Question: Can someone please help figure this out, is par value the 0.05? $ 42,549 $ 39,946 $ 290 5,807 1,391 434 1,468 35 Total Assets

Can someone please help figure this out, is par value the 0.05?

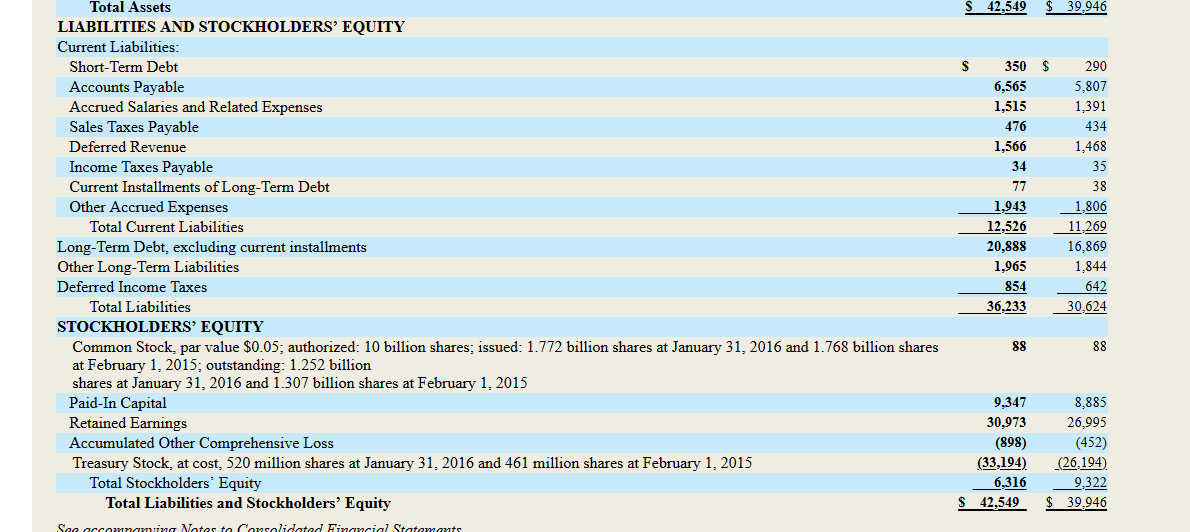

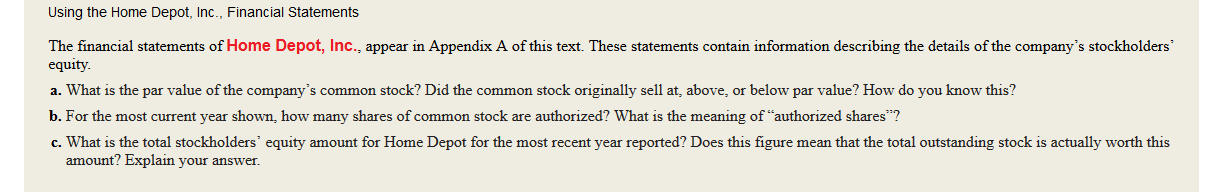

$ 42,549 $ 39,946 $ 290 5,807 1,391 434 1,468 35 Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Short-Term Debt Accounts Payable Accrued Salaries and Related Expenses Sales Taxes Payable Deferred Revenue Income Taxes Payable Current Installments of Long-Term Debt Other Accrued Expenses Total Current Liabilities Long-Term Debt, excluding current installments Other Long-Term Liabilities Deferred Income Taxes Total Liabilities STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares: issued: 1.772 billion shares at January 31, 2016 and 1.768 billion shares at February 1, 2015; outstanding: 1.252 billion shares at January 31, 2016 and 1.307 billion shares at February 1, 2015 Paid-In Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury Stock, at cost, 520 million shares at January 31, 2016 and 461 million shares at February 1, 2015 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Sea accamnaming Motos to Consolidatad Financial Statamants 350 6,565 1,515 476 1,566 34 77 1,943 12,526 20,888 1,965 854 36,233 1.806 11,269 16,869 1,844 642 30,624 88 9,347 30.973 (898) (33,194) 6,316 $ 42,549 8,885 26,995 (452) (26,194) 9.322 $ 39,946 Using the Home Depot, Inc., Financial Statements The financial statements of Home Depot, Inc., appear in Appendix A of this text. These statements contain information describing the details of the company's stockholders equity. a. What is the par value of the company's common stock? Did the common stock originally sell at, above, or below par value? How do you know this? b. For the most current year shown, how many shares of common stock are authorized? What is the meaning of authorized shares? c. What is the total stockholders' equity amount for Home Depot for the most recent year reported? Does this figure mean that the total outstanding stock is actually worth this amount? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts