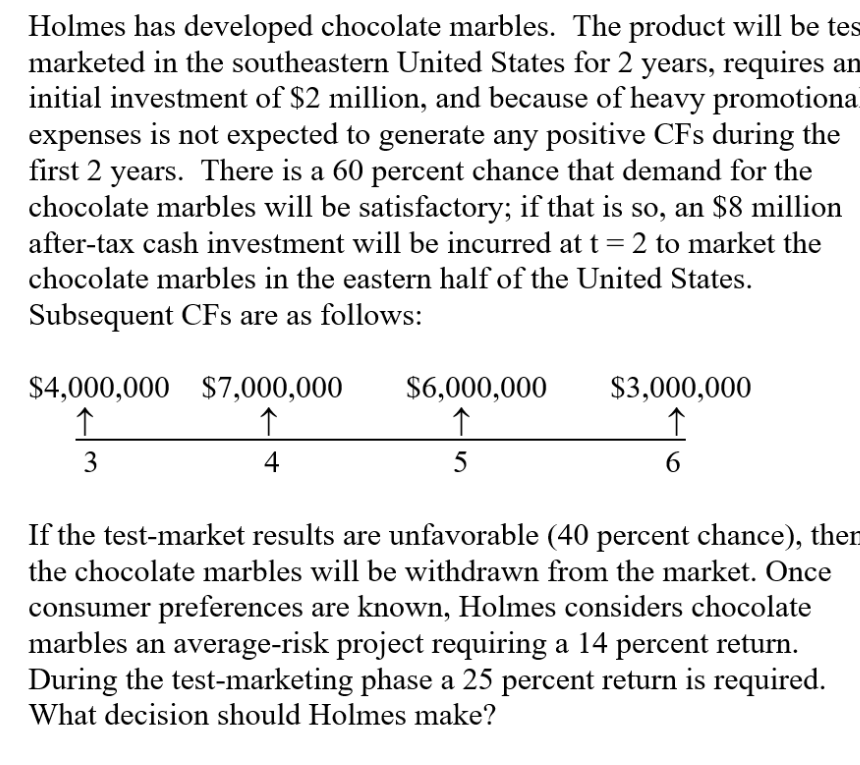

Holmes has developed chocolate marbles. The product will be tes marketed in the southeastern United States for 2 years, requires an initial investment of $2 million, and because of heavy promotiona expenses is not expected to generate any positive CFs during the first 2 years. There is a 60 percent chance that demand for the chocolate marbles will be satisfactory; if that is so, an $8 million after-tax cash investment will be incurred at t=2 to market the chocolate marbles in the eastern half of the United States. Subsequent CFs are as follows: If the test-market results are unfavorable (40 percent chance), ther the chocolate marbles will be withdrawn from the market. Once consumer preferences are known, Holmes considers chocolate marbles an average-risk project requiring a 14 percent return. During the test-marketing phase a 25 percent return is required. What decision should Holmes make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts