Question: can someone please explain this question 6. Consider the following risk-free securities available to buy or sell to all investors in the market: Security Price

can someone please explain this question

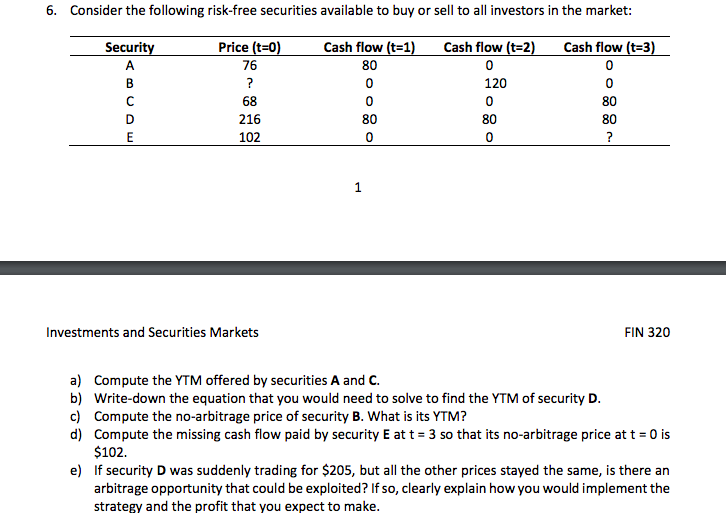

6. Consider the following risk-free securities available to buy or sell to all investors in the market: Security Price (t=0) Cash flow (t=1) Cash flow (t=2) Cash flow (t=3) 76 120 68 216 102 Investments and Securities Markets FIN 320 a) Compute the YTM offered by securities A and C. b) Write down the equation that you would need to solve to find the YTM of security D. c) Compute the no-arbitrage price of security B. What is its YTM? d) Compute the missing cash flow paid by security E at t = 3 so that its no-arbitrage price at t = 0 is $102. e) If security D was suddenly trading for $205, but all the other prices stayed the same, is there an arbitrage opportunity that could be exploited? If so, clearly explain how you would implement the strategy and the profit that you expect to make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts