Question: Can someone please help me with the missing fields? Complete Schedule M-1 for each of the following cases: Required: a. Corporate financial statement: net Income

Can someone please help me with the missing fields?

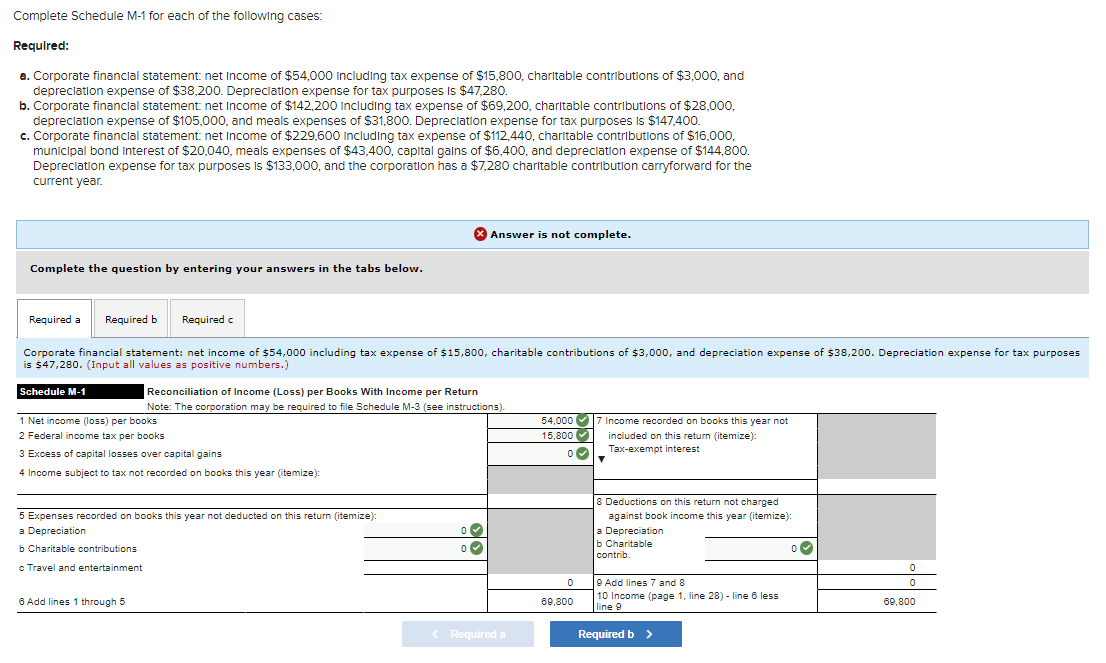

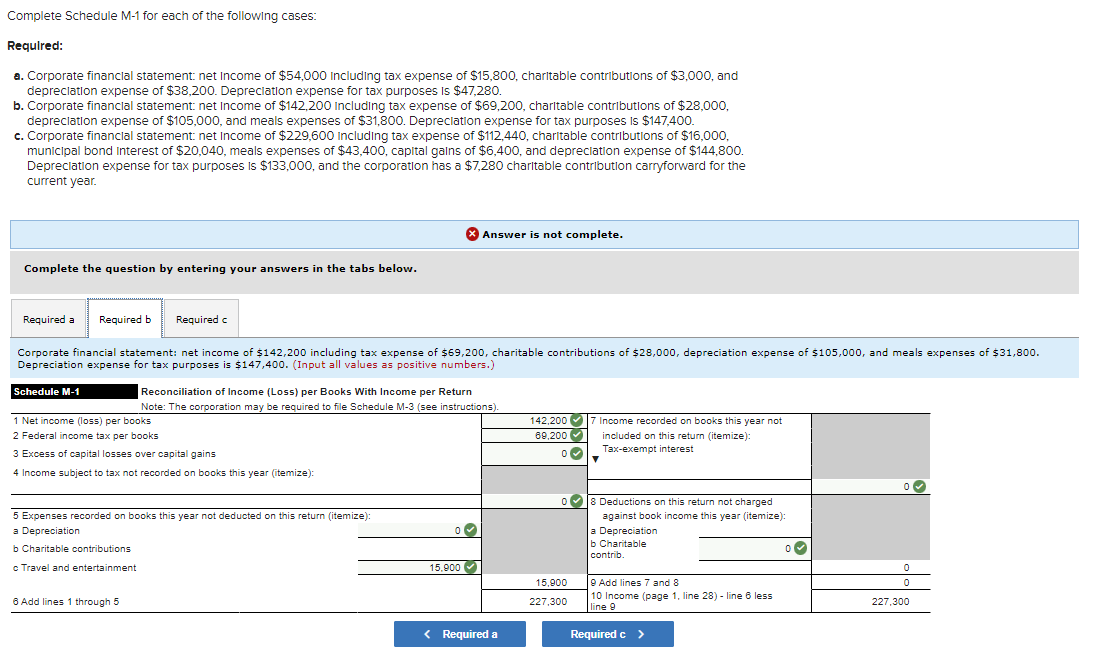

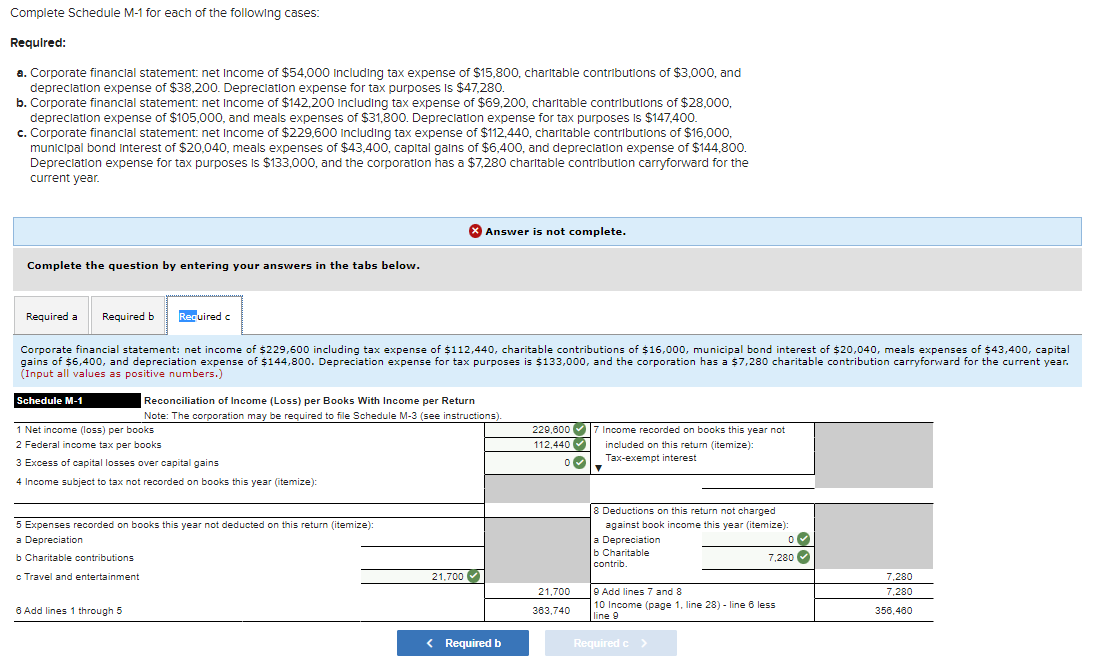

Complete Schedule M-1 for each of the following cases: Required: a. Corporate financial statement: net Income of $54,000 Including tax expense of $15,800, charitable contributions of $3,000, and depreciation expense of $38,200. Depreciation expense for tax purposes is $47,280. b. Corporate financial statement: net Income of $142,200 Including tax expense of $69,200, charitable contributions of $28,000, depreciation expense of $105,000, and meals expenses of $31,800. Depreciation expense for tax purposes is $147,400. c. Corporate financial statement: net Income of $229,600 Including tax expense of $112,440, charitable contributions of $16,000, municipal bond Interest of $20,040, meals expenses of $43,400, capital gains of $6,400, and depreciation expense of $144,800. Depreciation expense for tax purposes is $133.000, and the corporation has a $7,280 charitable contribution carryforward for the current year. X Answer is not complete. . Complete the question by entering your answers in the tabs below. Required a Required b Required Corporate financial statement: net income of $54,000 including tax expense of $15,800, charitable contributions of $3,000, and depreciation expense of $38,200. Depreciation expense for tax purposes is $47,280. (Input all values as positive numbers.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). M. 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize) : 54,000 15,800 0 0 7 Income recorded on books this year not included on this return (itemize): Tax-exempt interest 0 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 8 Deductions on this return not charged against book income this year (itemize): a Depreciation b Charitable 0 contrib. 0 0 0 0 9 Add lines 7 and 8 10 Income (page 1, line 28) - line 8 less line 9 6 Add lines 1 through 5 69,800 69,800 Complete Schedule M-1 for each of the following cases: Required: a. Corporate financial statement: net Income of $54,000 Including tax expense of $15,800, charitable contributions of $3,000, and depreciation expense of $38,200. Depreciation expense for tax purposes is $47,280. b. Corporate financial statement: net Income of $142,200 Including tax expense of $69,200, charitable contributions of $28,000, depreciation expense of $105,000, and meals expenses of $31,800. Depreciation expense for tax purposes is $147,400. c. Corporate financial statement: net Income of $229,600 Including tax expense of $112,440, charitable contributions of $16,000, municipal bond Interest of $20,040, meals expenses of $43,400, capital gains of $6,400, and depreciation expense of $144,800. Depreciation expense for tax purposes is $133,000, and the corporation has a $7,280 charitable contribution carryforward for the current year. * . Answer is not complete. Complete the question by entering your answers in the tabs below. Required a Required b Required Corporate financial statement: net income of $142,200 including tax expense of $69,200, charitable contributions of $28,000, depreciation expense of $105,000, and meals expenses of $31,800. Depreciation expense for tax purposes is $147,400. (Input all values as positive numbers.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions). -). 1 Net income (loss) per books 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 4 ) 142,200 69,200 0 Income recorded on books this year not included on this return itemize): Tax-exempt interest 0 0 0 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions 0 8 Deductions on this return not charged against book income this year (itemize): a Depreciation b Charitable 0 0 contrib. cTravel and entertainment 15.900 0 15,900 0 9 9 Add lines 7 and 8 10 Income (page 1, line 28) - line 8 less line 9 6 Add lines 1 through 5 227,300 227.300 Complete Schedule M-1 for each of the following cases: Required: a. Corporate financial statement:net Income of $54,000 Including tax expense of $15,800, charitable contributions of $3,000, and depreciation expense of $38,200. Depreciation expense for tax purposes is $47,280. b. Corporate financial statement: net income of $142,200 Including tax expense of $69,200, charitable contributions of $28,000, depreciation expense of $105,000, and meals expenses of $31,800. Depreciation expense for tax purposes is $147,400. c. Corporate financial statement:net Income of $229,600 Including tax expense of $112,440, charitable contributions of $16,000, municipal bond Interest of $20,040, meals expenses of $43,400, capital gains of $6,400, and depreciation expense of $144,800. Depreciation expense for tax purposes is $133,000, and the corporation has a $7,280 charitable contribution carryforward for the current year. % Answer is not complete. Complete the question by entering your answers in the tabs below. Required a Required b Recuired Corporate financial statement: net income of $229,600 including tax expense of $112,440, charitable contributions of $16,000, municipal bond interest of $20,040, meals expenses of $43,400, capital gains of $6,400, and depreciation expense of $144,800. Depreciation expense for tax purposes is $133,000, and the corporation has a $7,280 charitable contribution carryforward for the current year. (Input all values as positive numbers.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3 (see instructions) 1 Net income (loss) per books ) 2 Federal income tax per books 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 229,600 112,440 Income recorded on books this year not included on this return itemize): Tax-exempt interest 0 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment 8 Deductions on this return not charged against book income this year (itemize): a Depreciation 0 b Charitable 7.280 contrib 21.700 7.280 7,280 21,700 363,740 9 Add lines 7 and 8 10 Income (page 1, line 28) - line 6 less line 9 6 Add lines 1 through 5 356,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts