Question: Can someone please help me solve question C and D? :) Thank you so muchhhh Jeeslyn is considering buying an apartment as an investment, and

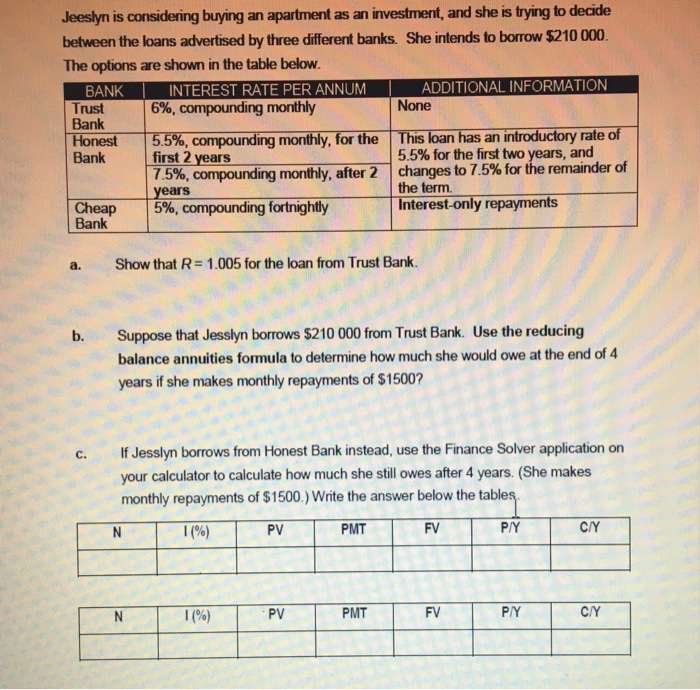

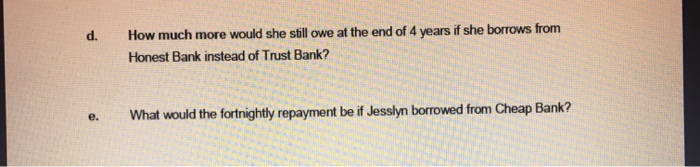

Jeeslyn is considering buying an apartment as an investment, and she is trying to decide between the loans advertised by three different banks. She intends to borrow $210 000. The options are shown in the table below. BANK INTEREST RATE PER ANNUM ADDITIONAL INFORMATION Trust 6%, compounding monthly None Bank Honest 5.5%, compounding monthly, for the This loan has an introductory rate of Bank first 2 years 5.5% for the first two years, and 7.5%, compounding monthly, after 2 changes to 7.5% for the remainder of years the term. Cheap 5%, compounding fortnightly Interest-only repayments Bank a. Show that R= 1.005 for the loan from Trust Bank. b. Suppose that Jesslyn borrows $210 000 from Trust Bank. Use the reducing balance annuities formula to determine how much she would owe at the end of 4 years if she makes monthly repayments of $1500? c. If Jesslyn borrows from Honest Bank instead, use the Finance Solver application on your calculator to calculate how much she still owes after 4 years. (She makes monthly repayments of $1500.) Write the answer below the tables N 11%) PV PMT FV P/Y C/Y N 1(%) PV PMT FV P/Y C/Y d. How much more would she still owe at the end of 4 years if she borrows from Honest Bank instead of Trust Bank? e. What would the fortnightly repayment be if Jesslyn borrowed from Cheap Bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts