Question: Can someone please help me with this question. I'll upvote for a fast response. Quick Concepts produce and sell phone cases at its factory. The

Can someone please help me with this question. I'll upvote for a fast response.

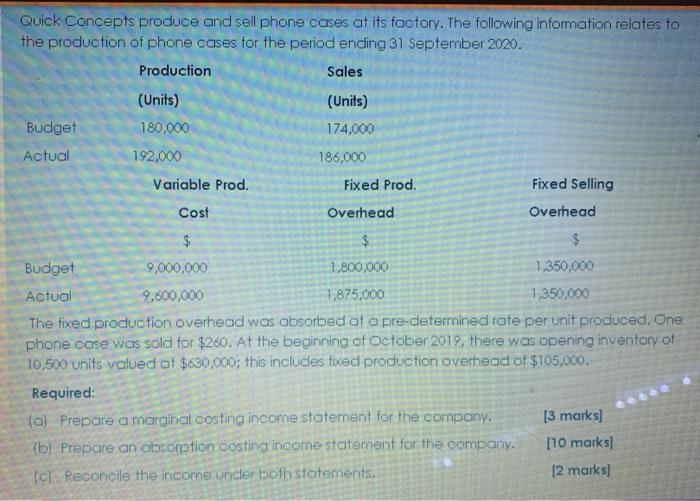

Quick Concepts produce and sell phone cases at its factory. The following information relates to the production of phone cases for the period ending 31 September 2020. Production Sales (Units) (Units) Budget 180,000 174,000 Actual 192,000 186,000 Variable Prod. Fixed Prod. Fixed Selling Cost Overhead Overhead $ $ $ Budget 9,000,000 1.800.000 1,350,000 Actual 9,600,000 1,875,000 1,350,000 The fixed production overhead was absorbed at a pre-determined rate per unit produced. One phone case was sold for $260. At the beginning of October 2018, there was opening inventory of 10,500 units valued at $630,000; this includes fixed production overhead of $105,000 Required: (al Prepare a marginal costing income statement for the company. [3 marks] (bl Prepare an absorption costing income statement for the company. [10 marks) (c) Reconcile the income under both statements. [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts