Question: Can someone help with this? Please show all work. The Mason Corporation's present capital structure, which is also its target capital structure, calls for 50

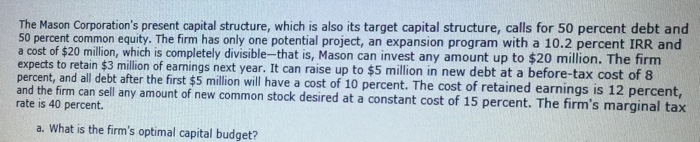

The Mason Corporation's present capital structure, which is also its target capital structure, calls for 50 percent debt and 50 percent common equity. The firm has only one potential project, an expansion program with a 10.2 percent IRR and is completely divisible-that is, Mason can invest any amount up to $20 million. The firm f earnings next year. It can raise up to $5 million in new debt at a before-tax cost of 8 on, W and the firm can sell any amount of new common stock desired at a constant cost of 15 perce rate is 40 percent. million will have a cost of 10 percent. The cost of retained earnings is 12 percent, nt. The firm's marginal tax a. What is the firm's optimal capital budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts