Question: can someone please help me answer this question Beth is anticipating significant changes in her life in 2021, and she has asked you to estimate

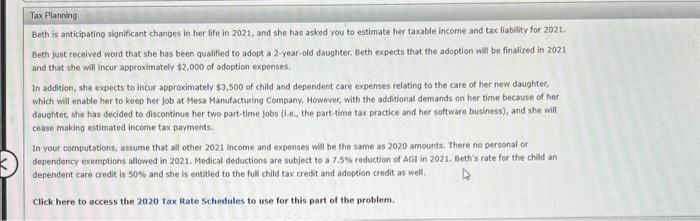

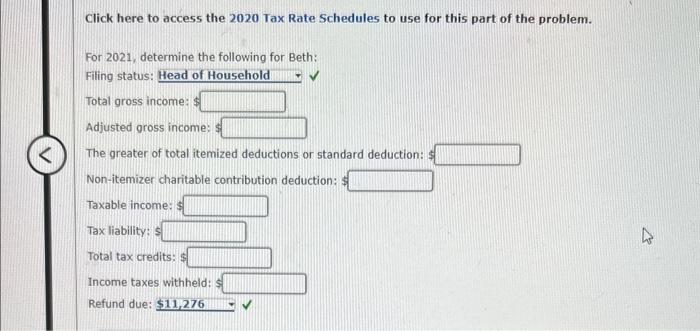

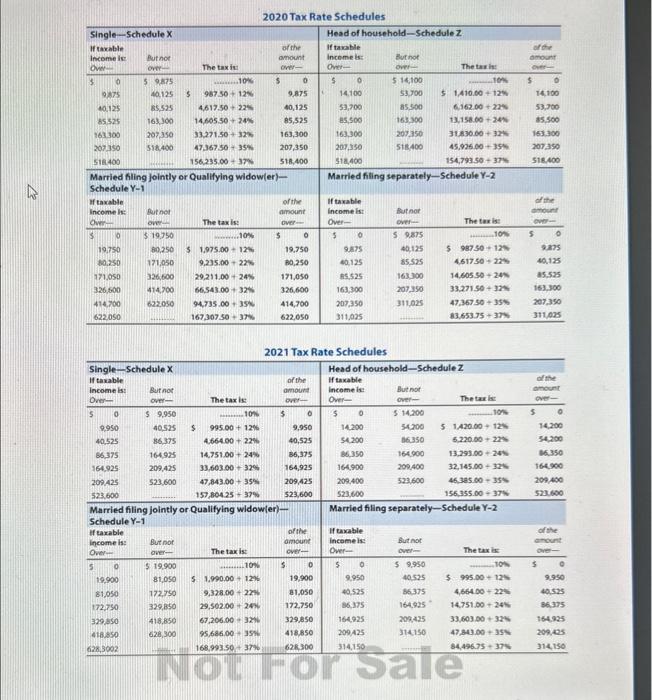

Beth is anticipating significant changes in her life in 2021, and she has asked you to estimate her taxable income and tax liability for 2021 . Beth fust feceived word that she has been qualified to adopt a 2 -year-old daughter. Beth expects that the adoption will be finalized in 2021 and that she will incur approximately $2,000 of adoption expenses. In addition, she expects to incur approximately $3,500 of child and dependent care expenses relating to the care of her new daughter, which will enable her to keep her job at Mesa Manufacturing Company, However, with the additional demands on her time because of her daughter, she has decided to discontinue her two part-time jobs (i.e., the part-time tax practice and her software business), and she will cease making estimated income tax payments. In your computations, assume that all other 2021 income and expenses will be the same as 2020 amounts, there no personal or dependency exemptions allowed in 2021. Medical deductions are subject to a 7.5\% reduction of AGt in 2021. Beth's rate for the chilid an dependent care credit is 50% and she is entiled to the full child tax credit and adoption credit as well. Click here to acces5 the 2020 rax Rate schedules to use for this part of the problem. Click here to access the 2020 Tax Rate Schedules to use for this part of the problem. For 2021, determine the following for Beth: Filing status: Total gross income: $ Adjusted gross income: : The greater of total itemized deductions or standard deduction: \$ Non-itemizer charitable contribution deduction: \$ Taxable income: Tax liability; s Total tax credits: \$ Income taxes withheld: Refund due: 2020 Tax Rate Schedules 2021 Tax Rate Schedules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts