Question: Can someone please help me solve these in excel? THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 28 - 29. On July 1, Year 1, Test

Can someone please help me solve these in excel?

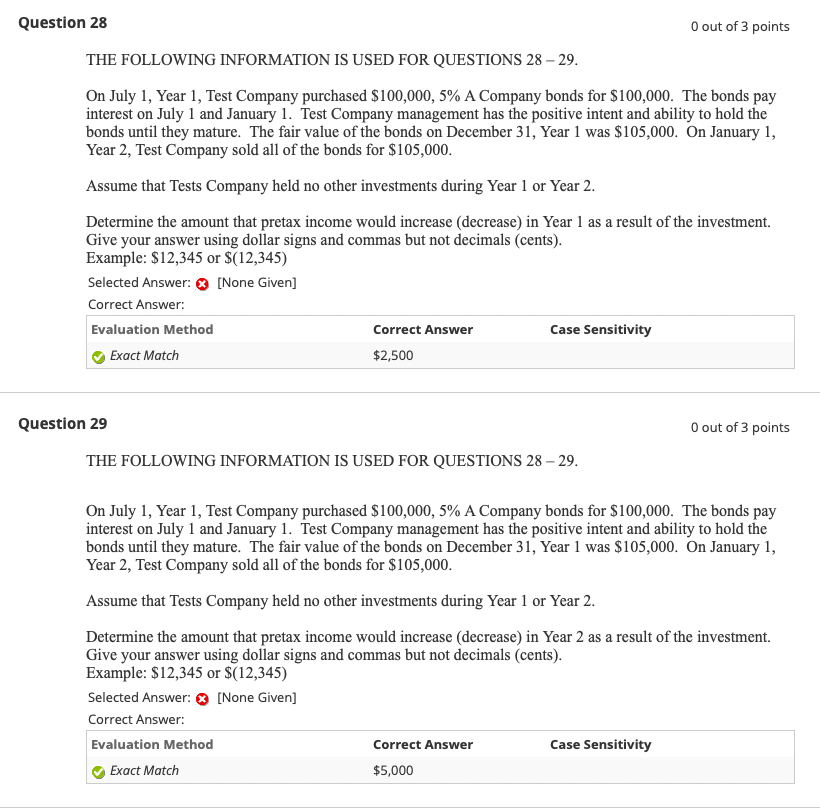

THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 28 - 29. On July 1, Year 1, Test Company purchased $100,000,5% A Company bonds for $100,000. The bonds pay interest on July 1 and January 1 . Test Company management has the positive intent and ability to hold the bonds until they mature. The fair value of the bonds on December 31, Year 1 was $105,000. On January 1 , Year 2, Test Company sold all of the bonds for $105,000. Assume that Tests Company held no other investments during Year 1 or Year 2. Determine the amount that pretax income would increase (decrease) in Year 1 as a result of the investment. Give your answer using dollar signs and commas but not decimals (cents). Example: $12,345 or $(12,345) Selected Answer: [None Given] Correct Answer: I 0 out of 3 points THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 28 - 29. On July 1, Year 1, Test Company purchased $100,000,5% A Company bonds for $100,000. The bonds pay interest on July 1 and January 1 . Test Company management has the positive intent and ability to hold the bonds until they mature. The fair value of the bonds on December 31 , Year 1 was $105,000. On January 1 , Year 2, Test Company sold all of the bonds for $105,000. Assume that Tests Company held no other investments during Year 1 or Year 2. Determine the amount that pretax income would increase (decrease) in Year 2 as a result of the investment. Give your answer using dollar signs and commas but not decimals (cents). Example: $12,345 or $(12,345) Selected Answer: x [None Given] Correct Answer: THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 28 - 29. On July 1, Year 1, Test Company purchased $100,000,5% A Company bonds for $100,000. The bonds pay interest on July 1 and January 1 . Test Company management has the positive intent and ability to hold the bonds until they mature. The fair value of the bonds on December 31, Year 1 was $105,000. On January 1 , Year 2, Test Company sold all of the bonds for $105,000. Assume that Tests Company held no other investments during Year 1 or Year 2. Determine the amount that pretax income would increase (decrease) in Year 1 as a result of the investment. Give your answer using dollar signs and commas but not decimals (cents). Example: $12,345 or $(12,345) Selected Answer: [None Given] Correct Answer: I 0 out of 3 points THE FOLLOWING INFORMATION IS USED FOR QUESTIONS 28 - 29. On July 1, Year 1, Test Company purchased $100,000,5% A Company bonds for $100,000. The bonds pay interest on July 1 and January 1 . Test Company management has the positive intent and ability to hold the bonds until they mature. The fair value of the bonds on December 31 , Year 1 was $105,000. On January 1 , Year 2, Test Company sold all of the bonds for $105,000. Assume that Tests Company held no other investments during Year 1 or Year 2. Determine the amount that pretax income would increase (decrease) in Year 2 as a result of the investment. Give your answer using dollar signs and commas but not decimals (cents). Example: $12,345 or $(12,345) Selected Answer: x [None Given] Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts