Question: Can someone let me know if I'm doing this correctly? An employee contributes $16,400 to a 401(k) plan each year, and the company matches 10

Can someone let me know if I'm doing this correctly?

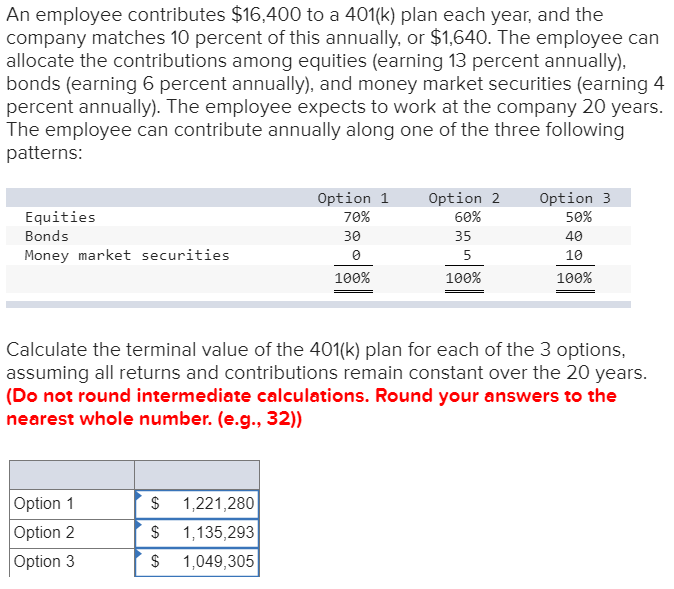

An employee contributes $16,400 to a 401(k) plan each year, and the company matches 10 percent of this annually, or $1,640. The employee can allocate the contributions among equities (earning 13 percent annually), bonds (earning 6 percent annually), and money market securities (earning 4 percent annually). The employee expects to work at the company 20 years. The employee can contribute annually along one of the three following patterns: Equities Bonds Money market securities Option 1 70% 30 Option 2 60% 35 Option 3 50% 40 10 100% 100% 100% Calculate the terminal value of the 401(k) plan for each of the 3 options, assuming all returns and contributions remain constant over the 20 years. (Do not round intermediate calculations. Round your answers to the nearest whole number. (e.g., 32)) Option 1 Option 2 Option 3 $ $ $ 1,221,280 1,135,293 1,049,305 An employee contributes $16,400 to a 401(k) plan each year, and the company matches 10 percent of this annually, or $1,640. The employee can allocate the contributions among equities (earning 13 percent annually), bonds (earning 6 percent annually), and money market securities (earning 4 percent annually). The employee expects to work at the company 20 years. The employee can contribute annually along one of the three following patterns: Equities Bonds Money market securities Option 1 70% 30 Option 2 60% 35 Option 3 50% 40 10 100% 100% 100% Calculate the terminal value of the 401(k) plan for each of the 3 options, assuming all returns and contributions remain constant over the 20 years. (Do not round intermediate calculations. Round your answers to the nearest whole number. (e.g., 32)) Option 1 Option 2 Option 3 $ $ $ 1,221,280 1,135,293 1,049,305

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts