Question: Can someone help with this please? I need about 2 pages worth for this. Using the data from this modules Connect Excel Simulation - Calculation

Can someone help with this please? I need about 2 pages worth for this.

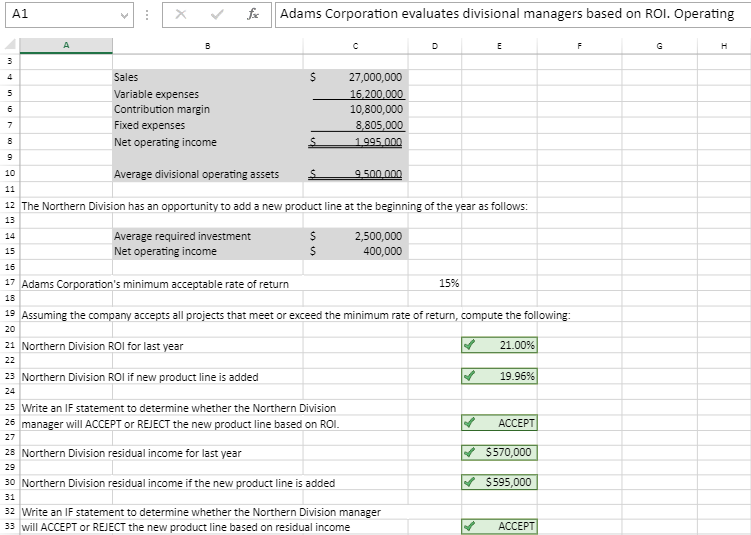

Using the data from this modules Connect Excel Simulation - "Calculation of Return of Investment and Residual Income for Adam Corporations Northern Division", compare and contrast how the calculations may have impacted the division managers decision regarding accepting or rejecting a new product line. Include discussion of the limits of using ROI vs Residual Income for evaluating performance of the division. Do you think the division managers decision to invest would change if his/her bonus was based on company ROI versus Residual Income? What is best for the company as a whole?

A1 XfAdams Corporation evaluates divisional managers based on ROI. Operating 5 27,000,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 10,800,000 8805,000 10 Average divisional operating assets9500 000 12 The Northern Division has an opportunity to add a new product line at the beginning of the year as follows: Average required investment Net operating income 2,500,000 400,000 15 Adams Corporation's minimum acceptable rate of return 15 19 20 15% ing the company accepts all projects that meet or exceed the minimum rate of r , compute the following 21 Northern Division ROI for last year 21.00% 23 Northern Division ROI if new product line is added 19.96% 25 26 manager will ACCEPT or REJECT the new product line based on RO 2 Northern Division residual income for last year an IF statement to determine whether the Northern Division ACCEPT 570,000 $595,000 29 30 Northern Division residual income if the new product line is added 2 Write an IF statement to determine whether the Northern Division manager 33 will ACCEPT or REJECT the new product line based on residual income ACCEPT A1 XfAdams Corporation evaluates divisional managers based on ROI. Operating 5 27,000,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 10,800,000 8805,000 10 Average divisional operating assets9500 000 12 The Northern Division has an opportunity to add a new product line at the beginning of the year as follows: Average required investment Net operating income 2,500,000 400,000 15 Adams Corporation's minimum acceptable rate of return 15 19 20 15% ing the company accepts all projects that meet or exceed the minimum rate of r , compute the following 21 Northern Division ROI for last year 21.00% 23 Northern Division ROI if new product line is added 19.96% 25 26 manager will ACCEPT or REJECT the new product line based on RO 2 Northern Division residual income for last year an IF statement to determine whether the Northern Division ACCEPT 570,000 $595,000 29 30 Northern Division residual income if the new product line is added 2 Write an IF statement to determine whether the Northern Division manager 33 will ACCEPT or REJECT the new product line based on residual income ACCEPT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts