Question: can someone please help me out with this? im so confused. this is all the information. The account balances of Pacilio Security Services, Inc. as

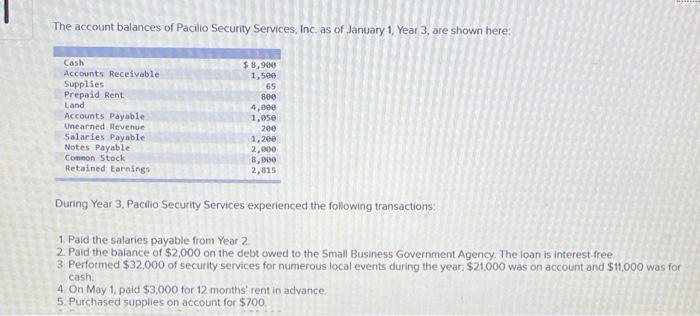

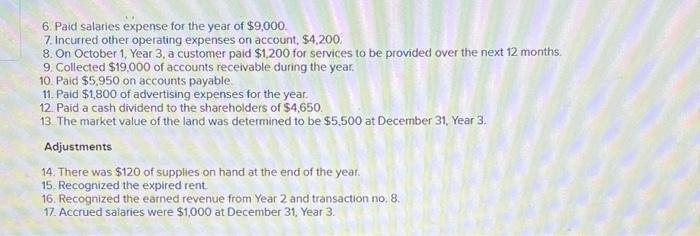

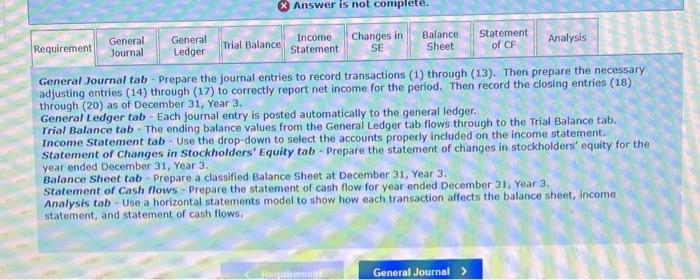

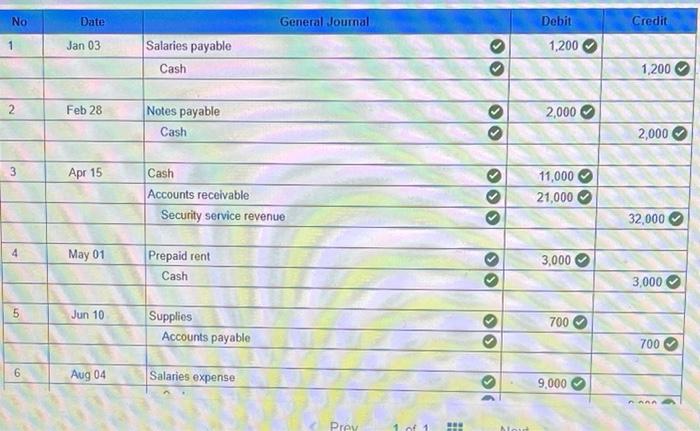

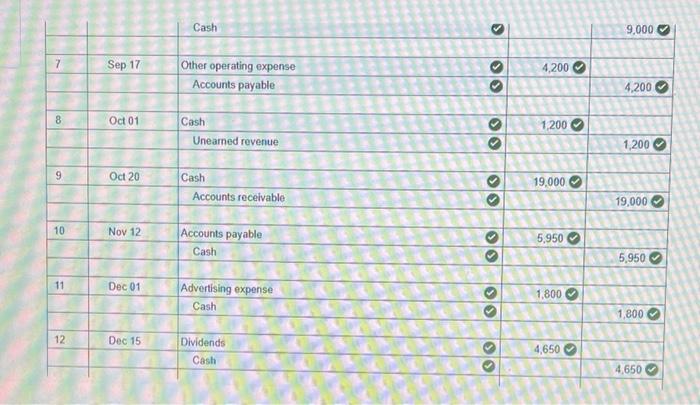

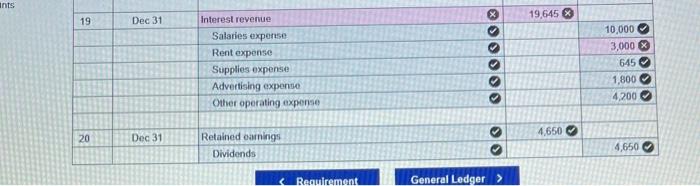

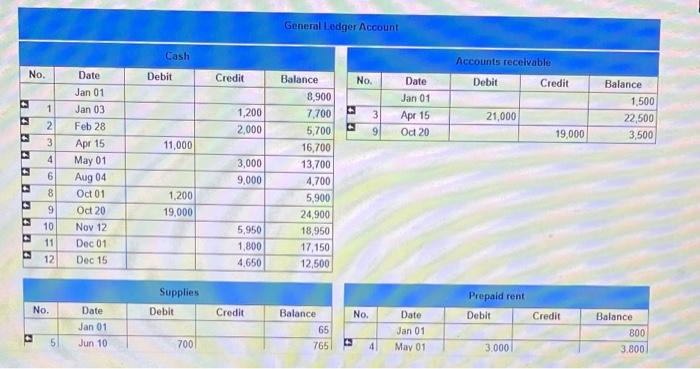

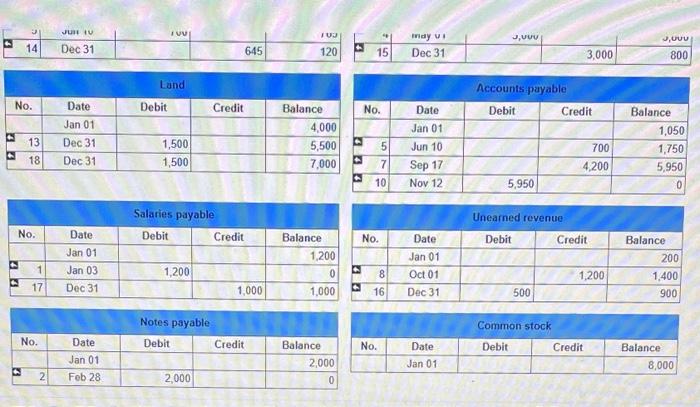

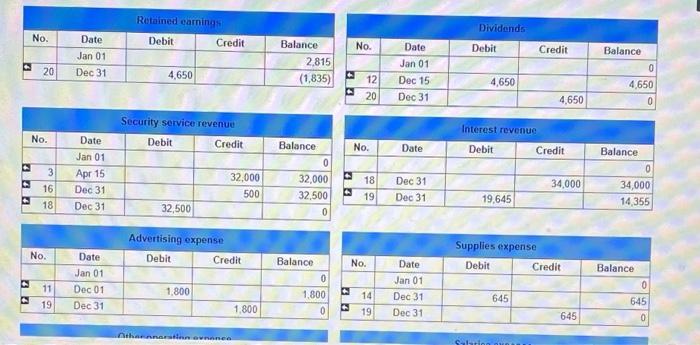

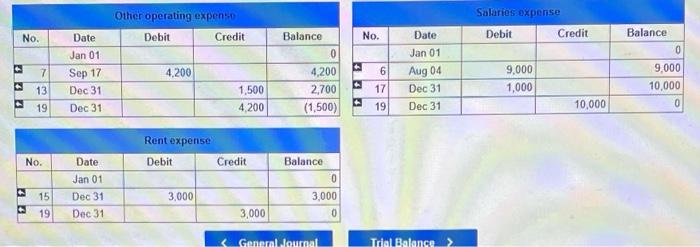

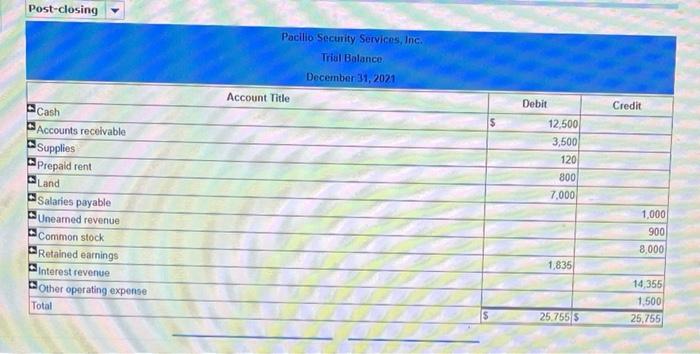

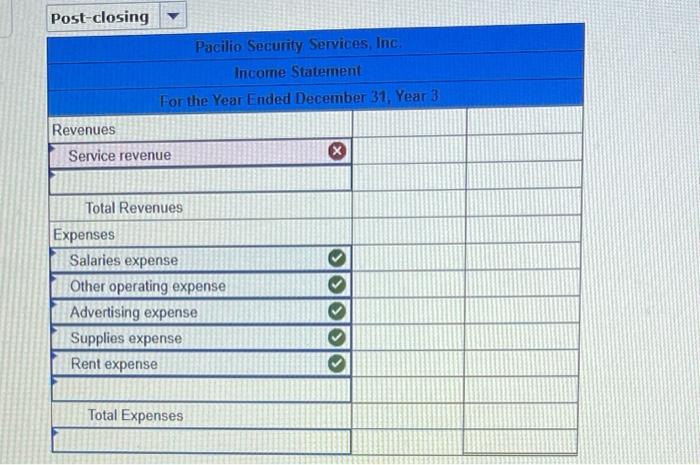

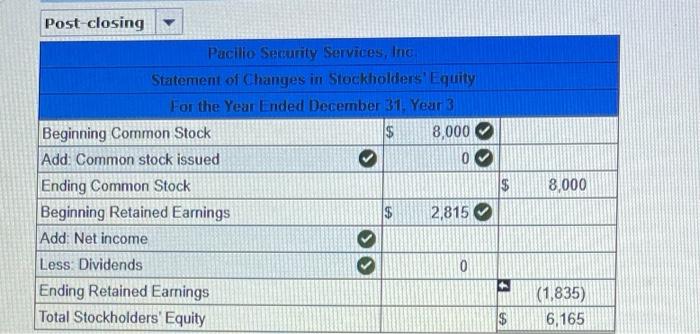

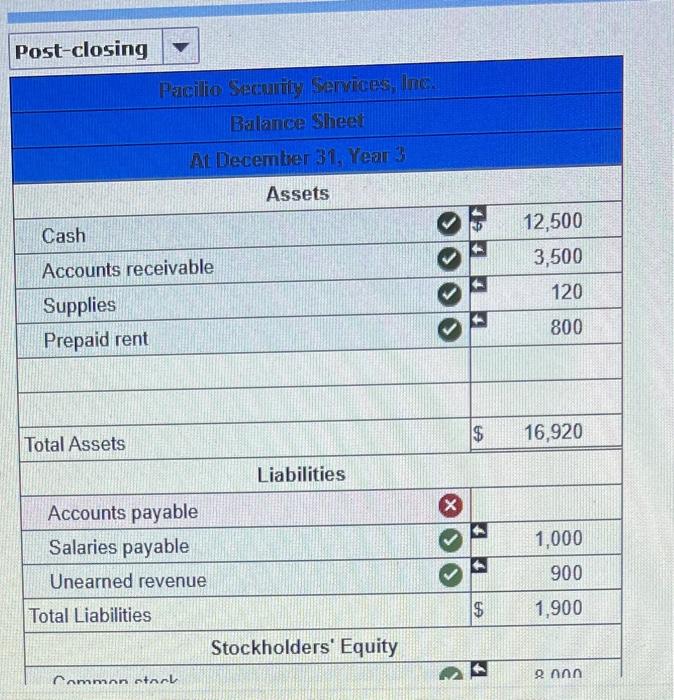

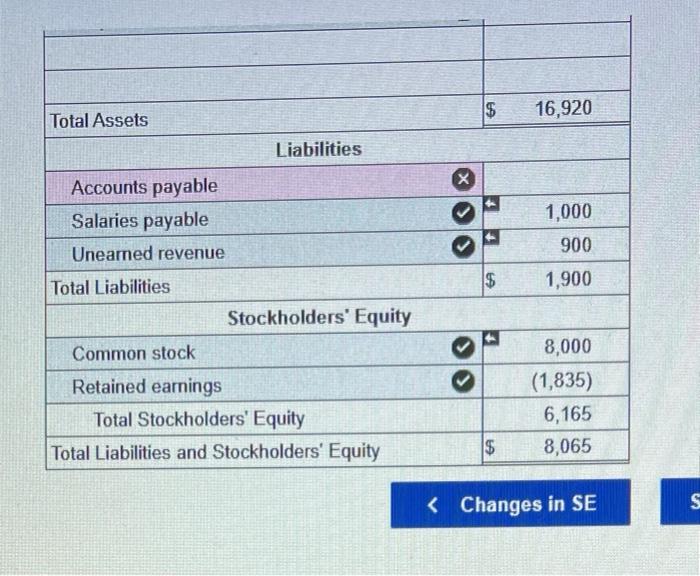

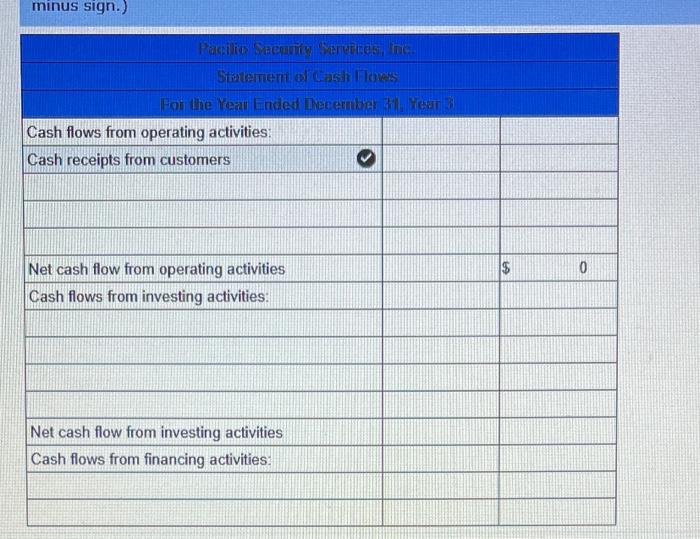

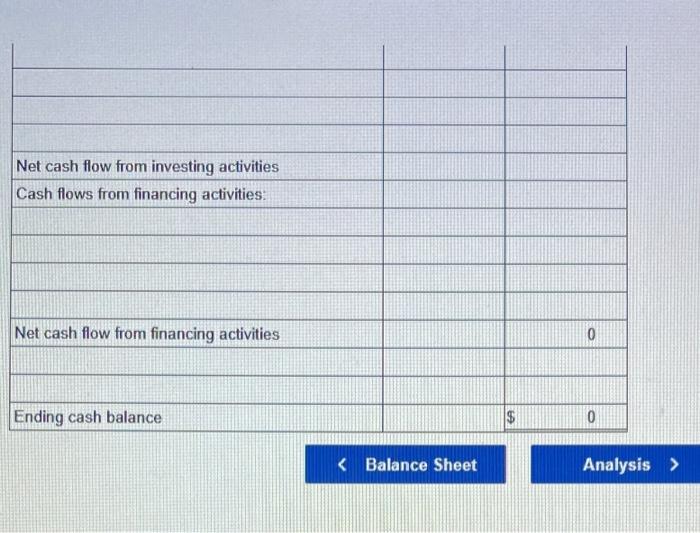

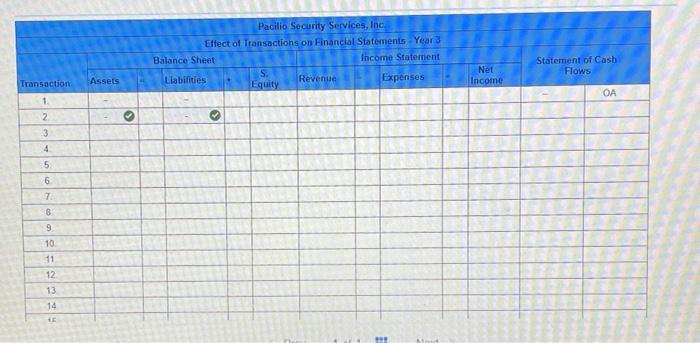

The account balances of Pacilio Security Services, Inc. as of January 1 Year 3, are shown here: Cash Accounts Receivable Supplies Prepaid Rent Land Accounts Payable Unearned Revenue Salaries Payable Notes Payable Common Stock Retained Earnings $ 8,900 1,500 65 800 4,000 1,050 200 1,200 2,000 8,000 2,815 During Year 3, Pacilo Security Services experienced the following transactions: 1 Paid the salaries payable from Year 2 2. Paid the balance of $2,000 on the debt owed to the Small Business Government Agency, The loan is interest-free 3. Performed $32,000 of security services for numerous local events during the year. $21,000 was on account and $11,000 was for cash 4 On May 1, paid $3,000 for 12 months' rent in advance 5. Purchased supplies on account for $700 6. Paid salaries expense for the year of $9,000. 7. Incurred other operating expenses on account, $4,200. 8 On October 1, Year 3, a customer paid $1,200 for services to be provided over the next 12 months. 9. Collected $19.000 of accounts receivable during the year 10. Paid $5,950 on accounts payable 11. Paid $1,800 of advertising expenses for the year. 12. Paid a cash dividend to the shareholders of $4,650. 13. The market value of the land was determined to be $5,500 at December 31, Year 3. Adjustments 14. There was $120 of supplies on hand at the end of the year. 15 Recognized the expired rent 16. Recognized the earned revenue from Year 2 and transaction no. 8. 17. Accrued salaries were $1,000 at December 31, Year 3. X Answer is not complete. General Journal General Ledger Trial Balance Income Statement Changes in SE Analysis Balance Sheet Requirement Statement of CF General Journal tab - Prepare the journal entries to record transactions (1) through (13). Then prepare the necessary adjusting entries (14) through (17) to correctly report net income for the period. Then record the closing entries (18) through (20) as of December 31, Year 3. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab. The ending balance values from the General Ledger tab flows through to the Trial Balance tab. Income Statement tab. Use the drop-down to select the accounts properly included on the income statement Statement of Changes in Stockholders' Equity tab - Prepare the statement of changes in stockholders' equity for the year ended December 31, Year 3. Balance Sheet tab - Prepare a classified Balance Sheet at December 31, Year 3. Statement of cash flows. Prepare the statement of cash flow for year ended December 31, Year 3, Analysis tab - Use a horizontal statements model to show how each transaction affects the balance sheet, incomo statement, and statement of cash flows. Requirement General Journal > No Date General Journal Debit Credit 1 Jan 03 1,200 Salaries payable Cash 1,200 2 Feb 28 2,000 Notes payable Cash E 2,000 3 Apr 15 Cash Accounts receivable Security service revenue 11,000 21,000 32,000 4 May 01 Prepaid rent Cash 3,000 3,000 5 Jun 10 Supplies Accounts payable 700 > 700 6 Aug 04 Salaries expense 9,000 Prey Cash > 9,000 Sep 17 Other operating expense Accounts payable 4,200 > 4,200 > 8 Oct 01 1,200 Cash Unearned revenue 1,200 9 Oct 20 19,000 Cash Accounts rectivable 00 19,000 > 10 Nov 12 Accounts payable Cash 5,950 3 5,950 11 Dec 01 Advertising expense Cash 1,800 Ol > 1,800 > 12 Dec 15 Dividends Cash 4,650 4,650 . 13 Dec 31 1,500 Land Other operating expense X 1,500 14 Dec 31 645 Supplies expense Supplies Do 645 15 Dec 31 Rent expense Prepaid rent 3,000 $ 3,000 16 Dec 31 500 Unearned revenue Security service revenue > 500 17 Dec 31 Salaries expense Salaries payable 1,000 Ols 1.000 18 Dec 31 Security service revenue Land Interest revenue 32,500 1,500 & X 34,000 x Ints 19,645 X 19 Dec 31 O Interest revenue Salaries expense Rent expense Supplies expense Advertising expenso Other operating expense 10,000 3,000 645 1,800 4,200 4,650 20 > Dec 31 Retained earnings Dividends 4,650 General Ledger Account Cash Accounts receivable No. Debit Credit No. Debit Credit 1 2 1,200 2,000 Date Jan 01 Apr 15 Od 20 21,000 Balance 1,500 22,500 3,500 9 19,000 3 11,000 +4220 Date Jan 01 Jan 03 Feb 28 Apr 15 May 01 Aug 04 Oct 01 Oct 20 Nov 12 4 6 8 3,000 9.000 Balance 8,900 7.700 5,700 16,700 13,700 4,700 5.900 24.900 18,950 17,150 12,500 1,200 19,000 9 10 11 12 Dec 01 Dec 15 5,950 1,800 4,650 Supplies Debit No. Credit Prepaid rent Debit Credit No. Credit Date Jan 01 Jun 10 Balance 65 Date Jan 01 May 01 Balance 800 3.800 5 700 765 4 3.0001 JURU IVU FU Way : J.UUU 14 Dec 31 645 120 15 Dec 31 3,000 JUUU 800 Land Accounts payable Debit Credit No. Debit Credit No. Date Jan 01 Dec 31 Dec 31 13 Balance 4,000 5,500 7,000 5 1,500 1,500 Date Jan 01 Jun 10 Sep 17 Nov 12 700 Balance 1,050 1,750 5,950 0 18 4,200 10 5,950 Unearned revenue Salaries payable Debit Credit No. No. Debit Credit Date Jan 01 Jan 03 Dec 31 1 Balance 1,200 0 1,000 Date Jan 01 Oct 01 Dec 31 Balance 200 1,400 900 1,200 1,200 17 1,000 16 500 Notes payable Debit Credit No. Common stock Debit Credit No. Date Jan 01 Feb 28 Balance 2,000 0 Date Jan 01 Balance 8,000 2 2,000 Retained earnings Dividends No. Debit Credit No. Debit Credit Date Jan 01 Dec 31 Balance 2.815 (1,835) 20 4,650 Date Jan 01 Dec 15 Dec 31 4,650 12 20 Balance 0 4,650 0 4,650 Security service revenue Debit Credit Interest revenue No. Date Debit Credit 3 16 18 Date Jan 01 Apr 15 Dec 31 Dec 31 32,000 500 Balance No. 0 32,000 18 32,500 19 0 Balance 0 34,000 14,355 Dec 31 Dec 31 34,000 19,645 32,500 Advertising expense Debit Credit No. Supplies expense Debit Credit No. Balance Date Jan 01 Dec 01 Dec 31 11 Balance 0 1.800 0 Date Jan 01 Dec 31 Dec 31 0 1.800 14 645 645 19 1.800 2 19 645 hell me t Shitinn Salarios expense Other operating expense Debit Credit No. Balance No. Debit Credit Balance Date Jan 01 Date Jan 01 0 0 14 4,200 6 Sep 17 Aug 04 7 13 19 4,200 2,700 (1.500) 9,000 1,000 ttt 1,500 4.200 Dec 31 Dec 31 9,000 10,000 0 17 19 Dec 31 Dec 31 10,000 Rent expense No. Debit Credit Date Jan 01 Dec 31 Dec 31 Balance 0 3,000 0 20 3,000 15 19 3,000 General Journal Trial Balance Post-closing Pacilio Security Services, Inc. Trial Balance December 31, 2021 Account Title Debit Credit 2 $ DEED 12,500 3,500 120 800 7.000 Cash Accounts receivable Supplies Prepaid rent Land Salaries payable Unearned revenue Common stock Retained earnings Interest revenue Other operating expense Total 1,000 900 8,000 1,835 14,355 1,500 25.755 25.7555 Post-closing Pacilio Security Services, Inc. Income Statement For the Year Ended December 31, Year 3 Revenues Service revenue X Total Revenues Expenses Salaries expense Other operating expense Advertising expense Supplies expense Rent expense OOooo Total Expenses Post closing Pacilio Security Services, Inc Statement of Changes in Stockholders' Equity For the Year Ended December 31: Year 3 Beginning Common Stock $ 8,000 Add: Common stock issued 0 Ending Common Stock Beginning Retained Earnings $ 2,815 Add: Net income Less: Dividends 0 Ending Retained Earnings Total Stockholders' Equity $ 8,000 $ (1,835) 6,165 $ Post-closing Pacilio Security Services, Inc. Balance Sheet At December 31, Year 3 Assets Cash 12,500 3,500 120 Accounts receivable Supplies Prepaid rent 800 $ 16,920 Total Assets Liabilities x 7 Accounts payable Salaries payable Unearned revenue 1,000 900 Total Liabilities $ 1,900 Stockholders' Equity Cammon otant 2nnn $ 16,920 Total Assets Liabilities x Accounts payable Salaries payable Uneamed revenue 1,000 900 Total Liabilities 1$ 1,900 Stockholders' Equity Common stock 8,000 Retained earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity (1,835) 6,165 8,065 $ Pacilio Security Services, Inc Effect of Transactions on Financial Statements Year 3 Balance Sheet Income Statement Liabilities Revenue Expenses Equity Net Income Statement of Cash Flows Assets Transaction 1 2 3 4 > 5 6 7 8 9 10 11 12 13 14 13 15 16 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts