Question: can someone please fill the table? Note accounts for each trader listed in these trades and the exchange Show balances in margins, profits, losses and

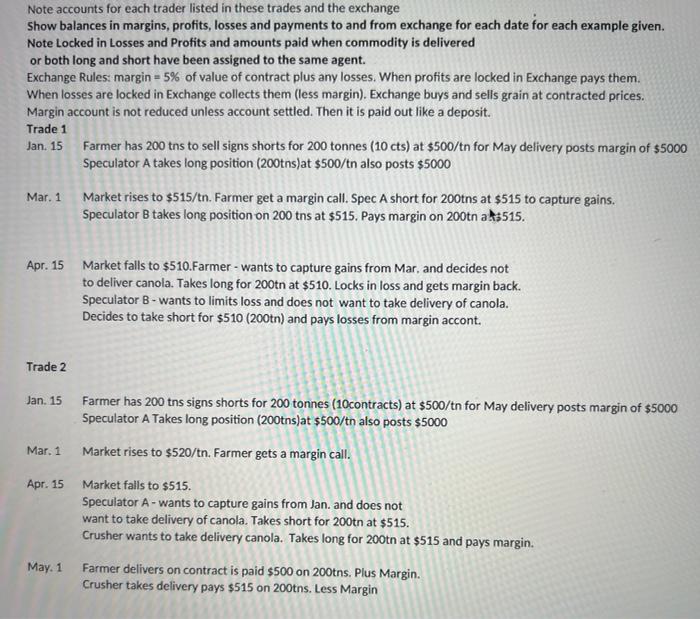

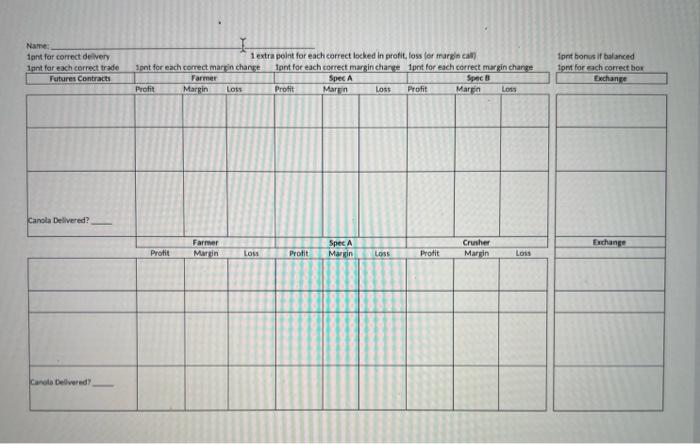

Note accounts for each trader listed in these trades and the exchange Show balances in margins, profits, losses and payments to and from exchange for each date for each example given. Note Locked in Losses and Profits and amounts paid when commodity is delivered or both long and short have been assigned to the same agent. Exchange Rules: margin = 5% of value of contract plus any losses. When profits are locked in Exchange pays them. When losses are locked in Exchange collects them (less margin). Exchange buys and sells grain at contracted prices. Margin account is not reduced unless account settled. Then it is paid out like a deposit. Trade 1 Jan. 15 Farmer has 200 tns to sell signs shorts for 200 tonnes (10 cts) at $500/tn for May delivery posts margin of $5000 Speculator A takes long position (200tns)at $500/tn also posts $5000 Mar. 1 Market rises to $515/tn. Farmer get a margin call. Spec A short for 200tns at $515 to capture gains. Speculator B takes long position on 200 tns at $515. Pays margin on 200tn at:515. Apr. 15 Market falls to $510.Farmer - wants to capture gains from Mar, and decides not to deliver canola. Takes long for 200tn at $510. Locks in loss and gets margin back. Speculator B-wants to limits loss and does not want to take delivery of canola. Decides to take short for $510 (200tn) and pays losses from margin accont. Trade 2 Jan. 15 Farmer has 200 tns signs shorts for 200 tonnes (10contracts) at $500/tn for May delivery posts margin of $5000 Speculator A Takes long position (200tns)at $500/tn also posts $5000 Mar. 1 Market rises to $520/tn. Farmer gets a margin call. Apr. 15 - Market falls to $515. Speculator A-wants to capture gains from Jan. and does not want to take delivery of canola. Takes short for 200tn at $515. Crusher wants to take delivery canola. Takes long for 200tn at $515 and pays margin. Farmer delivers on contract is paid $500 on 200tns. Plus Margin. Crusher takes delivery pays $515 on 200tns. Less Margin einer canola, Takes lo May. 1 Name tant for correct delivery 1pnt for each correct trade Futures Contracts 1 1 extra point for each correct locked in profit loss for marginal 1pnt for each correct marin change sont for each correct margin change pet for each correct margin change Farmer Spec A Spec Profit Margin Loss Profit Margin Loss Profit Marcin Loss Iprit bonus if balanced ont for each correct bor Exchange Canola Delivered? Farmer Exchange Profit Martin Spec A Margin Profit LOS Loss Crusher Marin Profit Loss Note accounts for each trader listed in these trades and the exchange Show balances in margins, profits, losses and payments to and from exchange for each date for each example given. Note Locked in Losses and Profits and amounts paid when commodity is delivered or both long and short have been assigned to the same agent. Exchange Rules: margin = 5% of value of contract plus any losses. When profits are locked in Exchange pays them. When losses are locked in Exchange collects them (less margin). Exchange buys and sells grain at contracted prices. Margin account is not reduced unless account settled. Then it is paid out like a deposit. Trade 1 Jan. 15 Farmer has 200 tns to sell signs shorts for 200 tonnes (10 cts) at $500/tn for May delivery posts margin of $5000 Speculator A takes long position (200tns)at $500/tn also posts $5000 Mar. 1 Market rises to $515/tn. Farmer get a margin call. Spec A short for 200tns at $515 to capture gains. Speculator B takes long position on 200 tns at $515. Pays margin on 200tn at:515. Apr. 15 Market falls to $510.Farmer - wants to capture gains from Mar, and decides not to deliver canola. Takes long for 200tn at $510. Locks in loss and gets margin back. Speculator B-wants to limits loss and does not want to take delivery of canola. Decides to take short for $510 (200tn) and pays losses from margin accont. Trade 2 Jan. 15 Farmer has 200 tns signs shorts for 200 tonnes (10contracts) at $500/tn for May delivery posts margin of $5000 Speculator A Takes long position (200tns)at $500/tn also posts $5000 Mar. 1 Market rises to $520/tn. Farmer gets a margin call. Apr. 15 - Market falls to $515. Speculator A-wants to capture gains from Jan. and does not want to take delivery of canola. Takes short for 200tn at $515. Crusher wants to take delivery canola. Takes long for 200tn at $515 and pays margin. Farmer delivers on contract is paid $500 on 200tns. Plus Margin. Crusher takes delivery pays $515 on 200tns. Less Margin einer canola, Takes lo May. 1 Name tant for correct delivery 1pnt for each correct trade Futures Contracts 1 1 extra point for each correct locked in profit loss for marginal 1pnt for each correct marin change sont for each correct margin change pet for each correct margin change Farmer Spec A Spec Profit Margin Loss Profit Margin Loss Profit Marcin Loss Iprit bonus if balanced ont for each correct bor Exchange Canola Delivered? Farmer Exchange Profit Martin Spec A Margin Profit LOS Loss Crusher Marin Profit Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts