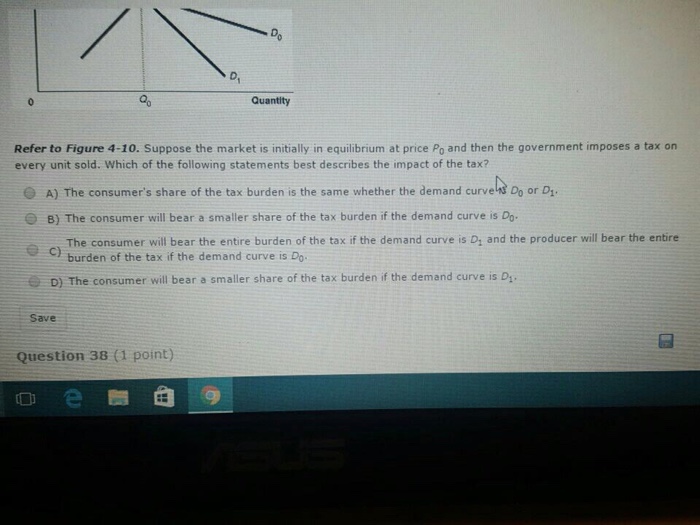

Question: Can someone please help me figure this question right ? Suppose the market is initially in equilibrium at price P_0 and then the government imposes

Suppose the market is initially in equilibrium at price P_0 and then the government imposes a tax on every unit sold. Which of the following statements best describes the impact of the tax? A) The consumer's share of the tax burden is the same whether the demand curved D_0 or D_1. B) The consumer will bear a smaller share of the tax burden if the demand curve is D_0. The consumer will bear the entire burden of the tax if the demand curve is D_1 and the producer will bear the entire burden of the tax if the demand curve is D_0. D) The consumer will bear a smaller share of the tax burden if the demand curve is D_1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts