Question: Can someone please help me with these two questions? I am ready to pull my hair out Exercise #9: PV of a delayed (Ordinary] Annuity

Can someone please help me with these two questions? I am ready to pull my hair out

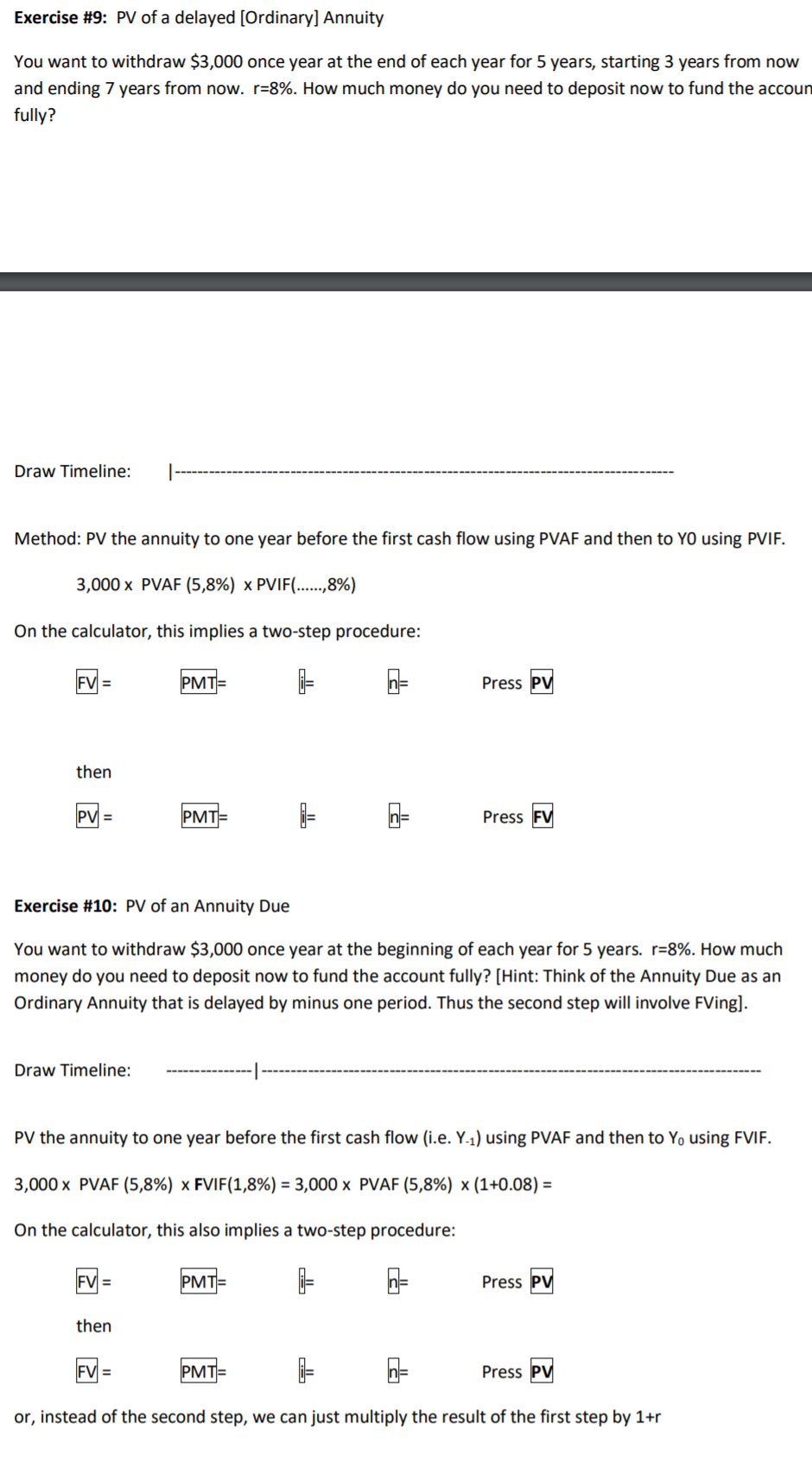

Exercise #9: PV of a delayed (Ordinary] Annuity You want to withdraw $3,000 once year at the end of each year for 5 years, starting 3 years from now and ending 7 years from now. r=8%. How much money do you need to deposit now to fund the accoun fully? Draw Timeline: Method: PV the annuity to one year before the first cash flow using PVAF and then to YO using PVIF. 3,000 x PVAF (5,8%) x PVIF......,8%) On the calculator, this implies a two-step procedure: FV = PMT= n Press PV then PV = PMT= = Press FV Exercise #10: PV of an Annuity Due You want to withdraw $3,000 once year at the beginning of each year for 5 years. r=8%. How much money do you need to deposit now to fund the account fully? (Hint: Think of the Annuity Due as an Ordinary Annuity that is delayed by minus one period. Thus the second step will involve FVing). Draw Timeline: PV the annuity to one year before the first cash flow (i.e. Y-1) using PVAF and then to Yo using FVIF. 3,000 x PVAF (5,8%) x FVIF(1,8%) = 3,000 x PVAF (5,8%) * (1+0.08) = On the calculator, this also implies a two-step procedure: FV= PMT= Press PV then FV = PMT= n= Press PV or, instead of the second step, we can just multiply the result of the first step by 1+r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts