Question: can someone please answer this question thanks. Question 3 View Policies Current Attempt in Progress The debt to equity ratio and interest-coverage ratio for Vega

can someone please answer this question thanks.

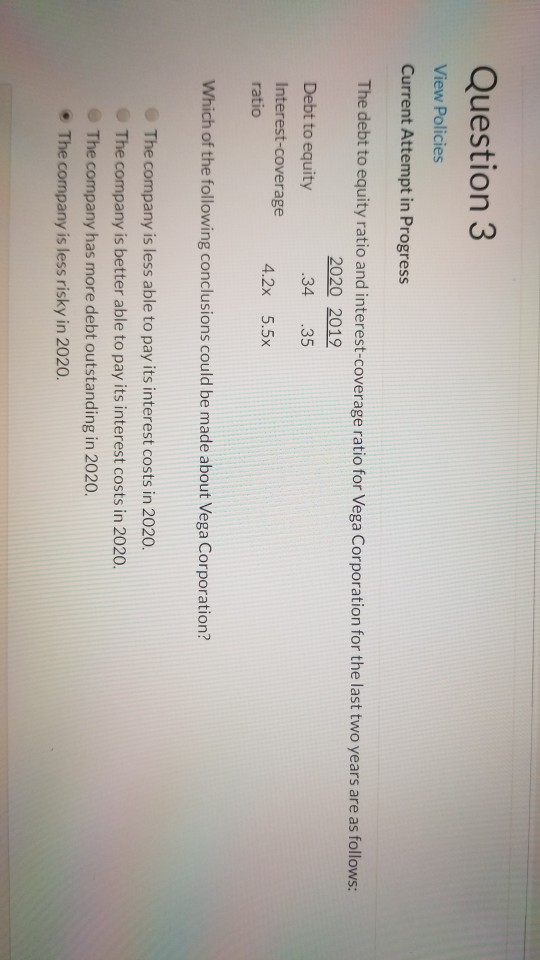

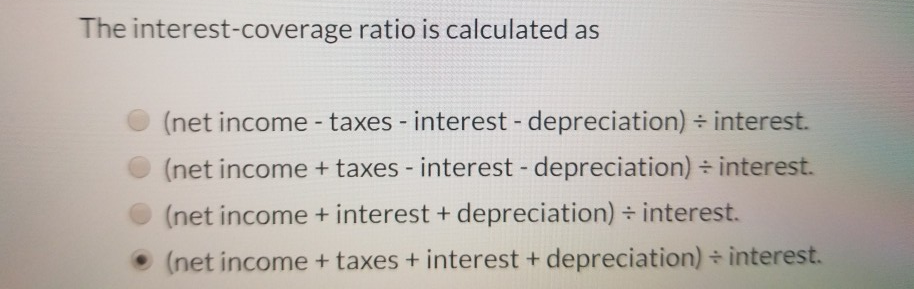

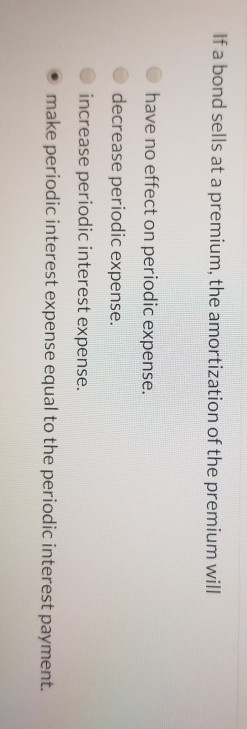

Question 3 View Policies Current Attempt in Progress The debt to equity ratio and interest-coverage ratio for Vega Corporation for the last two years are as follows: 2020 2019 Debt to equity 34 35 Interest-coverage 4.2x 5.5x ratio Which of the following conclusions could be made about Vega Corporation? The company is less able to pay its interest costs in 2020. The company is better able to pay its interest costs in 2020. The company has more debt outstanding in 2020. The company is less risky in 2020. The interest-coverage ratio is calculated as (net income - taxes - interest - depreciation) = interest. (net income + taxes - interest - depreciation) = interest. (net income + interest + depreciation) = interest. (net income + taxes + interest + depreciation) - interest. If a bond sells at a premium, the amortization of the premium will have no effect on periodic expense. decrease periodic expense. increase periodic interest expense. make periodic interest expense equal to the periodic interest payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts