Question: Can someone please help me with the question, I checked other answers but they havent properly used the options we can choose from in question

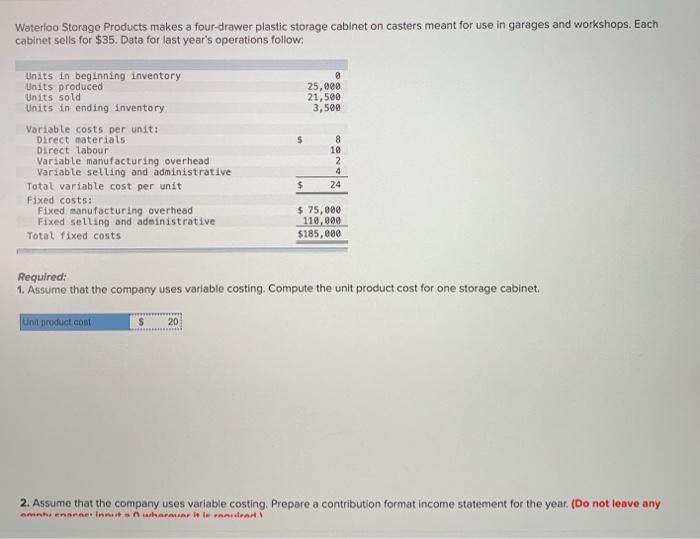

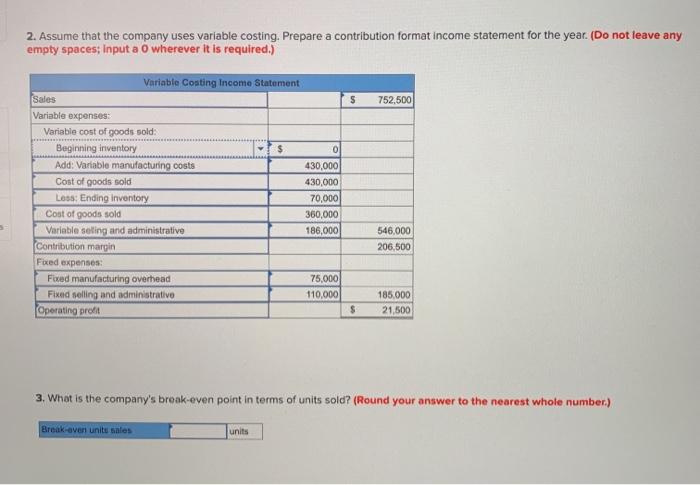

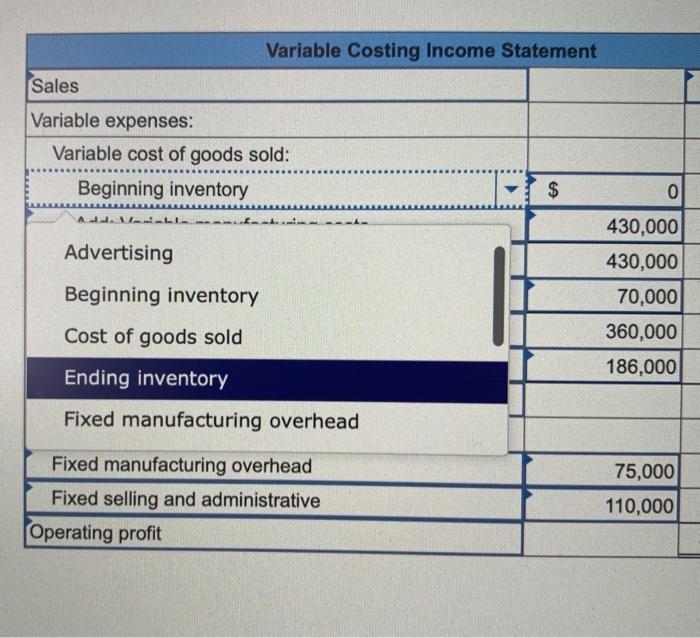

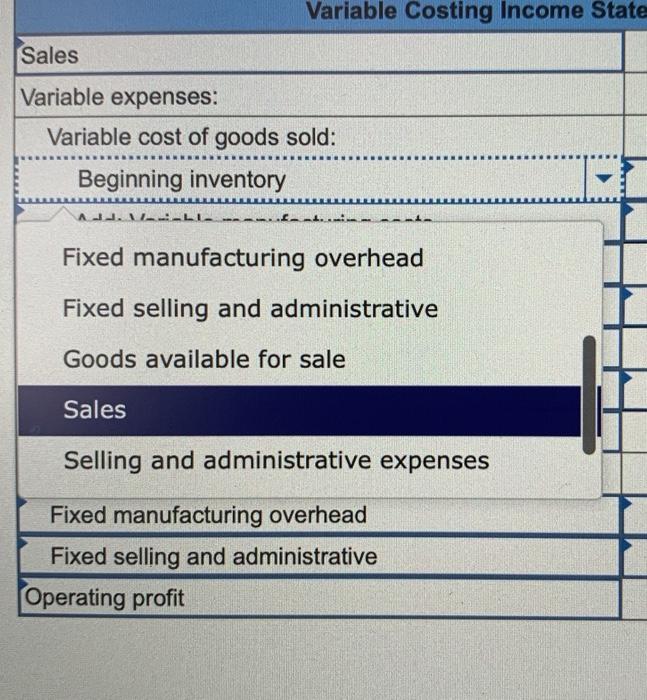

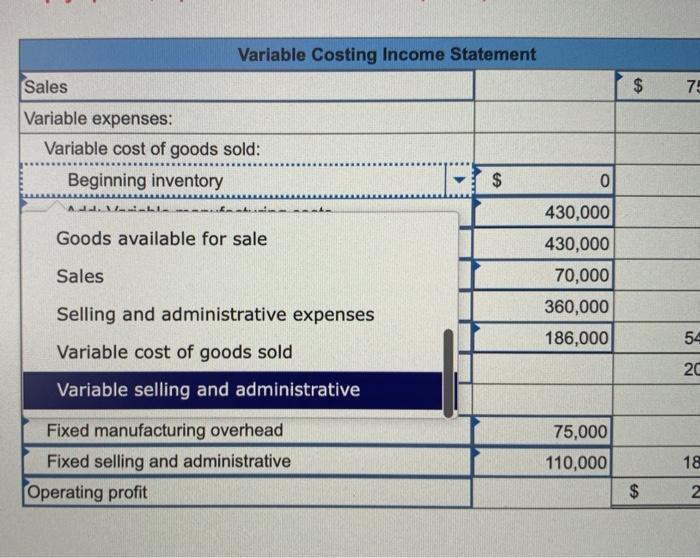

Waterloo Storage Products makes a four-drawer plastic storage cabinet on casters meant for use in garages and workshops. Each cabinet sells for $35. Data for last year's operations follow: 25,000 21,500 3,500 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct Labour Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 8 10 2 4 24 $ $ 75,000 110,000 $185,000 Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one storage cabinet. Unt product cont 20 2. Assume that the company uses variable costing. Prepare a contribution format income statement for the year. (Do not leave any omahe narae. innusta haru le randt 2. Assume that the company uses variable costing. Prepare a contribution format income statement for the year. (Do not leave any empty spaces; Input a 0 wherever it is required.) $ 752,500 0 Variable Coating Income Statement Sales Variable expenses: Variable cost of goods sold: Beginning inventory Add: Variable manufacturing costs Cost of goods sold Less Ending Inventory Cost of goods sold Variable seling and administrative Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative Operating profit 430,000 430,000 70,000 360,000 186,000 546,000 206,500 75,000 110,000 185.000 21,500 $ 3. What is the company's break-even point in terms of units sold? (Round your answer to the nearest whole number.) Break even unitu sales units Variable Costing Income Statement Sales Variable expenses: Variable cost of goods sold: Beginning inventory $ 0 ALL ---- Advertising 430,000 430,000 Beginning inventory Cost of goods sold 70,000 360,000 186,000 Ending inventory Fixed manufacturing overhead 75,000 Fixed manufacturing overhead Fixed selling and administrative Operating profit 110,000 Variable Costing Income State Sales Variable expenses: Variable cost of goods sold: Beginning inventory A. VILLA...... Fixed manufacturing overhead Fixed selling and administrative Goods available for sale Sales Selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative Operating profit Variable Costing Income Statement Sales $ $ 75 Variable expenses: Variable cost of goods sold: Beginning inventory $ $ 0 AWALADA 430,000 Goods available for sale Sales 430,000 70,000 360,000 186,000 Selling and administrative expenses 54 Variable cost of goods sold 20 Variable selling and administrative Fixed manufacturing overhead Fixed selling and administrative Operating profit 75,000 110,000 18 $ N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts