Question: Can someone please help me with this case? i just need help with a few jumping off points. CASE 1 Capital Mortgage Insurance Corporation (A)

Can someone please help me with this case? i just need help with a few jumping off points.

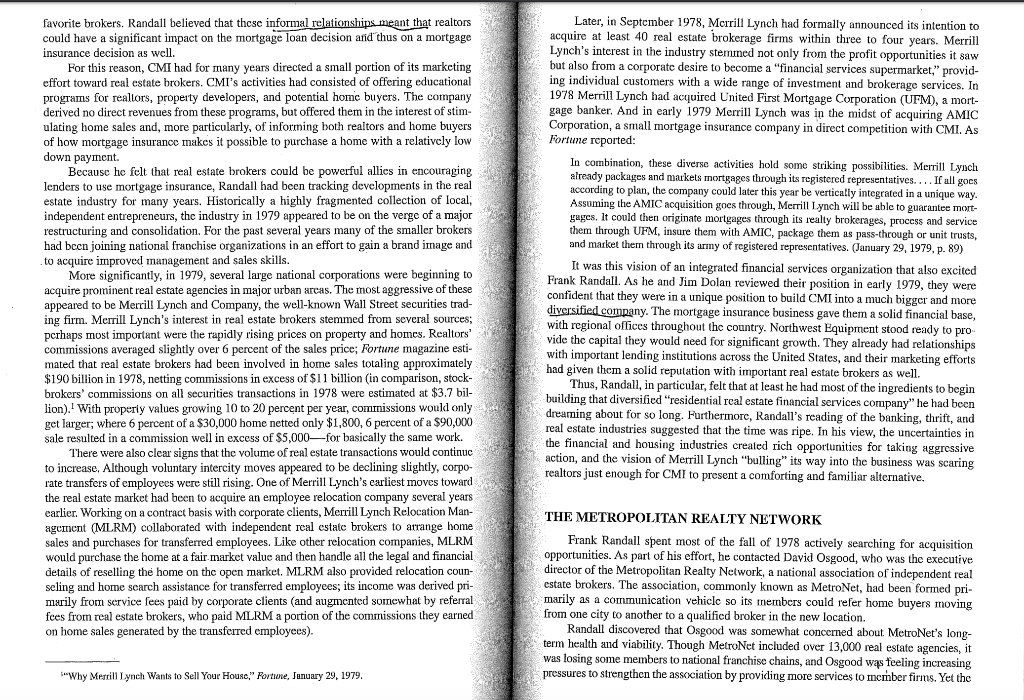

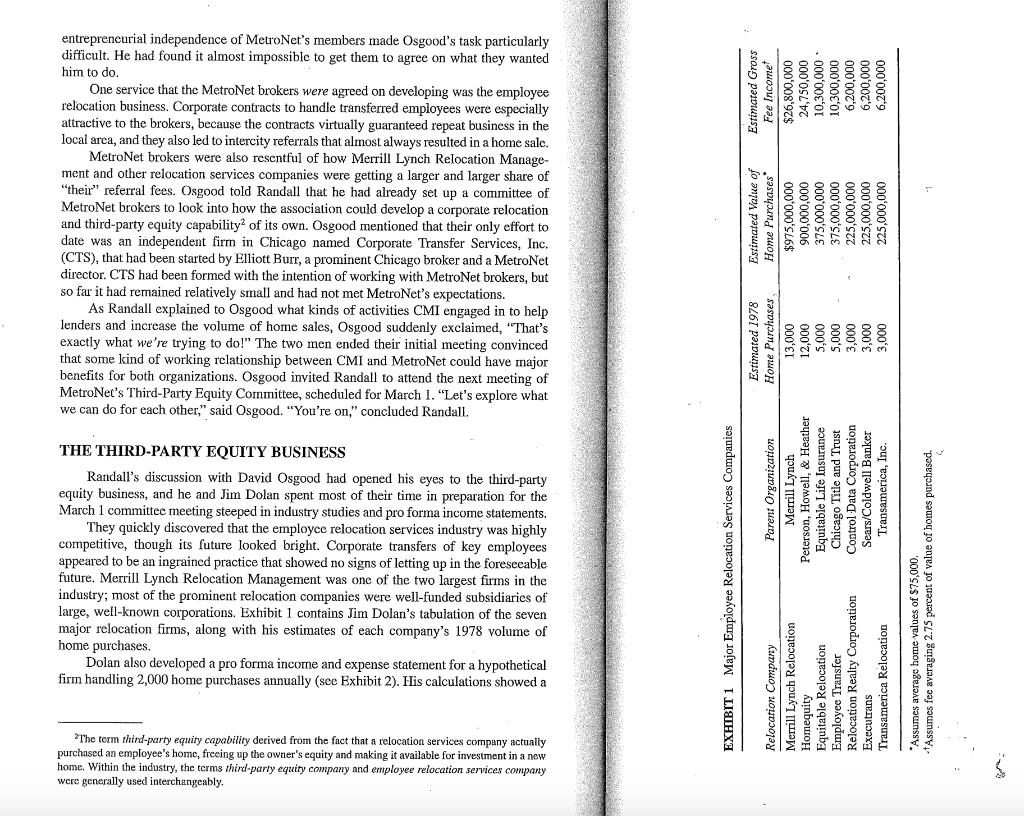

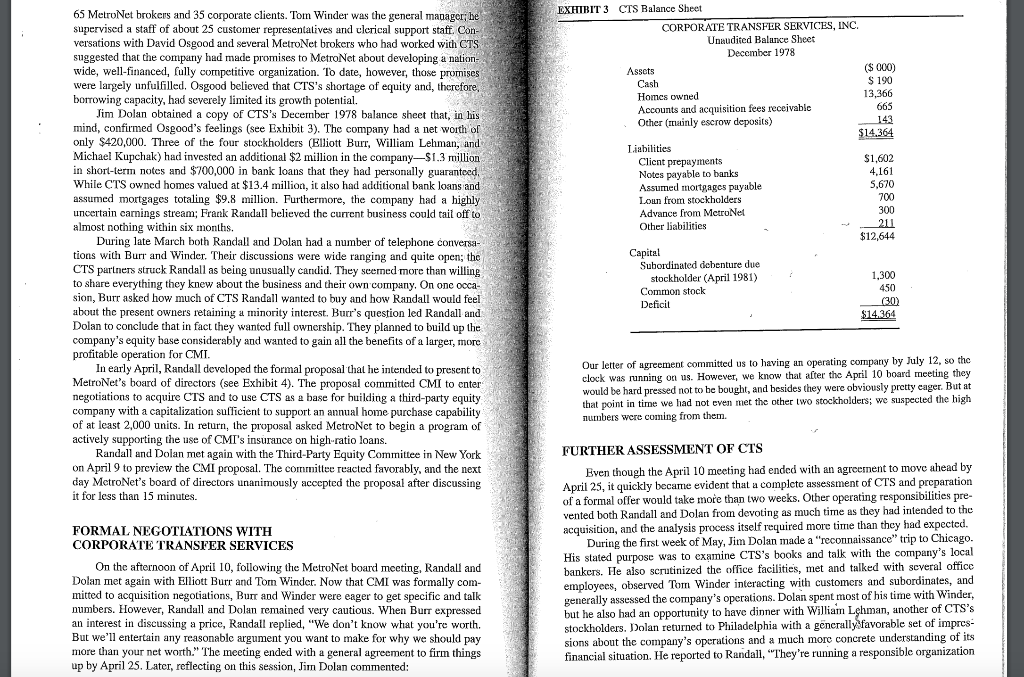

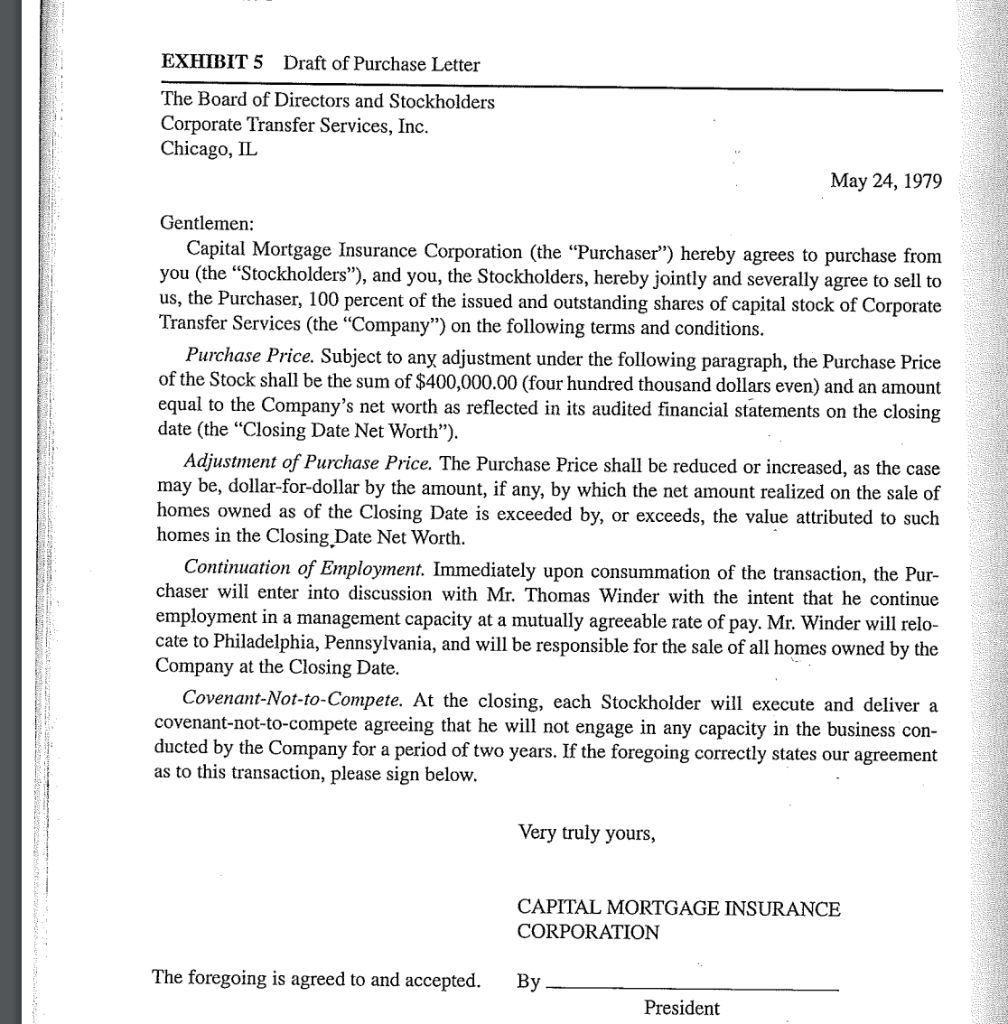

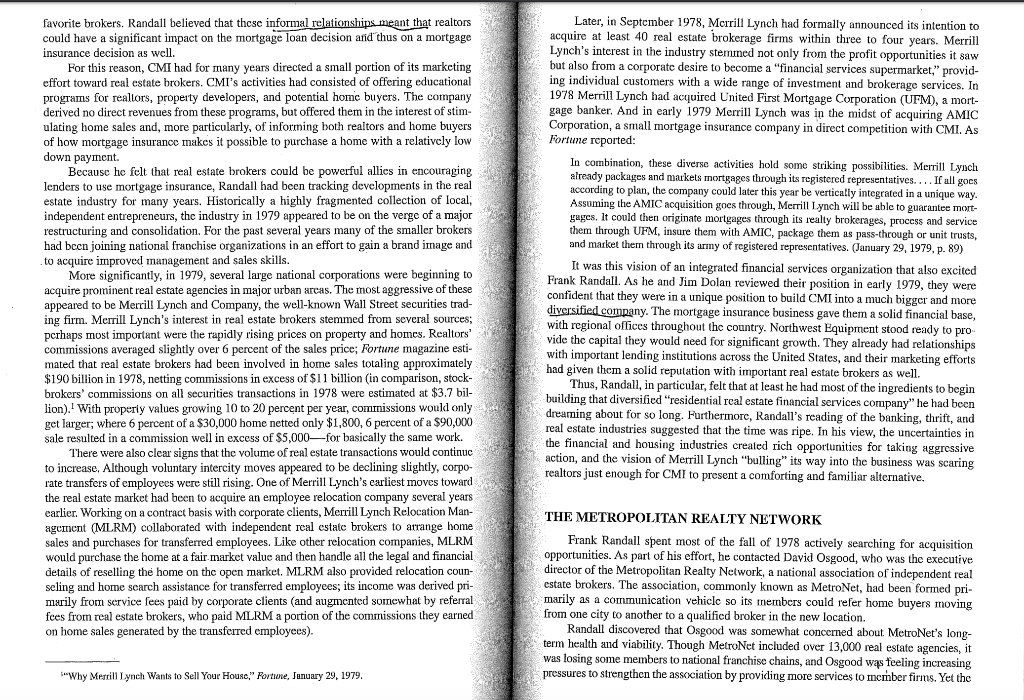

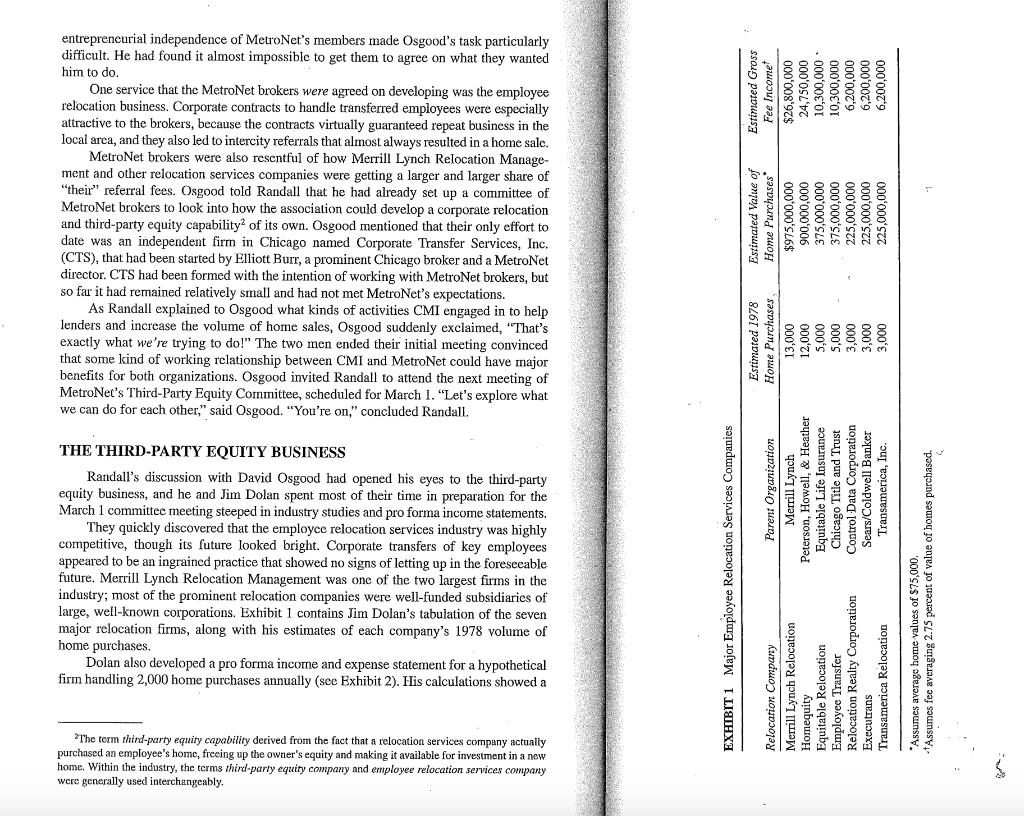

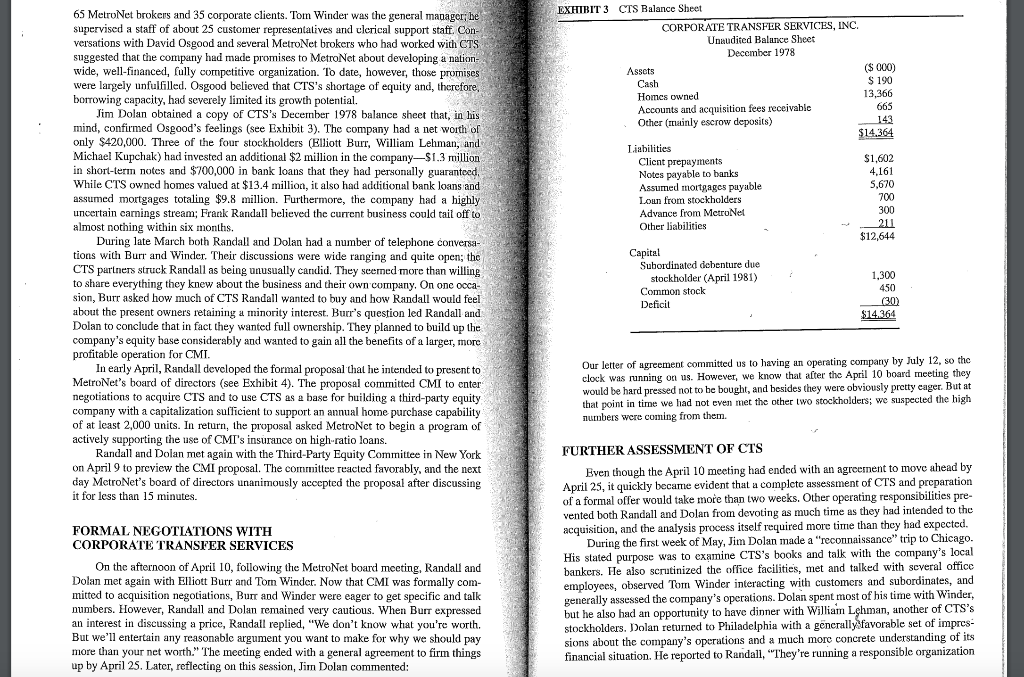

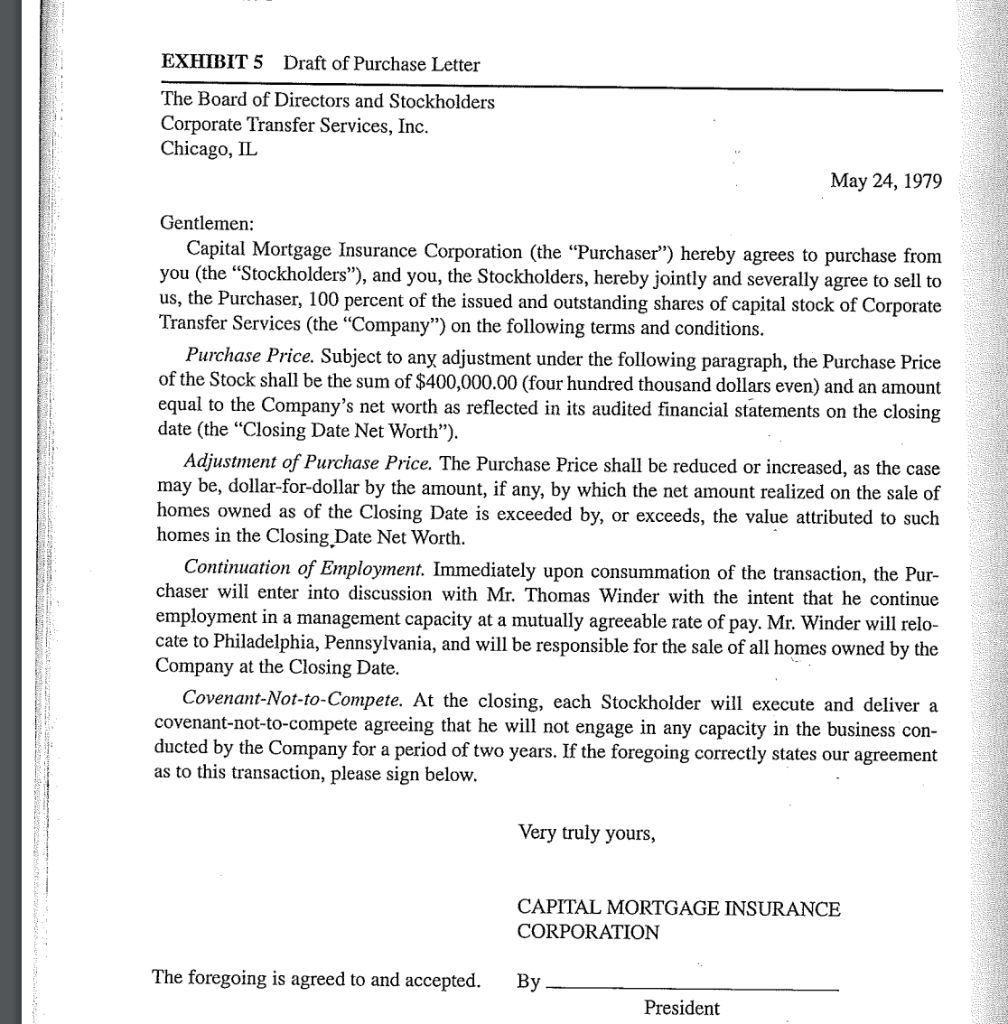

CASE 1 Capital Mortgage Insurance Corporation (A) Frank Randall hung up the telephone, leaned across his desk, and fixed a cold stare at Jim Dolan. OK, Jim. They've agreed to a meeting. We've got three days to resolve this thing, The ques- tion is, what approach should we take? How do we get them to accept our offer? Randall, president of Capital Mortgage Insurance Corporation (CMI), had called Dolan, his senior vice president and treasurer, into his office to help him plan their strat- cgy for completing the acquisition of Corporate Transfer Services (CTS). The two men had begun informal discussions with the principal stockholders of the small employee relocation services company some four months carlier. Now, in late May 1979, they were developing the terms of a formal purchase offer and plotting their strategy for the final negotiations The acquisition, if consummated, would be the first in CMI's history. Furthermore, it represented a significant departure from the company's present business, Randall and Dolan knew that the acquisition could have major implications, both for themselves and for the company they had revitalized over the past several years. Jim Dolan ignored Frank Randall's intense look and gazed out the eighth-floor window overlooking Philadelphia's Independence Square. That's not an casy question, Frank. We know they're still looking for a lot more money than we're thinking about. But heyond that, the four partners have their own differences, and we need to think through just what they're expecting. So I guess we'd better talk this one through pretty carefully equipment. Northwest had acquired CMI in 1978, two years after CMI's original parent company, an investment management corporation, had gone into Chapter 11 bankruptcy proceedings. CMI had been created to sell mortgage guaranty insurance policies to res- idential mortgage lenders throughout the United States. Mortgage insurance provides banks, savings and loans, mortgage bankers, and other mortgage lenders with protection against financial losses when homeowners default on their mortgage loans, Lending institutions normally protect their property loan investments by offering loans of only 70 percent to 80 percent of the appraised value of the property; the remain- ing 20 to 30 percent constitutes the homeowner's down payment. However, mortgage loan insurance makes it possible for lenders to offer so-called high-ratio loans of up to 95 percent of a home's appraised value. High-r'atio loans are permitted only when the lender insures the loan; although the policy protects the lender, the premiums are paid by the borrower, as an addition to monthly principal and interest charges. The principal attraction of mortgage insurance is that it makes purchasing a home possible for many more individuals. It is much easier to produce a 5 percent down pay ment than to save up the 20 to 30 percent traditionally required. CMI had a mixed record of success within the private mortgage insurance industry. Frank Randall, the company's first and only president, had gotten the organization off to an aggressive beginning, attaining a 14.8 percent market share by 1972. By 1979, how- ever, that share had fallen to just over 10 percent even though revenues had grown from $18 million in 1972 to over $30 million in 1979. Randall attributed the loss of market share primarily to the difficulties created by the bankruptcy of CMI's original parent Thus, he had been quite relieved when Northwest Equipment acquired CMI in January 1978. Northwest provided CMI with a level of management and financial support it had never before enjoyed. Furthermore, Northwest's corporate management had made it clear to Frank Randall that he was expected to build CMI into a much larger, diversified financial services company. Northwest's growth expectations were highly consistent with Frank Randall's own ambitions. The stability created by the acquisition, in combination with the increasing solidity of CMI's reputation with mortgage lenders, made it possible for Randall to turn his attention more and more toward external acquisitions of his own. During 1978 Ran- dall, with Jim Dolan's help, had investigated several acquisition opportunities in related insurance industries, with the hope of broadening CMI's financial base. After several unsuccessful investigations, the two men had come to believe that their knowledge and competence was focused less on insurance per se than it was on residential real estate and related financial transactions. These experiences had led to a recognition that, in Frank Randall's words, "we are a residential real estate financial services company." COMPANY AND INDUSTRY BACKGROUND CMI was a wholly owned subsidiary of Northwest Equipment Corporation, a major freight transporter and lessor Frailcars, commercial aircraft, and other industrial Capital Mortgage Insurance Company (A), 9-480-057. Copyright 1980 by the President and Fellows of Harvard College This case was prepared by James P. Ware as a basis for class discussion rather than to illustrate either cffective or ineffective bandling of an administrative situation. Reprinted by permission of the Harvard Busi- ness School, Although this case is more than 20 years ok, the exitors of this volume believe that it presents valuable lessons about the negotiation process. THE RESIDENTIAL REAL ESTATE INDUSTRY Frank Randall and Jim Dolan knew from personal experience that real estate bro- kers, who play an obvious and important role in property transactions, usually have close ties with local banks and savings and loans. When' mortgage funds are plentiful, brokers often steer prospective home buyers to particular lending institutions. When funds are scarce, the lenders would then favor prospective borrowers referred by their favorite brokers. Randall believed that these informal relationships meant that realtors could have a significant impact on the mortgage loan decision aridthus on a mortgage insurance decision as well. For this reason, CMI had for many years directed a small portion of its marketing effort toward real estate brokers. CMI's activities had consisted of offering educational programs for reallors, property developers, and potential home buyers. The company derived no direct revenues from these programs, but offered them in the interest of stim- ulating home sales and, more particularly, of informing both realtors and home buyers of how mortgage insurance makes it possible to purchase a home with a relatively low down payment. Because he felt that real estate brokers could be powerful allies in encouraging lenders to use mortgage insurance, Randall had been tracking developments in the real estate industry for many years. Historically a highly fragmented collection of local; independent entrepreneurs, the industry in 1979 appeared to be on the verge of a major restructuring and consolidation. For the past several years many of the smaller brokers had been joining national franchise organizations in an effort to gain a brand image and to acquire improved management and sales skills. More significantly, in 1979, several large national corporations were beginning to acquire prominent real estate agencies in major urban areas. The most aggressive of these appeared to be Merrill Lynch and Company, the well-known Wall Street securities trad- ing firm. Merrill Lynch's interest in real estate brokers stemmed from several sources; perhaps most important were the rapidly rising prices on property and homes. Realtors' commissions averaged slightly over 6 percent of the sales price; Fortune magazine esti- mated that real estate brokers had been involved in home sales totaling approximately $190 billion in 1978, netting commissions in excess of $11 billion in comparison, stock- brokers' commissions on all securities transactions in 1978 were estimated at $3.7 bil- lion). With properly values growing 10 to 20 percent per year, commissions would only get larger; where 6 percent of a $30,000 home netted only $1,800, 6 percent of a $90,000 sale resulted in a commission well in excess of $5,000-for basically the same work. There were also clear signs that the volume of real estate transactions would continue to increase. Although voluntary intercity moves appeared to be declining slightly, corpo- rate transfers of employees were still rising. One of Merrill Lynch's carliest moves toward the real estate market had been to acquire an employee relocation company several years earlier. Working on a contract basis with corporate clients, Merrill Lynch Relocation Man- agement (MLRM) collaborated with independent real estate brukers to arrange home sales and purchases for transferred employees. Like other relocation companies, MLRM would purchase home at a fair market value and then handle all the legal and financial details of reselling the home on the open market. MLRM also provided relocation coun- seling and home scarch assistance for transferred employees; its income was derived pri- marily from service fees paid by corporate clients and augmented somewhat by referral fees from real estate brokers, who paid MLRM a portion of the commissions they earned on home sales generated by the transferred employees). Later, in September 1978, Merrill Lynch had formally announced its intention to acquire at least 40 real estate brokerage firms within three to four years. Merrill Lynch's interest in the industry stemnined not only from the profit opportunities it saw but also from a corporate desire to become a "financial services supermarket," provid- ing individual customers with a wide range of investment and brokerage services. In 1978 Merrill Lynch had acquired United First Mortgage Corporation (UFM), a mort- gage banker. And in early 1979 Merrill Lynch was in the midst of acquiring AMIC Corporation, a small mortgage insurance company in direct competition with CMI. As Fortune reported: In combination, these diverse activities hold some striking possibilities. Merrill Lynch already packages and markets mortgages through its registered representatives.... If all goes according to plan, the company could later this year be vertically integrated in a unique way. Assoming the AMIC acquisition goes through, Merrill Lynch will be able to guarantee mort- yages. It could then originate mortgages through its really brokerages, process and service them through UFM, insure them with AMIC, package them as pass-through or unit trusts, and market them through its army of registered representatives. (January 29, 1979, p. 89) It was this vision of an integrated financial services organization that also excited Frank Randall. As he and Jim Dolan reviewed their position in early 1979, they were confident that they were in a unique position to build CMI into a much bigger and more diversified company. The mortgage insurance business gave them a solid financial base, with regional offices throughout the country. Northwest Equipment stood ready to pro vide the capital they would need for significant growth. They already had relationships with important lending institutions across the United States, and their marketing efforts had given them a solid reputation with important real estate brokers as well. Thus, Randall, in particular, felt that at least he had most of the ingredients to begin building that diversified "residential real estate financial services company" he had been dreaming about for so long. Furthermore, Randall's reading of the banking, thrift, and real estate industries suggested that the time was ripe. In his view, the uncertainties the financial and housing industries created rich opportunities for taking aggressive action, and the vision of Merrill Lynch "bulling" its way into the business was scaring realtors just enough for CMI to present a comforting and familiar alternative, THE METROPOLITAN REALTY NETWORK Frank Randall spent most of the fall of 1978 actively searching for acquisition opportunities. As part of his effort, he contacted David Osgood, who was the executive director of the Metropolitan Realty Network, a national association of independent real estate brokers. The association, commonly known as MetroNet, had been formed pri- marily as a communication vehicle so its members could refer home buyers moving from one city to another to a qualified broker in the new location. Randall discovered that Osgood was somewhat concerned about. MetroNet's long- term health and viability. Though MetroNet included over 13,000 real estate agencies, it was losing some members to national franchise chains, and Osgood was feeling increasing pressures to strengthen the association by providing more services to member firms. Yet the ""Why Merrill Lynch Wants to Sell Your House." Fortune, January 29, 1979. Estimated Gross Fee Income $26,800,000 24,750,000 10,300,000 10,300,000 6,200,000 6,200,000 6,200,000 entrepreneurial independence of MetroNet's members made Osgood's task particularly difficult. He had found it almost impossible to get them to agree on what they wanted him to do. One service that the MetroNet brokers were agreed on developing was the employee relocation business. Corporate contracts to handle transferred employees were especially attractive to the brokers, because the contracts virtually guaranteed repeat business in the local area, and they also led to intercity referrals that almost always resulted in a home sale, MetroNet brokers were also resentful of how Merrill Lynch Relocation Manage- ment and other relocation services companies were getting a larger and larger share of their referral fees. Osgood told Randall that he had already set up a committee of MetroNet brokers to look into how the association could develop a corporate relocation and third-party equity capability of its own. Osgood mentioned that their only effort to date was an independent firm in Chicago named Corporate Transfer Services, Inc. (CTS), that had been started by Elliott Burr, a prominent Chicago broker and a MetroNet director. CTS had been formed with the intention of working with MetroNet brokers, but so far it had remained relatively small and had not met MetroNet's expectations. As Randall explained to Osgood what kinds of activities CMI engaged in to help lenders and increase the volume of home sales, Osgood suddenly exclaimed, "That's exactly what we're trying to do!" The two men ended their initial meeting convinced that some kind of working relationship between CMI and MetroNet could have major benefits for both organizations. Osgood invited Randall to attend the next meeting of MetroNet's Third-Party Equity Committee, scheduled for March 1. "Let's explore what we can do for each other," said Osgood. You're on," concluded Randall. Estimated Value of $975,000,000 900,000,000 375,000,000 375.000.000 225,000,000 225,000,000 225,000,000 Home Purchases Home Purchases Estimated 1978 13.000 2,000 5,000 5,000 3,000 3,000 3,000 Parent Organization Merrill Lynch Peterson, Howell, & Heather Equitable Life Insurance Chicago Title and Trust Control Data Corporation Sears/Coldwell Banker Transamerica, Inc. THE THIRD-PARTY EQUITY BUSINESS Randall's discussion with David Osgood had opened his eyes to the third-party equity business, and he and Jim Dolan spent most of their time in preparation for the March 1 committee meeting steeped in industry studies and pro forma income statements. They quickly discovered that the employee relocation services industry was highly competitive, though its future looked bright. Corporate transfers of key employees appeared to be an ingrained practice that showed no signs of letting up in the foreseeable future. Merrill Lynch Relocation Management was one of the two largest firms in the industry; most of the prominent relocation companies were well-funded subsidiaries of large, well-known corporations. Exhibit I contains Jim Dolan's tabulation of the seven major relocation firms, along with his estimates of each company's 1978 volume of home purchases. Dolan also developed a pro forma income and expense statement for a hypothetical firm handling 2,000 home purchases annually (see Exhibit 2). His calculations showed a EXHIBIT 1 Major Employee Relocation Services Companies Relocation Company Merrill Lynch Relocation Equitable Relocation Relocation Realty Corporation Employee Transfer Homequity Transamerica Relocation Executrans *Assumes average home values of $75,000. *Assumes fec averaging 2.75 percent of value of homes purchased. The term third-party equiry capability derived from the fact that a relocation services company actually purchased an employee's home, freeing up the owner's equity and making it available for investment in a new home. Within the industry, the terms third-party equity company and employee relocation services company were generally used interchangeably. EXHIBIT 2 Hypothetical Employee Relocation Company Pro Forma Income Statement Key assumptions 1. Annual purchase volume of 2.000 homes. 2. Assume average holding period of 120 days. Inventory turns over three times antually, for an average of 667 units in inventory at any point in time, 3. Average home value of $75,000. 4. Existing mortgages on homes average 50 percent of property value. Additional required capital will be 40 percent equity, 60 percent long-term debt. 5. Fee income from corporate clients will average 2.75 percent of value of properties purchased (based on historical industry data). 6. Operating expenses (marketing, sales, office administration) will average 1 percent of value of properties purchased (all costs associated with purchases, including debt service, are billed back to corporate clients). Calculations Total value of purchases (2,000 units at $75,000) $150,000,000 Average inventory value 50,000,000 Capital required Existing mortgages 25,000,000 New long-term debt 15,000,000 Equity 10,000,000 Fee income at 2.75% 4,125,000 Operating expenses at 1% 1.500.000 Net income $2,625,000 Tax at 50% (1.312 500) Profit after tax $1,312,500 Return on equity 13.1% proposed specifically that MI build an operating company to handle the corporate relo- cation business jointly with the MetroNet brokers. As a quid pro quo, Randall suggested that the brokers could market CMI mortgage insurance to both potential home buyers and lending institutions. The committee's response to this idea was initially skeptical. Finally, however, they agreed to consider a more formal proposal at a later date. MetroNet's board of directors was scheduled to meet on April 10; the Third-Party Equity Committee could review the proposal on April 9 and, if they approved, present it to the full board on the 10th. As the committee meeting broke up, Randall and Dolan began talking with Elliott Burr and Thomas Winder, two of the four owners of Corporate Transfer Services, Inc. (CTS). Though Burr had been the principal founder of CTS, his primary business was a large real estate brokerage firm in north suburban Chicago that he operated in partnership with William Lehman, who was also a CTS stockholder. The four men sat back down at the meeting table, and Randall mentioned that his primary interest was to learn more about how an employee relocation business operated. Burr offered to send him copies of contracts with corporate clients, sample financial statements, and so on. At one point during their discussion Burr mentioned the possibil- ity of an acquisition. Randall asked, somewhat rhetorically, "How do you put a value on a company like this?" Burr responded almost immediately, "Funny you should ask. We've talked to attorney and have put together this proposal." Burr reached into his briefcase and pulled out a two-page document. He then proceeded to describe a complex set of terms involving the sale of an 80 percent interest in CTS, subject to guarantees concerning capitalization, lines of credit, data processing support, future distribution of profits and dividends, and more. Randall backed off immediately, explaining that he needed learn more about the nature of the business before he would seriously consider an acquisition. As Jim Dolan later recalled: I think they were expecting an offer right then and there. But it was very hard to understand what they really wanted; it was nothing we could actually work from. Besides that, the num- bers they were thinking about were ridiculously high-over $5 mi We put the letter away and told them we didn't want to get specific until after the April 10 meeting. And that's the way we left it. potential 13.1 percent return on equity (ROE). Dolan then discovered that some compa- nics achieved a much higher ROE by using a Home Purchase Trust, a legal arrangement that made it possible to obtain enough bank financing to leverage a company's equity base by as much as 10 to 1. Randall and Dolan were increasingly certain that they wanted to get CMI into the employee relocation services business. They saw it as a natural tie-in with CMI's mort- gage insurance operations one that could exploit the same set of relationships that CMI already had with banks, realtors, savings and loans, and other companies involved in the development, construction, sale, and financing of residential real estate. The men felt that real estate brokers had a critically important role in the process. Brokers were not only involved in the actual property transactions, but in addition they almost always had local contacts with corporations that could lead to the signing of employee relocation contracts. Equally important, from Randall's and Dolan's perspective, was their belief that a close relationship between CMI and the MetroNet brokers would also lead to significant sales of CMI's mortgage insurance policies. The March 1 meeting with MetroNet's Third-Party Equity Committee turned into an exploration of how CMI and MetroNet might help each other by stimulating both home sales and high-ratio mortgage loans. After several hours of discussion, Frank Randall PREPARATION FOR THE APRIL 10 MEETING During the next six weeks Randall and Dolan continued their investigations of the employee relocation industry and studied CTS much more closely. One of their major questions was how much additional mortgage insurance the MetroNet brokers might be able to generate. Frank Randall had CMI's marketing staff conduct a telephone survey of about 25 key MetroNet brokers. The survey suggested that most brokers were aware of mortgage insurance, although few of them were actively pushing it. All of those questioned expressed an interest in using CMI's mar- keting programs, and were eager to learn more about CMI insurance, By early May a fairly clear picture of CTS was emerging. The company had been founded in 1975; it had barely achieved a breakeven profit level. Annual home purchases and sales had reached a level of almost 500 properties, and CTS has worked with about 65 MetroNet brokers and 35 corporate clients. Tom Winder was the general manager, he supervised a staff of about 25 customer representatives and clerical support staff. Con- versations with David Osgood and several MetroNet brokers who had worked with CTS suggested that the company had made promises to MetroNet about developing a nation wide, well-financed, fully competitive organization. To date, however, those promises were largely unfulfilled. Osgood believed that CTS's shortage of equity and, therefore, borrowing capacity, had severely limited its growth potential. Jim Dolan obtained a copy of CTS's December 1978 balance sheet that, in Iris mind, confirmed Osgood's feelings (see Exhibit 3). The company had a net worth of only $420,000. Three of the four stockholders (Elliott Burr, William Lehman, and Michael Kupchak) had invested an additional $2 million in the company$1.3 million in short-term notes and $700,000 in bank loans that they had personally guaranteed, While CTS owned homes valued at $13.4 million, it also had additional bank loans and assumed mortgages totaling $9.8 million. Furthermore, the company had a highly uncertain camnings stream; Frank Randall believed the current business could tail off to almost nothing within six months. During late March both Randall and Dolan had a number of telephone conversa- tions with Burr and Winder. Their discussions were wide ranging and quite open; the CTS partners struck Randall as being unusually candid. They seemed more than willing to share everything they knew about the business and their own company. On one occa- sion, Burr asked how much of CTS Randall wanted to buy and how Randall would feel about the present owners retaining a minority interest. Burr's question led Randall and Dolan to conclude that in fact they wanted full ownership. They planned to build up the company's equity base considerably and wanted to gain all the benefits of a larger, more profitable operation for CMI. In early April, Randall developed the formal proposal that he intended to present to MetroNet's board of directors (see Exhibit 4). The proposal committed CMI to enter negotiations to acquire CTS and to use CTS as a base for huilding a third-party equity company with a capitalization sufficient to support an annual home purchase capability of at least 2,000 units. In return, the proposal asked MetroNct to begin a program of actively supporting the use of CMI's insurance on high-ratio loans. Randall and Dolan met again with the Third-Party Equity Committee in New York on April 9 to preview the CMI proposal. The committee reacted favorably, and the next day MetroNet's board directors unanimously accepted the proposal after discussing it for less than 15 minutes. EXHIBIT 3 CTS Balance Sheet CORPORATE TRANSFER SERVICES, INC. Unaudited Balunce Sheet December 1978 Assets ($ 000) Cash $ 190 Homes owned 13,366 Accounts and acquisition fees receivable 665 Other (mainly escrow deposits) 143 $14.364 Liabilities Client prepayments $1,602 Notes payable to banks 4.161 Assumed mortgages puyable 5,670 Loun from stockholders 700 Advance from MetroNet 300 Other liabilities 20 $12,644 Capital Subordinated debenture due stockholder (April 1981) 1,300 Common stock 450 Deficit (30) $14,364 Our letter of agreement committed us to having an operating company by July 12, so the clock was running on us. However, we know that after the April 10 board meeting they would be hard pressed not to be bought, and besides they were obviously pretty eager. But at that point in time we had not even met the other two stockholders; we suspected the high numbers were coming from them. FORMAL NEGOTIATIONS WITH CORPORATE TRANSFER SERVICES On the afternoon of April 10, following the MetroNet board meeting, Randall and Dolan met again with Elliott Burr and Tom Winder. Now that CMI was formally com- mitted to acquisition negotiations, Burr and Winder were eager to get specific and talk numbers. However, Randall and Dolan remained very cautious. When Burt expressed an interest in discussing a price, Randall replied, "We don't know what you're worth. But we'll entertain any reasonable argument you want to make for why we should pay more than your net worth." The meeting ended with a general agreement to firmn things up by April 25. Later, reflecting on this session, Jim Dolan commented: FURTHER ASSESSMENT OF CTS Even though the April 10 meeting had ended with an agreement to move ahead by April 25, it quickly became evident that a complete assessment of CTS and preparation of a formal offer would take more than two weeks. Other operating responsibilities pre- vented both Randall and Dolan from devoting as much time as they had intended to the acquisition, and the analysis process itself required more time than they had expected. During the first week of May, Jim Dolan made a "reconnaissance" trip to Chicago. His stated purpose was to examine CTS's books and talk with the company's local bankers. He also scrutinized the office facilities, met and talked with several office employees, observed Torri Winder interacting with customers and subordinates, and generally assessed the company's operations. Dolan spent most of his time with Winder, but he also had an opportunity to have dinner with William Lehman, another of CTS's stockholders. Dolan returned to Philadelphia with a generally favorable set of imprcs- sions about the company's operations and a much more concrete understanding of its financial situation. He reported to Randall, They're running a responsible organization EXHIBIT 5 Draft of Purchase Letter The Board of Directors and Stockholders Corporate Transfer Services, Inc. Chicago, IL May 24, 1979 Gentlemen: Capital Mortgage Insurance Corporation (the Purchaser") hereby agrees to purchase from you (the "Stockholders), and you, the Stockholders, hereby jointly and severally agree to sell to us, the Purchaser, 100 percent of the issued and outstanding shares of capital stock of Corporate Transfer Services (the "Company) on the following terms and conditions. Purchase Price. Subject to any adjustment under the following paragraph, the Purchase Price of the Stock shall be the sum of $400,000.00 (four hundred thousand dollars even) and an amount equal to the Company's net worth as reflected in its audited financial statements on the closing date (the "Closing Date Net Worth"). Adjustment of Purchase Price. The Purchase Price shall be reduced or increased, as the case may be, dollar-for-dollar by the amount, if any, by which the net amount realized on the sale of homes owned as of the Closing Date is exceeded by, or exceeds, the value attributed to such homes in the Closing Date Net Worth. Continuation of Employment. Immediately upon consummation of the transaction, the Pur- chaser will enter into discussion with Mr. Thomas Winder with the intent that he continue employment in a management capacity at a mutually agreeable rate of pay. Mr. Winder will relo- cate to Philadelphia, Pennsylvania, and will be responsible for the sale of all homes owned by the Company at the Closing Date. Covenant-Not-to-Compete. At the closing, each Stockholder will execute and deliver a covenant-not-to-compete agreeing that he will not engage in any capacity in the business con- ducted by the Company for a period of two years. If the foregoing correctly states our agreement as to this transaction, please sign below. Very truly yours, CAPITAL MORTGAGE INSURANCE CORPORATION The foregoing is agreed to and accepted. President EXHIBIT 5 Draft of Purchase Letter The Board of Directors and Stockholders Corporate Transfer Services, Inc. Chicago, IL May 24, 1979 Gentlemen: Capital Mortgage Insurance Corporation (the Purchaser") hereby agrees to purchase from you (the "Stockholders), and you, the Stockholders, hereby jointly and severally agree to sell to us, the Purchaser, 100 percent of the issued and outstanding shares of capital stock of Corporate Transfer Services (the "Company) on the following terms and conditions. Purchase Price. Subject to any adjustment under the following paragraph, the Purchase Price of the Stock shall be the sum of $400,000.00 (four hundred thousand dollars even) and an amount equal to the Company's net worth as reflected in its audited financial statements on the closing date (the "Closing Date Net Worth"). Adjustment of Purchase Price. The Purchase Price shall be reduced or increased, as the case may be, dollar-for-dollar by the amount, if any, by which the net amount realized on the sale of homes owned as of the Closing Date is exceeded by, or exceeds, the value attributed to such homes in the Closing Date Net Worth. Continuation of Employment. Immediately upon consummation of the transaction, the Pur- chaser will enter into discussion with Mr. Thomas Winder with the intent that he continue employment in a management capacity at a mutually agreeable rate of pay. Mr. Winder will relo- cate to Philadelphia, Pennsylvania, and will be responsible for the sale of all homes owned by the Company at the Closing Date. Covenant-Not-to-Compete. At the closing, each Stockholder will execute and deliver a covenant-not-to-compete agreeing that he will not engage in any capacity in the business con- ducted by the Company for a period of two years. If the foregoing correctly states our agreement as to this transaction, please sign below. Very truly yours, CAPITAL MORTGAGE INSURANCE CORPORATION The foregoing is agreed to and accepted. President Discussion Questions For Capital Mortgage Insurance Case: 1. How did Randall & Dolan prepare for the negotiation? 2. How did CTS prepare for the negotiation? 3. What strategy should CTS and CMI use in the negotiation? 4. Once CTS presents their initial offer, what question should they expect from CMI