Question: Can someone please help me solve question 3? I posted this question before but I was hoping for a more indepth explanation showing the formulas.

Can someone please help me solve question 3? I posted this question before but I was hoping for a more indepth explanation showing the formulas. I am still very confused.

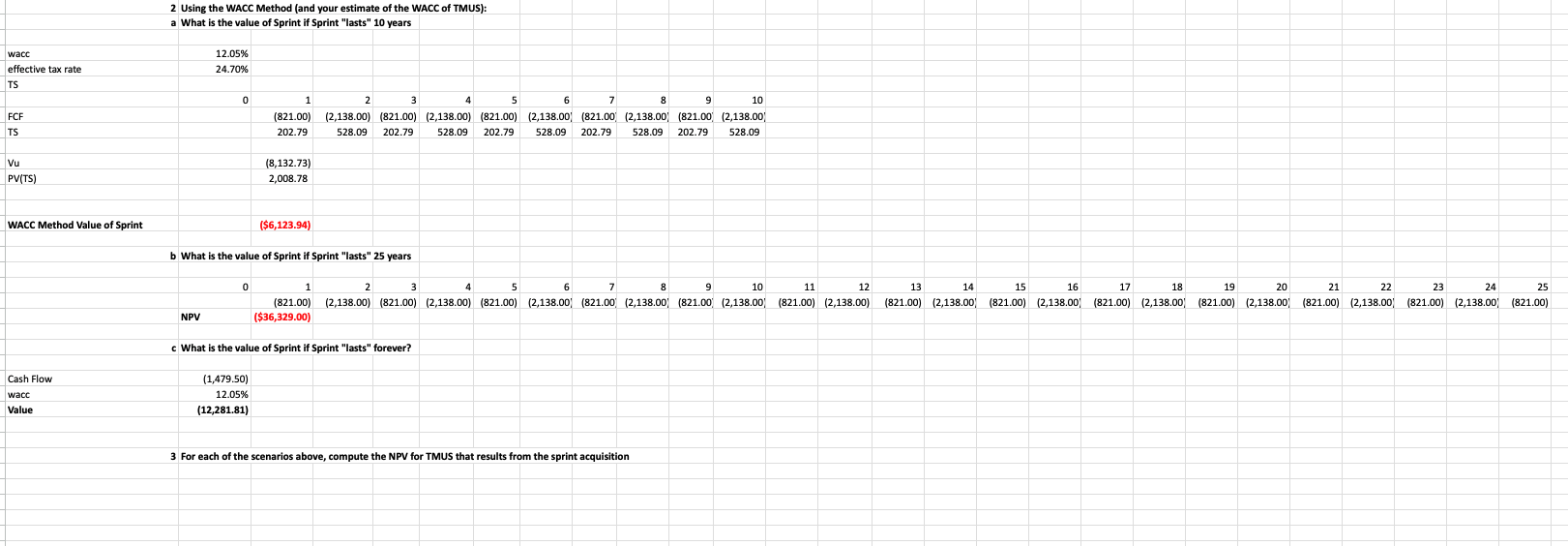

2 Using the WACC Method (and your estimate of the WACC of TMUS): a What is the value of Sprint if Sprint "lasts" 10 years wace effective tax rate TS FCF Vu WACC Method Value of Sprint 12.05% ($6,123.94) b What is the value of Sprint if Sprint "lasts" 25 years NPV c What is the value of Sprint if Sprint "lasts" forever? Cash Flow wace (1,479.50) 12.05% 3 For each of the scenarios above, compute the NPV for TMUS that results from the sprint acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts