Question: can someone please explain this solution how did they get the 143,505 in the first part and how did they get the solution for req

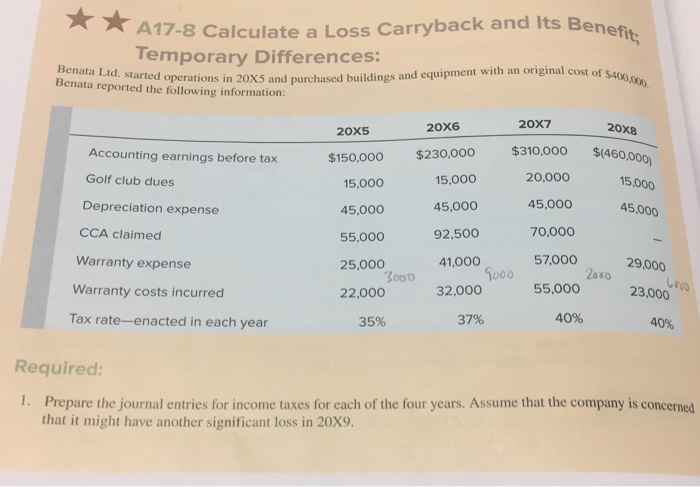

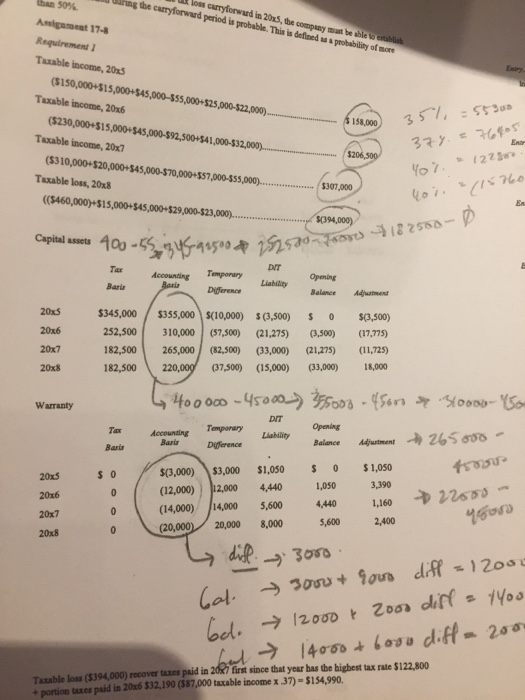

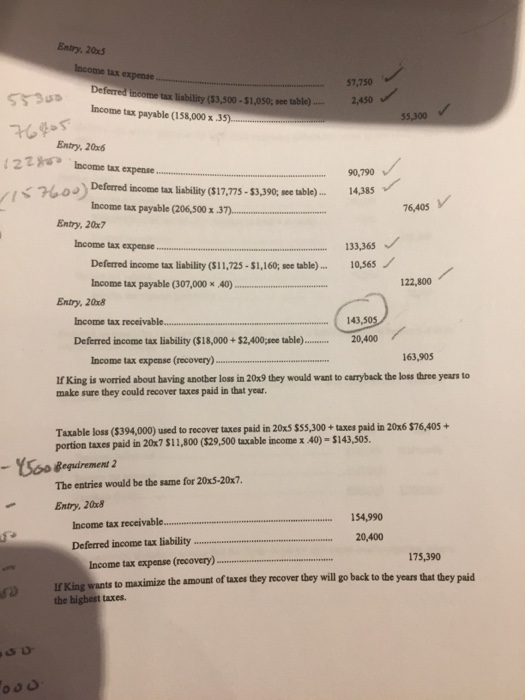

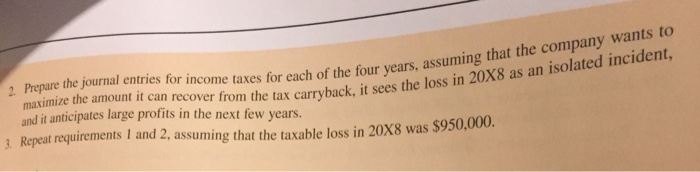

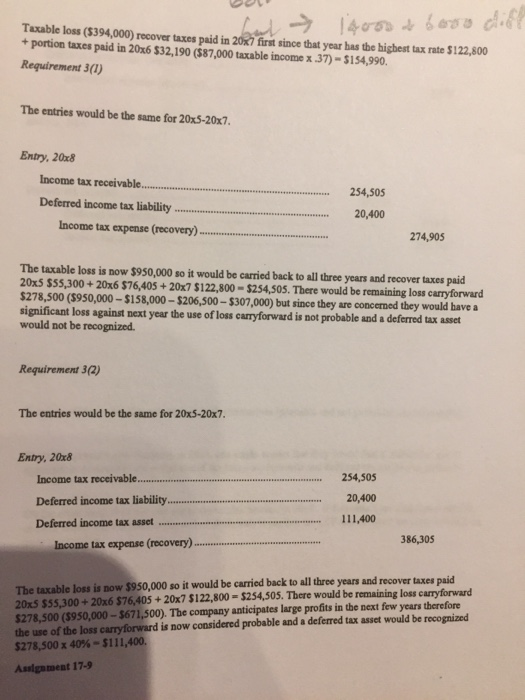

** A17-8 Calculate a Loss Carryback and Its Benefit; Temporary Differences: penata Ltd. started operations in 20x5 and purchased buildings and equipment with an original cost of Benata reported the following information: I S400,000. 20X7 20X8 20X6 20X5 $(460,000) $310,000 $230,000 $150,000 Accounting earnings before tax 20,000 15,000 15,000 Golf club dues 15,000 45,000 45,000 45,000 Depreciation expense 45,000 70,000 92,500 CCA claimed 55,000 57,000 29,000 41,000 25,000 300D 22,000 Warranty expense So00 2080 23,000 55,000 32,000 Warranty costs incurred 40% 40% 37% 35% Tax rate-enacted in each year Required: 1. Prepare the journal entries for income taxes for each of the four years. Assume that the company is concerned that it might have another significant loss in 20X9. fing the carryforward period is probable. This is defined ua probability of more loss carryforward in 20x5, the company mat be ble o eblish than 50% Amigament 17-8 Requirement 1 Taxable income, 20x5 Entry (S150,000+S15,000+$45,000-55,000+$25,000-522,000). In Tuxable income, 20x6 351, : 553u0 (S230,000+S15,000+$45,000-S92,500+541,000-532,000). $ 158,000 Taxable income, 20x7 377. = 76FS $206,500 (5310,000+$20,000+545,000-S70,000+S57,000-s55,000). Yo7. Taxable loss, 20x8 $307,000 ((S460,000)+$15,000+545,000+$29,000-523,000).. En $394,000) Capital assets 400 -5 3459950025S2 18250-D DIT Tax Temporary Accounting Baris Opening Liability Baris Diference Balance Adjustment 20xS $345,000 $355,000 S(10,000) $(3,500) $(3,500) 20x6 252,500 310,000 (57,500) (21,275) (3,500) (17,775) 20x7 182,500 265,000 (82,500) (33,000) (21,275) (11,725) 220,000 20x8 (37,500) (15,000) 18,000 182,500 (33,000) 400 000 -45000) 355008 - 45om oo00- Warranty DIT Opening Temporary Tax Accounting Baris Liability Adjustment 265000 Balance Difference $1,050 $3,000 $1,050 $(3,000) 20x5 3,390 1,050 12,000 4,440 (12,000) 20x6 1,160 14,000 4,440 5,600 (14,000) 20x7 2,400 5,600 8,000 20,000 (20,000 20x8 dif. 3000. Cel. 30os+ 9ous diff =12000 12000 t 2oos diff = 1Yo bel. bol-> Taxable loss ($394,000) recover taxes paid in 20x7 first since that year has the highest tax rate $122,800 + portion taxes paid in 20x6 $32,190 ($87,000 taxable income x 37) $154,990. erd 140 + boou diff- 200 Entry, 20x5 Income tax expense 57,750 Deferred income tux liability ($3,500 - $1,050, see table) Income tax payable (158,000 x 35)- 55300 2,450 55,300 ww.... Entry, 20x6 122 Income tax expense 90,790 Deferred income tax liability ($17,775 - $3,390; see table) . VI57600) 14,385 Income tax payable (206,500 x 37)- 76,405 V Entry, 20x7 Income tax expense 133,365 / Deferred income tax liability (S11,725 - $1,160; see table) . 10,565 Income tax payable (307,000 x 40) 122,800 Entry, 20x8 143,505 Income tax receivable. 20,400 Deferred income tax liability ($18,000 + $2,400;see table).. 163,905 Income tax expense (recovery). If King is worried about having anotber loss in 20x9 they would want to carryback the loss three years to make sure they could recover taxes paid in that year. Taxable loss ($394,000) used to recover taxes paid in 20xS $55,300 + taxes paid in 20x6 $76,405 + portion taxes paid in 20x7 $11,800 ($29,500 taxable income x 40) = $143,505. - 5o0 Beguirement 2 The entries would be the same for 20x5-20x7. Entry, 20x8 154,990 ....... Income tax receivable. 20,400 Deferred income tax liability 175,390 Income tax expense (recovery) IK King wants to maximize the amount of taxes they recover they will go back to the years that they paid the highest taxes. 2. Prepare the journal entries for income taxes for each of the four years, assuming that the company wants to maximize the amount it can recover from the tax carryback, it sees the loss in 20X8 as an isolated incident, and it anticipates large profits in the next few years. 1. Repeat requirements 1 and 2, assuming that the taxable loss in 20X8 was $950,000. -> 14000 + 6000 dift Taxable loss ($394,000) recover taxes paid in 20x7 first since that year has the higbest tax rate $122,800 + portion taxes paid in 20x6 $32,190 (587,000 taxable income x 37) - $154,990. Requirement 3(1) The entries would be the same for 20x5-20x7. Entry, 20x8 Income tax receivable. 254,505 Deferred income tax liability 20,400 Income tax expense (recovery). 274,905 The taxable loss is now $950,000 so it would be carried back to all three years and recover taxes paid 20xS $55,300 + 20x6 $76,405 + 20x7 $122,800 - $254,505. There would be remaining loss carryforward $278,500 ($950,000 $158,000 $206,500 - $307,000) but since they are concerned they would have a significant loss against next year the use of loss carryforward is not probable and a deferred tax asset would not be recognized. %3D Requirement 3(2) The entries would be the same for 20x5-20x7. Entry, 20x8 254,505 Income tax receivable. 20,400 Deferred income tax liability. 111,400 Deferred income tax asset 386,305 Income tax expense (recovery) The taxable loss is now $950,000 so it would be carried back to all three years and recover taxes paid 20x5 $55,300 + 20x6 $76,405 + 20x7 $122,800 = $254,505. There would be remaining loss carryforward $278,500 ($950,000- $671,500). The company anticipates large profits in the next few years therefore the use of the loss carryforward is now considered probable and a deferred tax asset would be recognized $278,500 x 40%%-$111,400. Assigament 17-9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts