Question: Can someone please help me through this problem? The answer is given but I don't understand it. 8. Franklin corp. is looking at a new

Can someone please help me through this problem? The answer is given but I don't understand it.

Can someone please help me through this problem? The answer is given but I don't understand it.

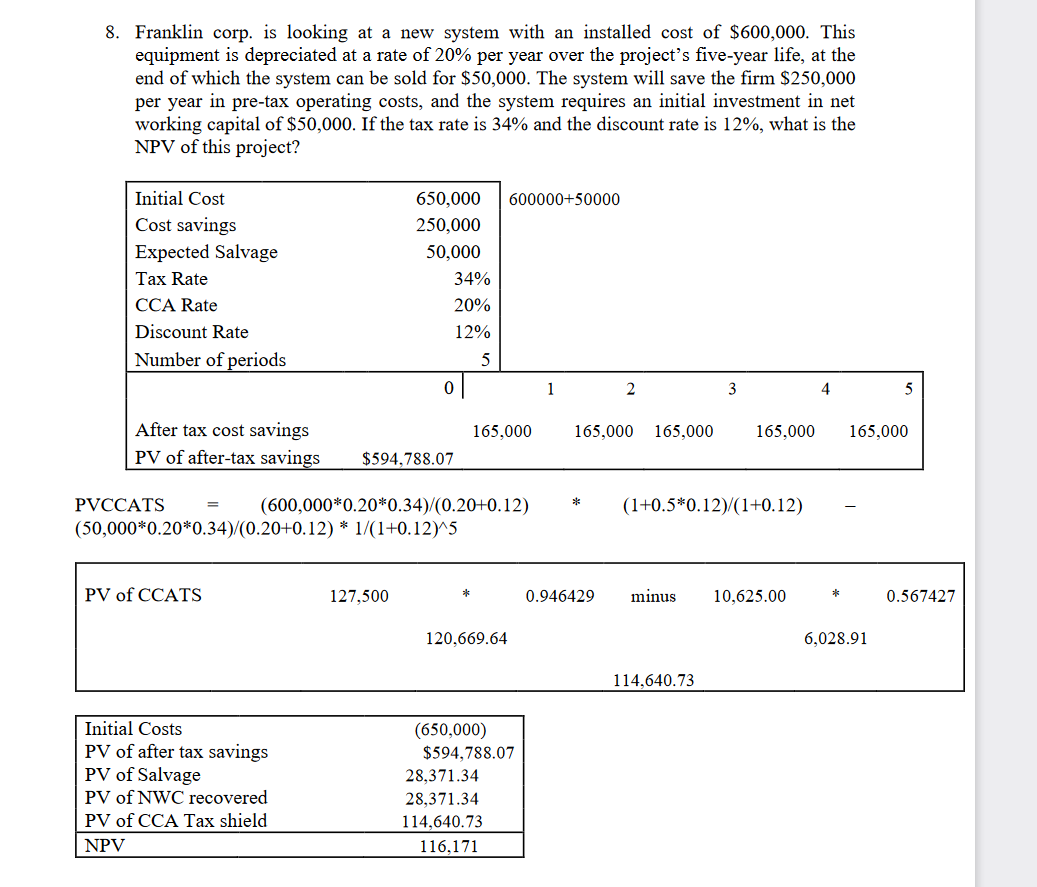

8. Franklin corp. is looking at a new system with an installed cost of $600,000. This equipment is depreciated at a rate of 20% per year over the project's five-year life, at the end of which the system can be sold for $50,000. The system will save the firm $250,000 per year in pre-tax operating costs, and the system requires an initial investment in net working capital of $50,000. If the tax rate is 34% and the discount rate is 12%, what is the NPV of this project? 600000+50000 Initial Cost Cost savings Expected Salvage Tax Rate CCA Rate Discount Rate Number of periods 650,000 250,000 50,000 34% 20% 12% 5 0 1 2 3 4 5 165,000 165,000 165,000 165,000 165,000 After tax cost savings PV of after-tax savings $594,788.07 = * (1+0.5*0.12)/(1+0.12) PVCCATS (600,000*0.20*0.34)/(0.20+0.12) (50,000*0.20*0.34)/(0.20+0.12) * 1/(1+0.12) 5 PV of CCATS 127,500 * 0.946429 minus 10,625.00 0.567427 120,669.64 6,028.91 114,640.73 Initial Costs PV of after tax savings PV of Salvage PV of NWC recovered PV of CCA Tax shield (650,000) $594,788.07 28,371.34 28,371.34 114,640.73 116,171 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts