Question: Can someone please help me with this, in particular b, c and d. Thanks! Q3 (Essential to cover) Consider a four-year bond with a face

Can someone please help me with this, in particular b, c and d.

Thanks!

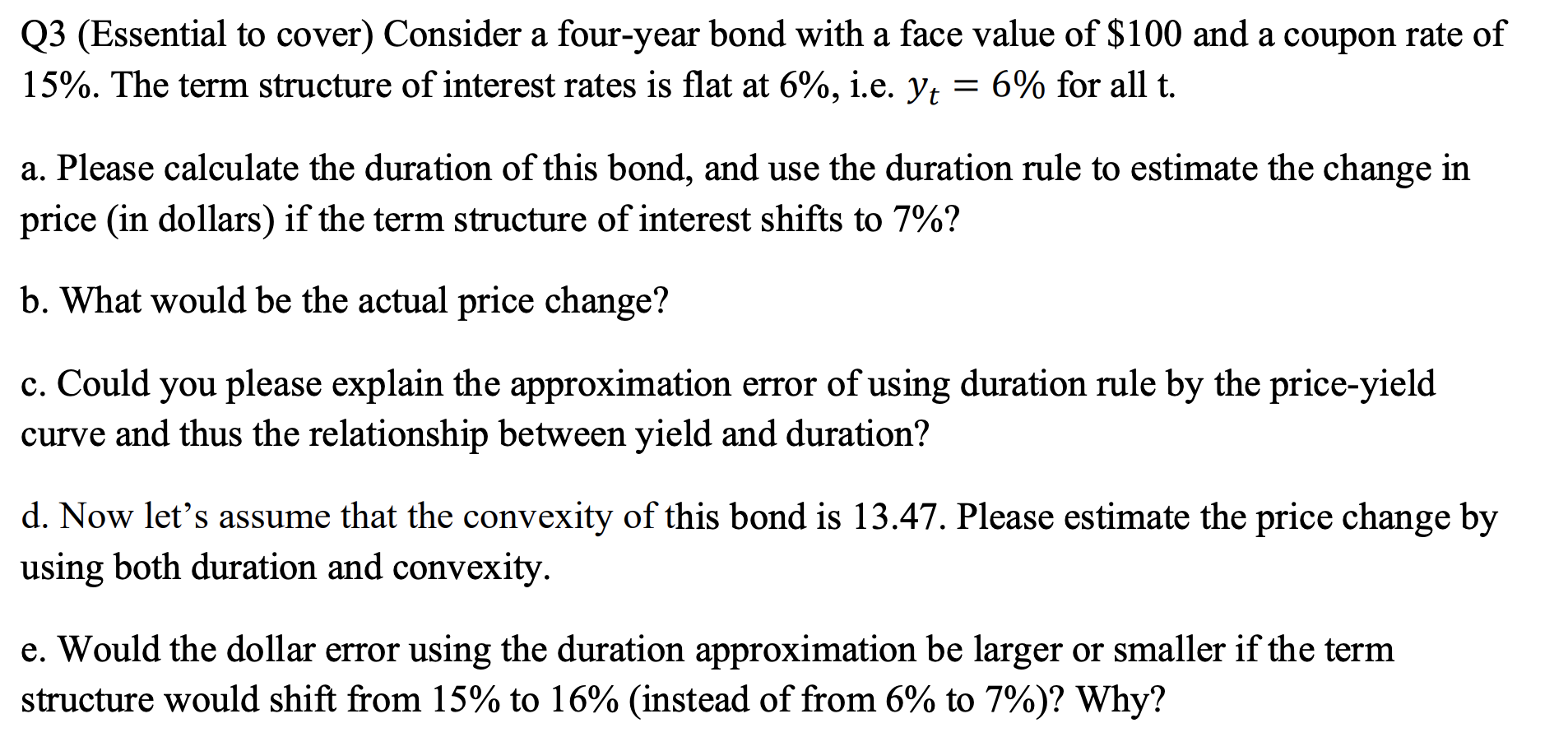

Q3 (Essential to cover) Consider a four-year bond with a face value of $100 and a coupon rate of 15%. The term structure of interest rates is flat at 6%, i.e. Yt = 6% for all t. a. Please calculate the duration of this bond, and use the duration rule to estimate the change in price (in dollars) if the term structure of interest shifts to 7%? b. What would be the actual price change? c. Could you please explain the approximation error of using duration rule by the price-yield curve and thus the relationship between yield and duration? d. Now let's assume that the convexity of this bond is 13.47. Please estimate the price change by using both duration and convexity. e. Would the dollar error using the duration approximation be larger or smaller if the term structure would shift from 15% to 16% (instead of from 6% to 7%)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts