Question: can someone please help fill in orange area? *Excel Formulas only please* A B D E F G Finding the Fair Value of a Bond

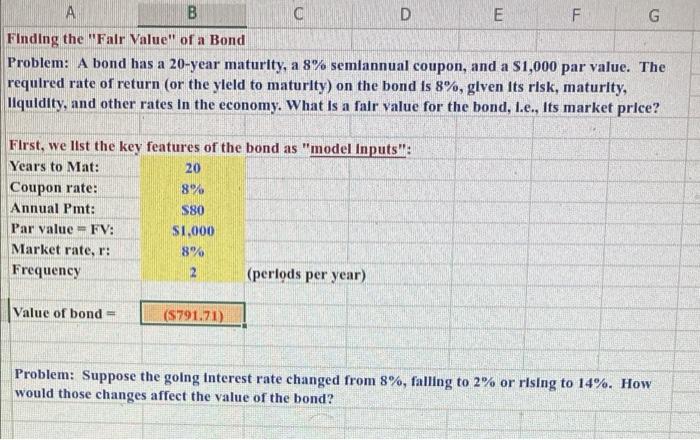

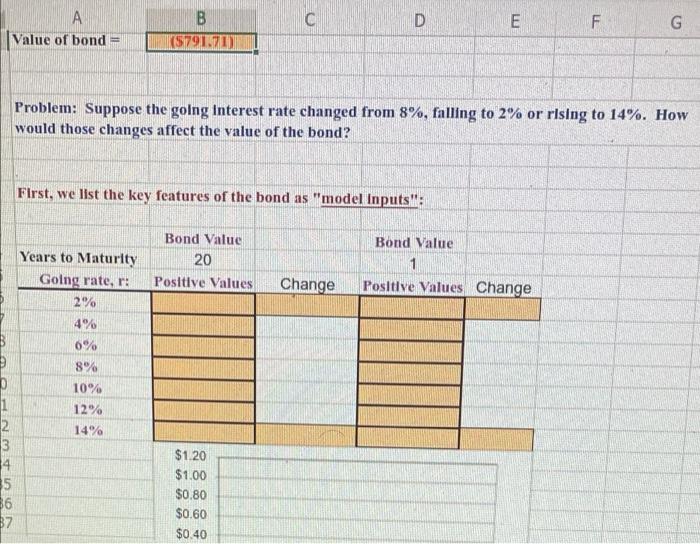

A B D E F G Finding the "Fair Value of a Bond Problem: A bond has a 20-year maturity, a 8% semiannual coupon, and a $1,000 par value. The required rate of return (or the yleld to maturity) on the bond is 8%, glven its risk, maturity, liquldity, and other rates in the economy. What is a falr value for the bond, 1.e., Its market price? First, we list the key features of the bond as "model Inputs: Years to Mat: 20 Coupon rate: 8% Annual Pmt: S80 Par value FV: $1.000 Market rate, r: 8% Frequency 2 (periods per year) Value of bond - (5791.71) Problem: Suppose the going interest rate changed from 8%, falling to 2% or rising to 14%. How would those changes affect the value of the bond? A Value of bond D E F. G B ||(579120 Problem: Suppose the going interest rate changed from 8%, falling to 2% or rising to 14%. How would those changes affect the value of the bond? First, we list the key features of the bond as "model Inputs: Years to Maturity Going rate, r: 2% 4% Bond Value 20 Positive Values Bond Value 1 Positive Values Change Change 6% B > 8% 10% 12% 14% 1 2 3 4 5 $6 B7 $1.20 $1.00 $0.80 $0.60 $0.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts