Question: Can Someone please help me with this problem? During Heaton Company's first two years of operations, the company reported absorption costing net operating income as

Can Someone please help me with this problem?

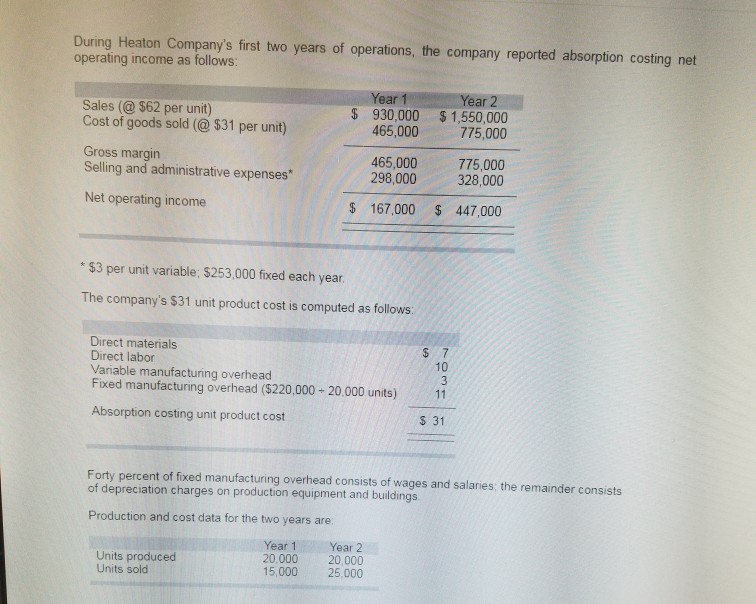

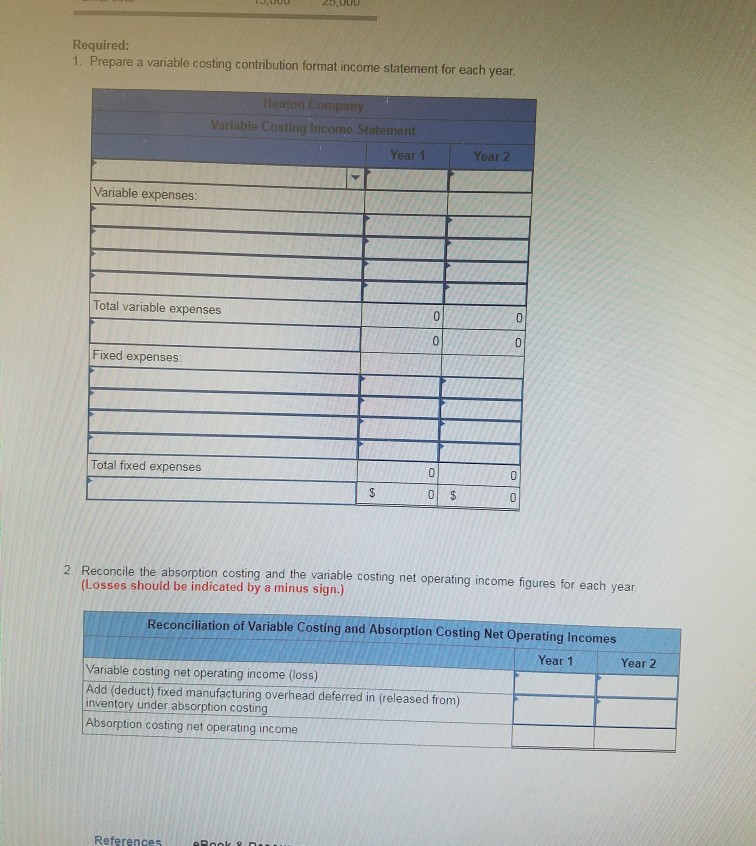

During Heaton Company's first two years of operations, the company reported absorption costing net operating income as follows Year 1 Year 2 Sales (@ $62 per unit) Cost of goods sold (@ $31 per unit) $ 930,000 $1,550,000 465,000 775,000 Gross margin Selling and administrative expenses* 465,000 298,000 775,000 328,000 Net operating income $ 167,000 447,000 $3 per unit variable; $253,000 fixed each year. The company's $31 unit product cost is computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($220,000 10 20.000 units) 11 S 31 Absorption costing unit product cost Forty percent of fixed manufacturing overhead consists of wages and salaries: the remainder consists of depreciation charges on production equipment and buildings Production and cost data for the two years are: Units produced Units sold Year 1Year 2 20,000 20,000 15,000 25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts