Question: Can someone please help me solve this? Homework: Chapter 15 Homework Save Score: 0 of 1 pt 7 of 8 (6 complete HW Score: 71.88%,

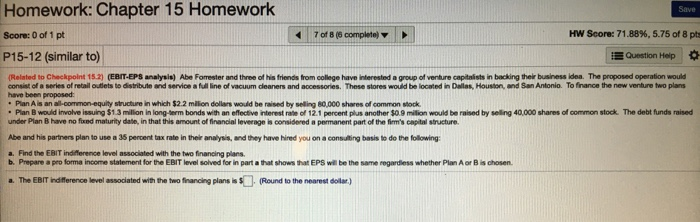

Homework: Chapter 15 Homework Save Score: 0 of 1 pt 7 of 8 (6 complete HW Score: 71.88%, 5.75 of 8 pts P15-12 (similar to) Question Help Related to Checkpoint 15-2) (EBIT-EPS analysis) Abe Forrester and three of his friends from college have interested a group of venture capitalists in backing their business idea. The proposed operation would consist of a series of retail outlets to distribute and service a full line of vacuum deaners and accessories. These stores would be located in Dallas, Houston, and San Antonio. To finance the new venture two plans have been proposed: Plan Als an all-coton-equity structure in which $2.2 million dollars would be raised by selling 80.000 shares of common stock. Plan B would involve issuing $1.3 million in long term bonds with an effective interest rate of 12.1 percent plus another $0.9 million would be raised by selling 40,000 shares of common stock. The debt funds raised under Plan B have no fixed maturity date in that this amount of financial leverage is considered a permanent part of the firm's capital structure. Abe and his partners plan to use a 36 percent tax rate in their analysis, and they have hired you on a consulting basis to do the following: a Find the EBIT indifference level associated with the two financing plans b. Prepare a pro forma income statement for the EBIT level solved for in part a that shows that EPS will be the same regardless whether Plan A or Bis The EBIT indifference level associated with the two financing plans is ). (Round to the nearest dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts