Question: Can someone help with this question? attached is an example to help 6.3b#4 Question 4 1 pts 4. Dave needs to pay 1400 at the

Can someone help with this question? attached is an example to help

6.3b#4

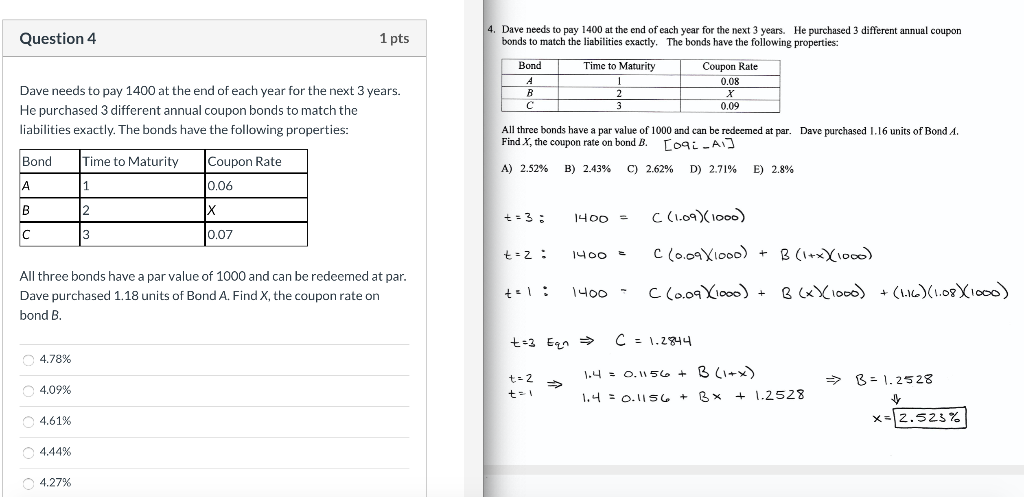

Question 4 1 pts 4. Dave needs to pay 1400 at the end of each year for the next 3 years. He purchased 3 different annual coupon bonds to match the liabilities exactly. The bonds have the following properties: Bond Time to Maturity Coupon Rate 0.08 2 Dave needs to pay 1400 at the end of each year for the next 3 years. He purchased 3 different annual coupon bonds to match the liabilities exactly. The bonds have the following properties: 0.09 All three bonds have a par value of 1000 and can be redeemed at par. Dave purchased 1.16 units of Bond A. Find X, the coupon rate on bond B. TOL AI A) 2.52% B) 2.43% C) 2.62% D) 2.71% E) 2.8% Bond A 1 B Time to Maturity 0 2 Coupon Rate .06 X 0.07 t=3; 1400 = C(1.091000) t=2: 1400 C (0.09X1000) + B (1+xX1000) All three bonds have a par value of 1000 and can be redeemed at par Dave purchased 1.18 units of Bond A. Find X, the coupon rate on bond B. +1: 1400- C (0.09 X1000) + B (x 1000) +(1-16) (1.08X1000) t-3 Eqn C = 1.2844 4.78% t= 2 4.09% t- > 1 4 = 0.156 + B (1 x) 1.4 = 0.14 50 + 2x + 1.2528. B = 1.2528 4.61% x-2.5237 4.44% 4.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts