Question: can someone please explain how to get all 1-3 questions please, Thank you! Required information (The following information applies to the questions displayed below) Timberly

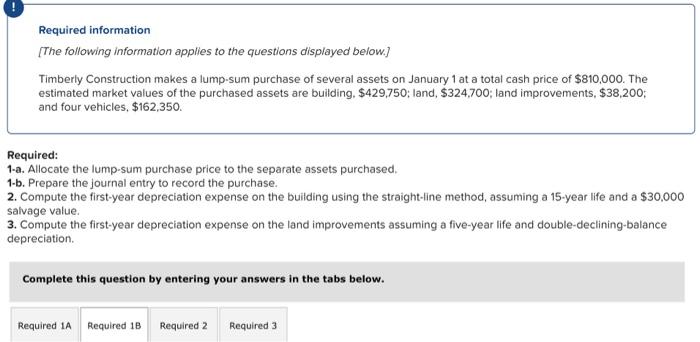

Required information (The following information applies to the questions displayed below) Timberly Construction makes a lump sum purchase of several assets on January 1 at a total cash price of $810,000. The estimated market values of the purchased assets are building, $429,750; land, $324,700; land improvements, $38,200; and four vehicles, $162,350. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts