Question: Can someone please explain how to do these on a financial calculator? I have my final tomorrow. Your firm is selling a 3-year old machine

Can someone please explain how to do these on a financial calculator? I have my final tomorrow.

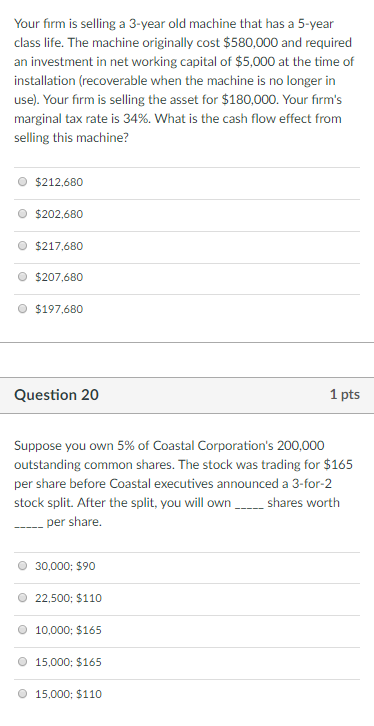

Your firm is selling a 3-year old machine that has a 5-year class life. The machine originally cost $580,000 and required an investment in net working capital of $5,000 at the time of installation (recoverable when the machine is no longer in use). Your firm is selling the asset for $180,000. Your firm's marginal tax rate is 34%. What is the cash flow effect from selling this machine? O $212,680 O$202,680 O $217.680 O $207,680 O $197.680 Question 20 1 pts Suppose you own 5% of Coastal Corporation's 200,000 outstanding common shares. The stock was trading for $165 per share before Coastal executives announced a 3-for-2 stock split. After the split, you will own shares worth per share. O 30,000; $90 O 22,500: $110 O 10,000; $165 O 15,000: $165 O 15,000; $110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts