Question: Can someone please answer all the question and explain them. 40 points (8 points per section) Assume that you are the chief financial officer for

Can someone please answer all the question and explain them.

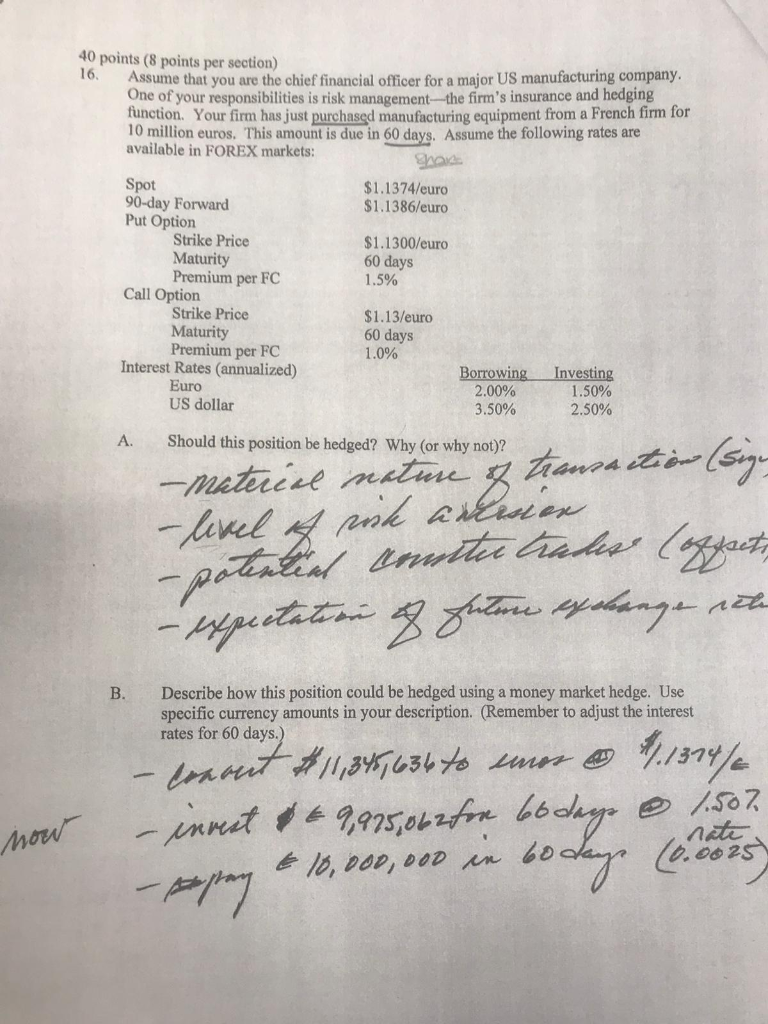

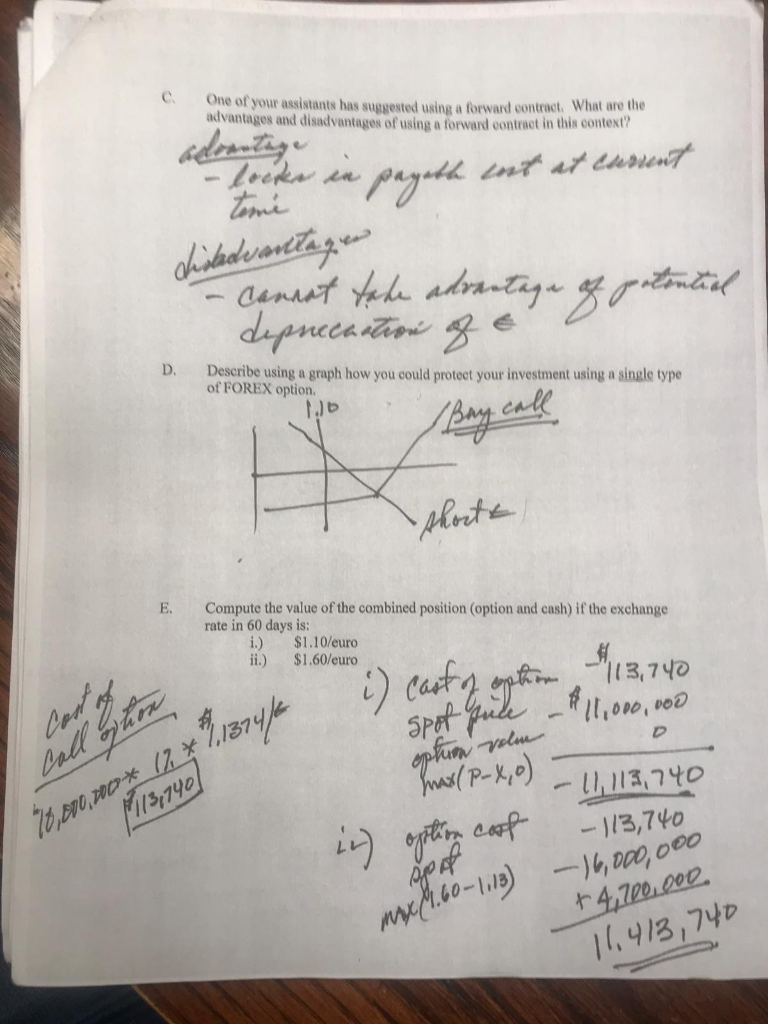

40 points (8 points per section) Assume that you are the chief financial officer for a major US manufacturing company. 16, One of your responsibilities is risk management-the firm's insurance and hedging function. Your firm has just purchased manufacturing equipment from a French firm for 10 million euros. This amount is due in 60 days. Assume the following rates are available in FOREX markets: Spot 90-day Forward Put Option $1.1374/euro $1.1386/euro Strike Price Maturity Premium per FC $1.1300/euro 60 days 1.5% Call Option Strike Price $1.13/euro 60 days 1.0% Maturity Premium per FC Interest Rates (annualized) Euro US dollar Borrowing 2.00% 3.50% Investing 1.50% 2.50% Should this position be hedged? Why (or why not)? A. tranoa -materene mtue -petalinl ta adee (t -ypitatni n Describe how this position could be hedged using a money market hedge. Use specific currency amounts in your description. (Remember to adjust the interest rates for 60 days.) . - aut 3 nite 10, DOD, DOD PIT) C. One of your assistants has suggested using a forward contract. What are the advantages and disadvantages of using a forward contract in this context adcetey Leeka n paye temi int at eusrunt hiskdk raretog depneca e D. Describe using a graph how you could protect your investment using a single type of FOREX option. Bay cade plrte E. Compute the value of the combined position (option and cash) if the exchange rate in 60 days is: i.) ii. $1.10/euro $1,60/euro Oed Dall girn Casty p s,740 5pat udell,on0, seD optinan elm Jwas P-o) -1/3,740 +4,700 000 14.413,740 40 points (8 points per section) Assume that you are the chief financial officer for a major US manufacturing company. 16, One of your responsibilities is risk management-the firm's insurance and hedging function. Your firm has just purchased manufacturing equipment from a French firm for 10 million euros. This amount is due in 60 days. Assume the following rates are available in FOREX markets: Spot 90-day Forward Put Option $1.1374/euro $1.1386/euro Strike Price Maturity Premium per FC $1.1300/euro 60 days 1.5% Call Option Strike Price $1.13/euro 60 days 1.0% Maturity Premium per FC Interest Rates (annualized) Euro US dollar Borrowing 2.00% 3.50% Investing 1.50% 2.50% Should this position be hedged? Why (or why not)? A. tranoa -materene mtue -petalinl ta adee (t -ypitatni n Describe how this position could be hedged using a money market hedge. Use specific currency amounts in your description. (Remember to adjust the interest rates for 60 days.) . - aut 3 nite 10, DOD, DOD PIT) C. One of your assistants has suggested using a forward contract. What are the advantages and disadvantages of using a forward contract in this context adcetey Leeka n paye temi int at eusrunt hiskdk raretog depneca e D. Describe using a graph how you could protect your investment using a single type of FOREX option. Bay cade plrte E. Compute the value of the combined position (option and cash) if the exchange rate in 60 days is: i.) ii. $1.10/euro $1,60/euro Oed Dall girn Casty p s,740 5pat udell,on0, seD optinan elm Jwas P-o) -1/3,740 +4,700 000 14.413,740

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts