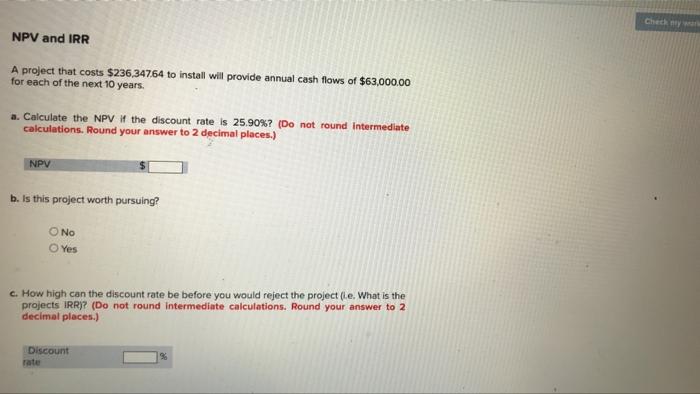

Question: Can someone please help me with these two questions underneath? I'd greatly appreciate it. Check NPV and IRR A project that costs $236,34764 to install

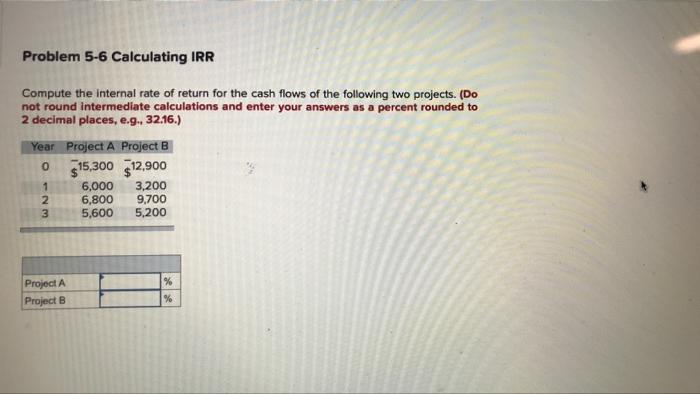

Check NPV and IRR A project that costs $236,34764 to install will provide annual cash flows of $63,000.00 for each of the next 10 years. a. Calculate the NPV # the discount rate is 25.90%? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) NPV b. Is this project worth pursuing? No Yes c. How high can the discount rate be before you would reject the project (le. What is the projects IRR)? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Discount Problem 5-6 Calculating IRR Compute the internal rate of return for the cash flows of the following two projects. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Year Project A Project B 15,300 12,900 6,000 3,200 9,700 5,600 5,200 O NM 2 3 6,800 % Project A Project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts