Question: Can someone please correct the boxes in red. I attempted. Still not correct Additional Problem 2 Your answer is partially correct. Try again. Bonita Ltd.

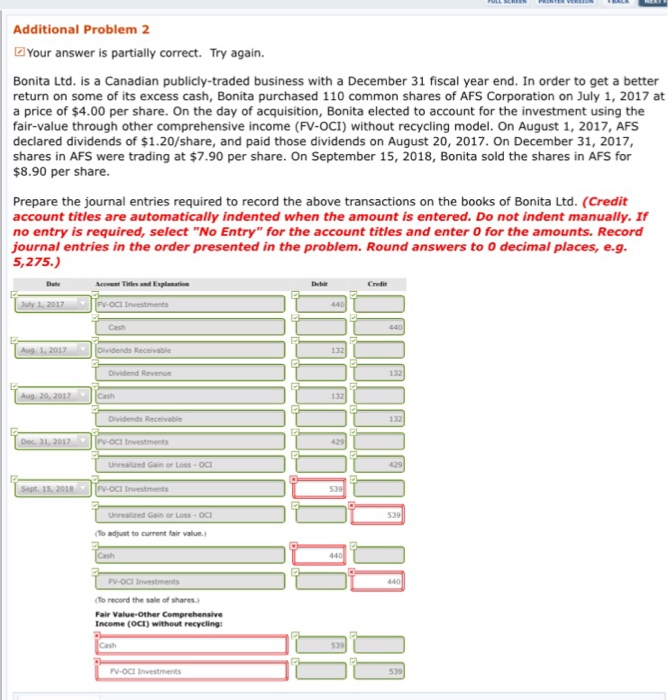

Additional Problem 2 Your answer is partially correct. Try again. Bonita Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its excess cash, Bonita purchased 110 common shares of AFS Corporation on July 1, 2017 at a price of $4.00 per share. On the day of acquisition, Bonita elected to account for the investment using the fair-value through other comprehensive income (FV-OCI) without recycling model. On August 1, 2017, AFS declared dividends of $1.20/share, and paid those dividends on August 20, 2017. On December 31, 2017, shares in AFS were trading at $7.90 per share. On September 15, 2018, Bonita sold the shares in AFS for $8.90 per share. Prepare the journal entries required to record the above transactions on the books of Bonita Ltd. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Round answers to O decimal places, e.g 5,275.) uly 1, 2017 Aug 20, 2017 Gain or Loss-Oc Sept, 15, 2018 Loss-OCI 539 To ady ist to current far value.' FV-ocl (To record the sale of shares Income (OCI) without recycling PV-OCI Investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts