Question: Can someone please help me solve the below 4 questions? Thanks! The Up and Coming Corporation?s common stock has a beta of 1.6 . If

Can someone please help me solve the below 4 questions? Thanks!

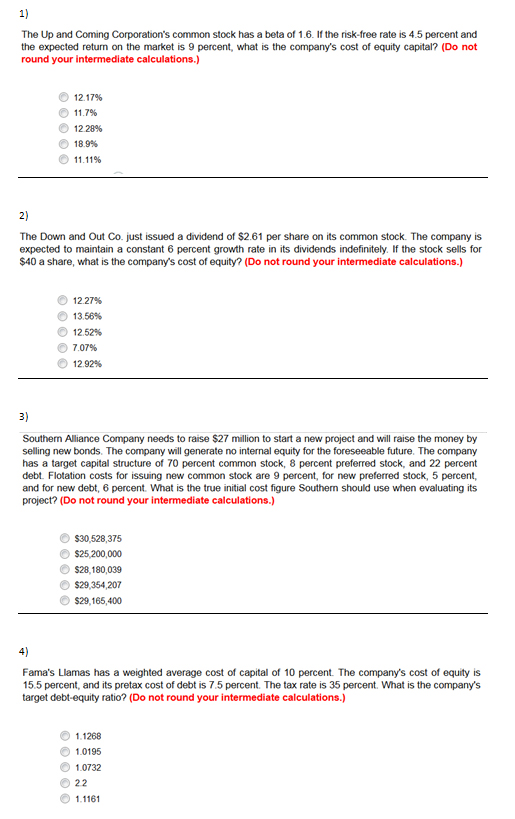

The Up and Coming Corporation?s common stock has a beta of 1.6 . If the risk-fee rate is 4.5 percent and the expected return on the market is 9 percent , what is the company?s cost of equity capital?(Do not round your intermediate calculations.)The Down and Out Co. Just issued a dividend of $2.61 per share on its common stock. The company is expected to maintain a constant 6 percent growth rate in its dividends indefinitely. If the stock sells for $ 40 a share , what is the company?s cost of equity? (Do not round your intermediate calculations.)Southern Alliance Company needs to raise $27 million to start a new project and will raise the money by selling new bonds. The company will generate no integral equity for the foreseeable future. The company has a target capital structure of 70 percent common stock, 8 percent preferred stock, and 22 percent debt. Flotation costs for issuing new common stock are 9 percent, for new preferred stock, 5 percent , and for new debt, 6 percent . What is the true initial cost figure Southren should use when evaluating its project? (Do not round your intermediate calculations.)Fama?s Liamas has a weighted average cost of capital of 10 percent. The company?s cost of equity is 15.5 percent , and its pretax cost of debt is 7.5 percent. The tax rate is 35 percent. What is the company?s target debt-equity ratio? (Do not round your intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts