Question: Can someone please help me answer the question below? Discussion Question 17-11 (LO. 2) Marmot Corporation pays a dividend of $100,000 in the current year.

Can someone please help me answer the question below?

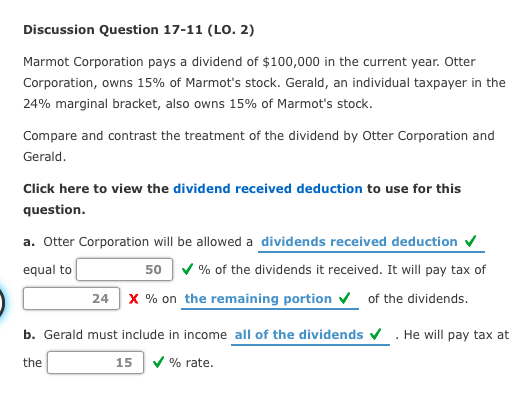

Discussion Question 17-11 (LO. 2) Marmot Corporation pays a dividend of $100,000 in the current year. Otter Corporation, owns 15% of Marmot's stock. Gerald, an individual taxpayer in the 24% marginal bracket, also owns 15% of Marmot's stock. Compare and contrast the treatment of the dividend by Otter Corporation and Gerald. Click here to view the dividend received deduction to use for this question. a. Otter Corporation will be allowed a dividends received deduction equal to 50 % of the dividends it received. It will pay tax of X % on the remaining portion of the dividends. 24 . He will pay tax at b. Gerald must include in income all of the dividends the 15 % rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts