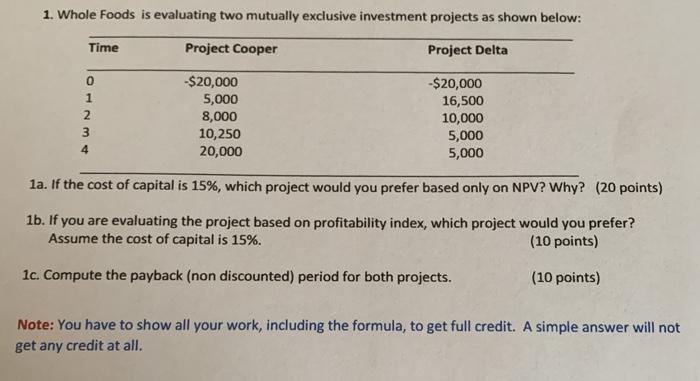

Question: Can someone please help me answer this question by showing all the steps on how to work out this problem? 1. Whole Foods is evaluating

1. Whole Foods is evaluating two mutually exclusive investment projects as shown below: Time Project Cooper Project Delta 0 1 2 3 4 -$20,000 5,000 8,000 10,250 20,000 -$20,000 16,500 10,000 5,000 5,000 1a. If the cost of capital is 15%, which project would you prefer based only on NPV? Why? (20 points) 1b. If you are evaluating the project based on profitability index, which project would you prefer? Assume the cost of capital is 15%. (10 points) 1c. Compute the payback (non discounted) period for both projects. (10 points) Note: You have to show all your work, including the formula, to get full credit. A simple answer will not get any credit at all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts