Question: Can someone please explain and help me solve these tables for accounting DO D E F G H L M N FIFO - PERIODIC O

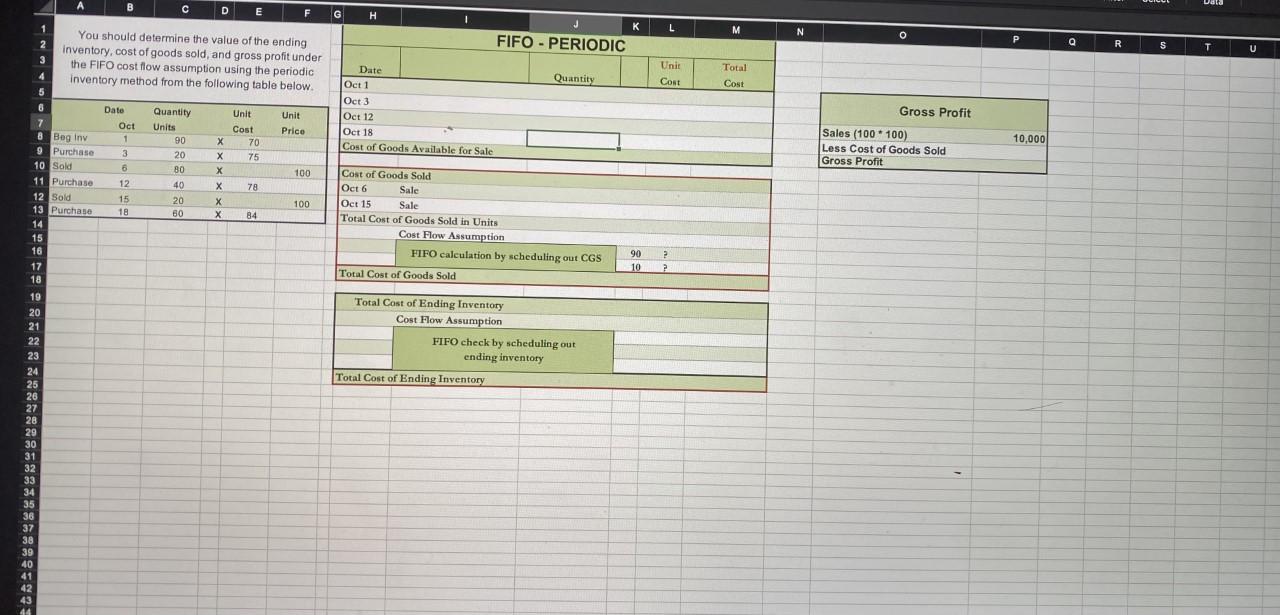

Can someone please explain and help me solve these tables for accounting

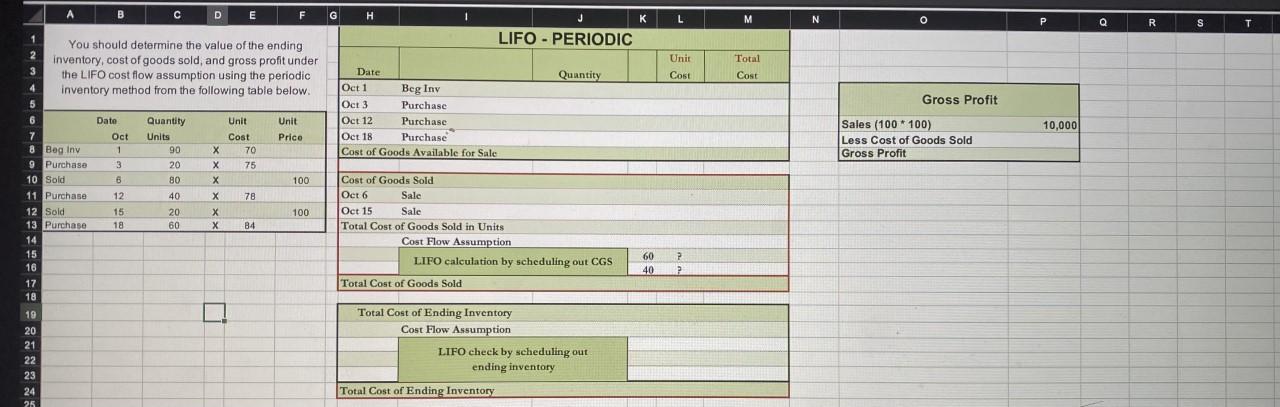

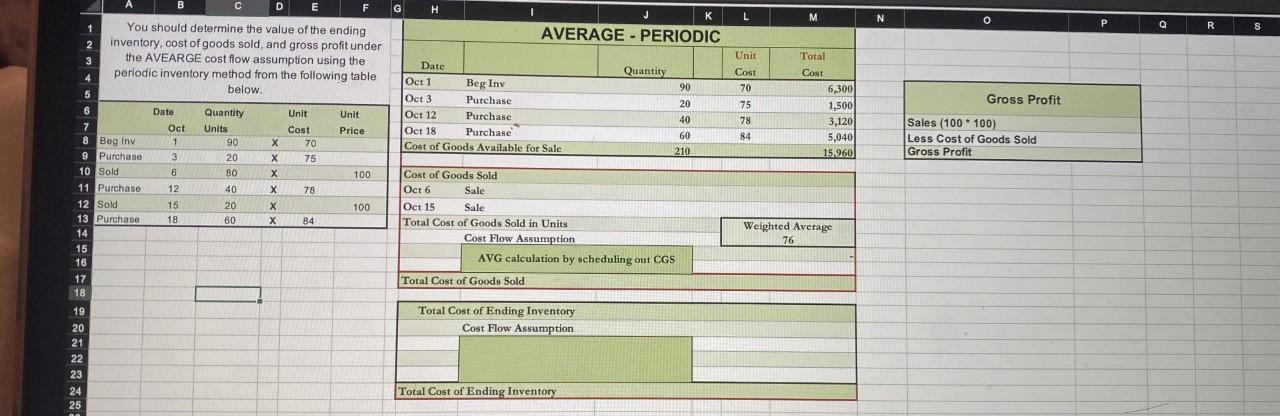

DO D E F G H L M N FIFO - PERIODIC O 1 2 3 P Q R S U U You should determine the value of the ending inventory, cost of goods sold, and gross profit under the FIFO cost flow assumption using the periodic inventory method from the following table below Quantity Unit Cost Total Cost 4 5 6 Date Oct 1 Oct 3 Oct 12 Oct 18 Cost of Goods Available for Sale Unit Price Unit Cost 70 75 Date Oct 1 3 3 6 12. 15 18 10,000 Quantity Units 90 20 80 40 20 60 Gross Profit Salos (100 * 100) Less Cost of Goods Sold Gross Profit 7 8 Bog Inv 9 Purchase 10 Sold 11 Purchase 12 Sold 13 Purchase 14 15 16 100 X 78 100 84 Cost of Goods Sold Oct 6 Sals Oct 15 Sale Total Cost of Goods Sold in Units Cost Flow Assumption FIFO calculation by scheduling out CGS Total Cost of Goods Sold 2 90 10 ? 17 18 Total Cost of Ending Inventory Cost Flow Assumption FIFO check by scheduling out ending inventory Total Cost of Ending Inventory 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 A C D E F G H 1 L M . N O P Q R S LIFO - PERIODIC Date Unit Cost Total Cost Quantity Gross Profit Oct 1 Beg Inv Oct 3 Purchase Oct 12 Purchase Oct 18 Purchase Cost of Goods Available for Sale 10,000 Sales (100* 100) Less Cost of Goods Sold Gross Profit You should determine the value of the ending 2 inventory, cost of goods sold, and gross profit under 3 the LIFO cost flow assumption using the periodic inventory method from the following table below. 5 6 Date Quantity Unit Unit 7 Oct Units Cost Prico 8 Bag Inv 1 1 90 70 9 Purchase 3 20 X 75 10 Sold 6 80 100 11 Purchase 12 40 78 12 Sold 15 20 100 13 Purchase 18 60 B4 14 15 16 17 18 Cost of Goods Sold Oct 6 Sale Oct 15 Sale Total Cost of Goods Sold in Units Cost Flow Assumption LIFO calculation by scheduling out CGS Total Cost of Goods Sold 60 40 ? ? 10 20 21 22 23 Total Cost of Ending Inventory Cost Flow Assumption LIFO check by scheduling out ending inventory Total Cost of Ending Inventory 24 25 B D E G . L M M N O J AVERAGE - PERIODIC P Q Q R S S 1 2 3 You should determine the value of the ending inventory, cost of goods sold, and gross profit under the AVEARGE cost flow assumption using the periodic inventory method from the following table below: Quantity 4 5 Unit Cost 70 75 78 Gross Profit Total Cost 6,300 1,500 3,120 5,040 15.960 Date Oct 1 Beg Iny Oct 3 Purchase Oct 12 Purchase Oct 18 Purchase Cost of Goods Available for Sale 6 Date 90 20 40 60 210 Unit Price Unit Cost 70 75 Oct 1 1 Quantity Units 90 20 80 84 Sales (100 100) Less Cost of Goods Sold Gross Profit 3 6 100 7 8 Beg Inv 9 Purchase 10 Sold 11 Purchase 12 Sold 13 Purchase 14 15 16 17 18 X 78 12 15 18 40 20 60 100 84 Cost of Goods Sold Oct 6 Sale Oct 15 Sale Total Cost of Goods Sold in Units Cost Flow Assumption AVG calculation by scheduling out CGS Total Cost of Goods Sold Weighted Average 76 Total Cost of Ending Inventory Cost Flow Assumption 19 20 21 22 23 24 25 Total Cost of Ending Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts