Question: can someone please answer this problem and explain the steps Problem 24.2A Prepare a statement of cash flows. LO 24-1, 24-2, 24-3, 24-4, 24-5 Postclosing

can someone please answer this problem and explain the steps

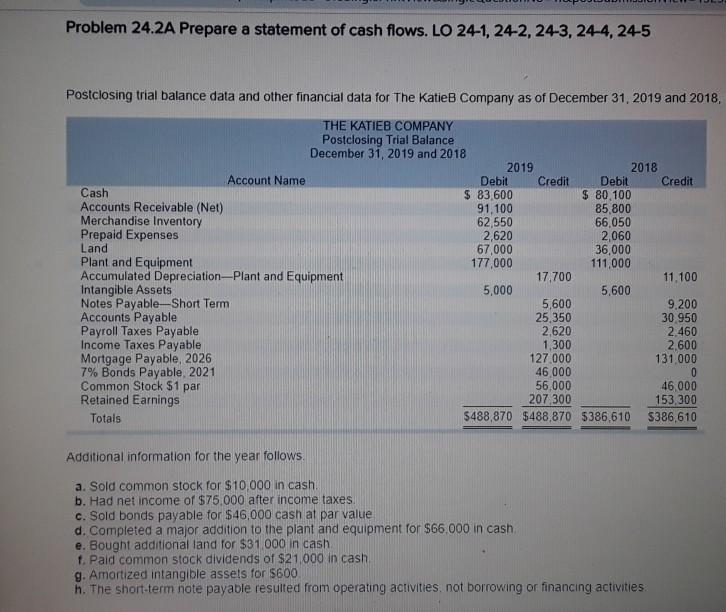

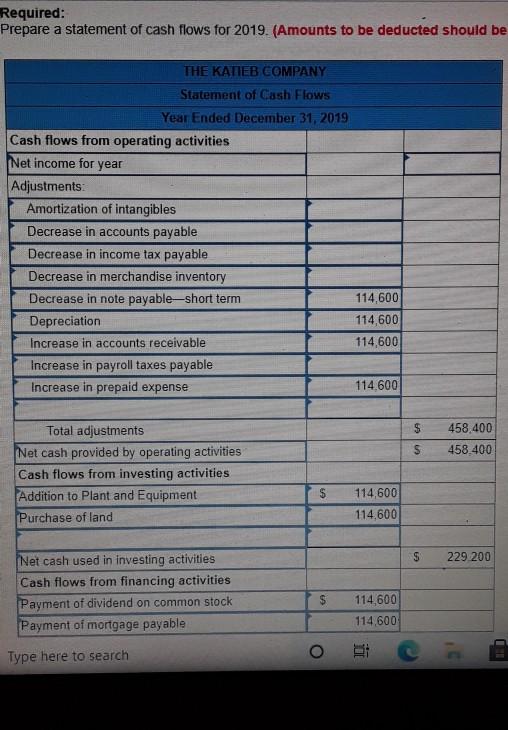

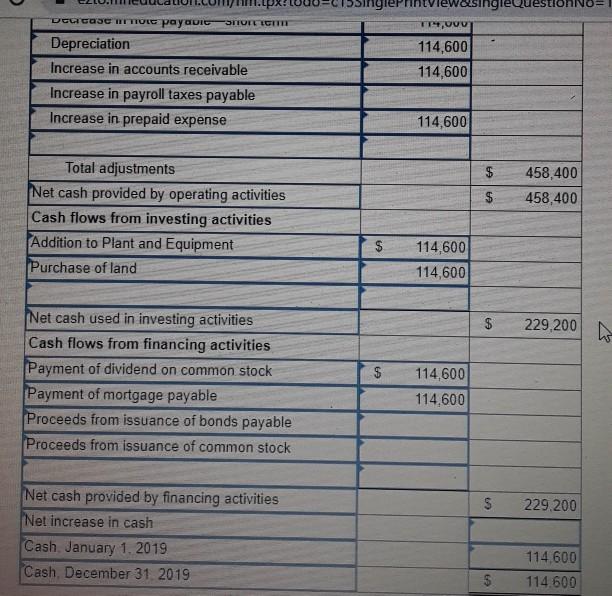

Problem 24.2A Prepare a statement of cash flows. LO 24-1, 24-2, 24-3, 24-4, 24-5 Postclosing trial balance data and other financial data for The Katie B Company as of December 31, 2019 and 2018, THE KATIEB COMPANY Postclosing Trial Balance December 31, 2019 and 2018 2019 2018 Account Name Debit Credit Debit Credit Cash $ 83 600 $ 80 100 Accounts Receivable (Net) 91.100 85,800 Merchandise Inventory 62,550 66,050 Prepaid Expenses 2,620 2,060 Land 67,000 36,000 Plant and Equipment 177,000 111.000 Accumulated Depreciation-Plant and Equipment 17,700 11.100 Intangible Assets 5,000 5,600 Notes Payable-Short Term 5,600 9.200 Accounts Payable 25,350 30 950 Payroll Taxes Payable 2.620 2.460 Income Taxes Payable 1.300 2.600 Mortgage Payable, 2026 127 000 131,000 7% Bonds Payable 2021 46,000 0 Common Stock $1 par 56.000 46.000 Retained Earnings 207 300 153,300 Totals S488,870 $488,870 5386,610 $386,610 Additional information for the year follows. a. Sold common stock for $10.000 in cash b. Had net income of $75.000 after income taxes. c. Sold bonds payable for $46,000 cash at par value d. Completed a major addition to the plant and equipment for $66.000 in cash e. Bought additional land for $31.000 in cash 1. Paid common stock dividends of $21.000 in cash g. Amortized intangible assets for $600 h. The short-term note payable resulted from operating activities, not borrowing or financing activities Required: Prepare a statement of cash flows for 2019. (Amounts to be deducted should be THE KATIEB EOMPANY Statement of Cash Flows Year Ended December 31, 2019 Cash flows from operating activities Net income for year Adjustments: Amortization of intangibles Decrease in accounts payable Decrease in income tax payable Decrease in merchandise inventory Decrease in note payable-short term Depreciation Increase in accounts receivable Increase in payroll taxes payable Increase in prepaid expense 114,600 114,600 114,600 114.600 $ S 458,400 458.400 Total adjustments Net cash provided by operating activities Cash flows from investing activities Addition to Plant and Equipment Purchase of land $ 114,600 114,600 5 229 200 Net cash used in investing activities Cash flows from financing activities Payment of dividend on common stock Payment of mortgage payable $ 114,600 114,600 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts