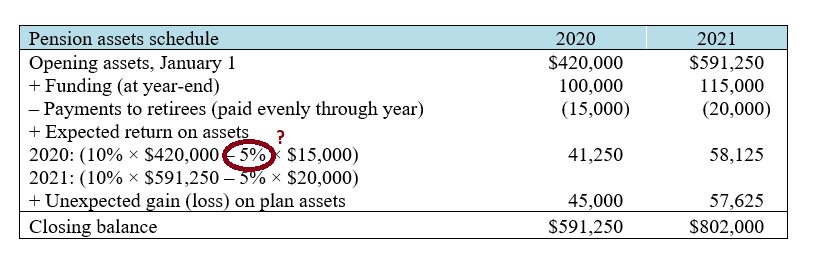

Question: Can someone please explain why here in the solution I have provided for this question we multiply the asset by 5% when it is not

Can someone please explain why here in the solution I have provided for this question we multiply the asset by 5% when it is not paid mid-year? Thanks

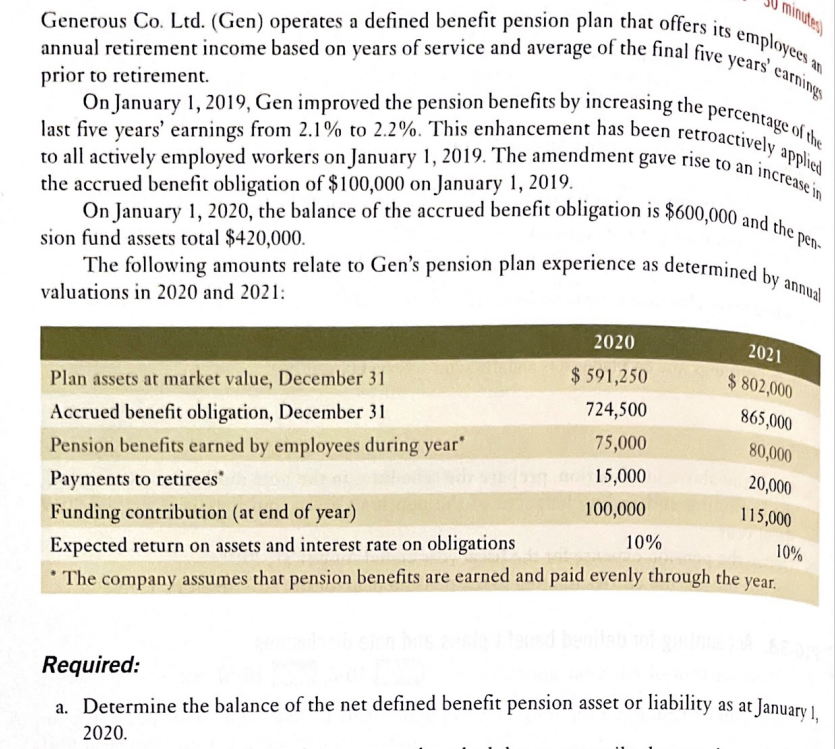

Generous Co. Ltd. (Gen) operates a defined benefit pension plan that offers its employees annual retirement income based on years of service and average of the final five years earrings prior to retirement On January 1, 2019, Gen improved the pension benefits by increasing the percentage of the to all actively employed workers on January 1, 2019. The amendment gave rise to an increase in last five years' earnings from 2.1% to 2.2%. This enhancement has been retroactively applied the accrued benefit obligation of $100,000 on January 1, 2019. On January 1, 2020, the balance of the accrued benefit obligation is $600,000 and the peri- sion fund assets total $420,000. The following amounts relate to Gen's pension plan experience as determined by annual valuations in 2020 and 2021: 2020 $ 591,250 Plan assets at market value, December 31 724,500 Accrued benefit obligation, December 31 Pension benefits earned by employees during year" 75,000 15,000 Payments to retirees Funding contribution (at end of year) 100,000 10% Expected return on assets and interest rate on obligations * The company assumes that pension benefits are earned and paid evenly through the year. 2021 $ 802,000 865,000 80,000 20,000 115,000 10% Required: a. Determine the balance of the net defined benefit pension asset or liability as at January 1, 2020. 2020 $420,000 100,000 (15,000) 2021 $591,250 115,000 (20,000) Pension assets schedule Opening assets, January 1 + Funding (at year-end) - Payments to retirees (paid evenly through year) + Expected return on assets ? 2020: (10% * $420,000 5% $15,000) 2021: (10% + $591,250 -5% * $20,000) + Unexpected gain (loss) on plan assets Closing balance 41,250 58,125 45,000 $591,250 57,625 $802,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts