Question: Can someone help with the problem below? The one in the web is not correct 3. You have a cancer drug project that requires a

Can someone help with the problem below? The one in the web is not correct

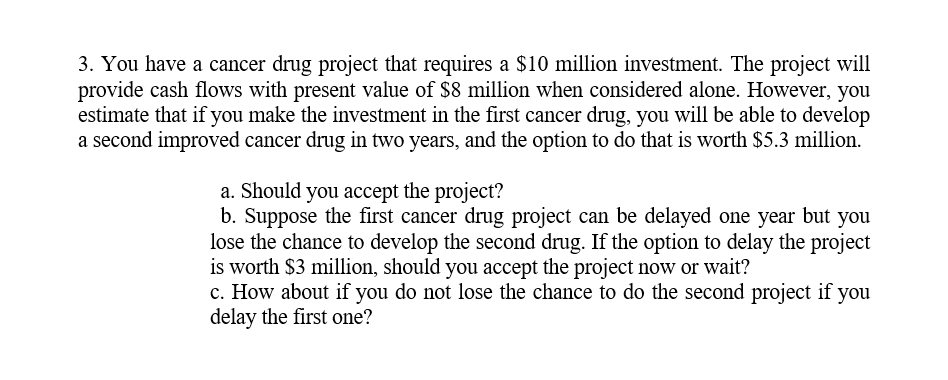

3. You have a cancer drug project that requires a $10 million investment. The project will provide cash flows with present value of $8 million when considered alone. However, you estimate that if you make the investment in the first cancer drug, you will be able to develop a second improved cancer drug in two years, and the option to do that is worth $5.3 million. a. Should you accept the project? b. Suppose the first cancer drug project can be delayed one year but you lose the chance to develop the second drug. If the option to delay the project is worth $3 million, should you accept the project now or wait? c. How about if you do not lose the chance to do the second project if you delay the first one? 3. You have a cancer drug project that requires a $10 million investment. The project will provide cash flows with present value of $8 million when considered alone. However, you estimate that if you make the investment in the first cancer drug, you will be able to develop a second improved cancer drug in two years, and the option to do that is worth $5.3 million. a. Should you accept the project? b. Suppose the first cancer drug project can be delayed one year but you lose the chance to develop the second drug. If the option to delay the project is worth $3 million, should you accept the project now or wait? c. How about if you do not lose the chance to do the second project if you delay the first one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts