Question: Can someone please explain to me how this answer came to? I learned that when getting the Profitability index, we divide the Net PV of

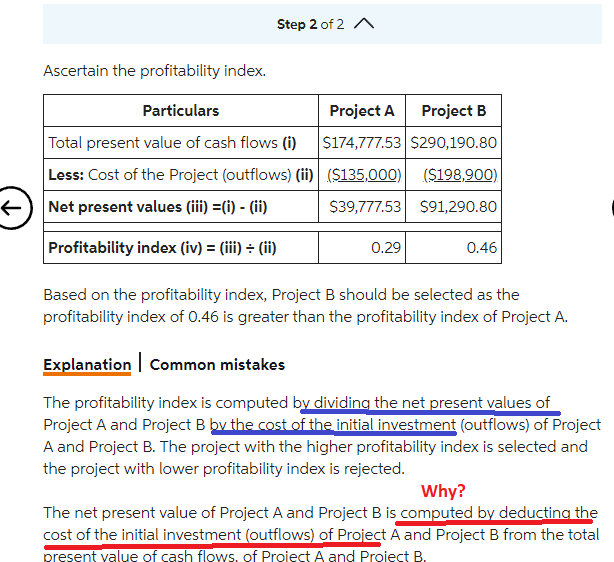

Can someone please explain to me how this answer came to? I learned that when getting the Profitability index, we divide the Net PV of all cash flows with the cost of initial investment (also mentioned in the photo below underlined by blue). But why was the Net PV deducted to the cost in this answer? (underlined in red). Please explain in the easiest way possible.

Step 2 of 2 A Ascertain the profitability index. Particulars Total present value of cash flows (i) Less: Cost of the Project (outflows) (ii) Project A Project B $174,777.53 $290,190.80 ($135,000) ($198,900) Net present values (iii) =(i) - (ii) $39,777.53 $91,290.80 Profitability index (iv) = (iii) + (ii) 0.29 0.46 Based on the profitability index, Project B should be selected as the profitability index of 0.46 is greater than the profitability index of Project A. Explanation Common mistakes The profitability index is computed by dividing the net present values of Project A and Project B by the cost of the initial investment (outflows) of Project A and Project B. The project with the higher profitability index is selected and the project with lower profitability index is rejected. Why? The net present value of Project A and Project B is computed by deducting the cost of the initial investment (outflows) of Project A and Project B from the total present value of cash flows, of Project A and Project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts