Question: Can someone please explain how to do these on a financial calculator? I have my final tomorrow. You decide to form a portfolio with the

Can someone please explain how to do these on a financial calculator? I have my final tomorrow.

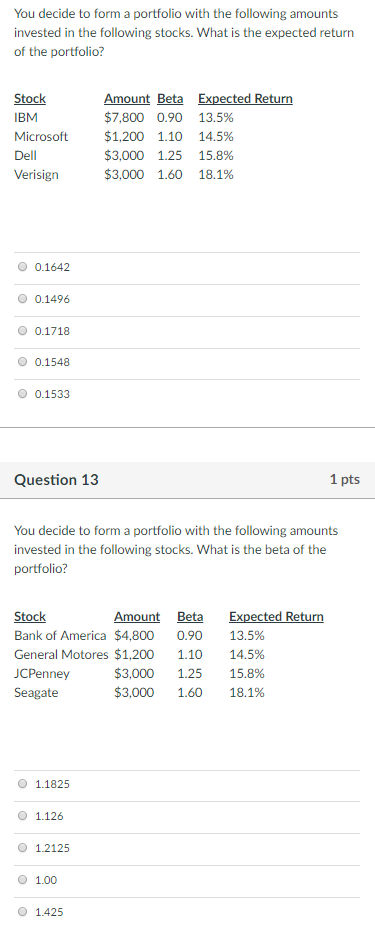

You decide to form a portfolio with the following amounts invested in the following stocks. What is the expected return of the portfolio? Stock IBM Microsoft $1.200 1.10 14.5% Dell Verisign Amount Beta Expected Return $7.800 0.90 13.5% $3,000 1.25 15.8% $3,000 1.60 18.1% O 0.1642 0.1496 O 0.1718 0.1548 0.1533 Question 13 1 pts You decide to form a portfolio with the following amounts invested in the following stocks. What is the beta of the portfolio? Amount Beta Expected Return Stock Bank of America $4,800 General Motores $1.200 UCPenney Seagate 0.90 1.10 $3,000 1.25 15.8% $3,000 1.60 18.1% 13.5% 14.5% O 1.1825 O 1.126 O 12125 1.00 O 1.425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts