Question: Can someone please help me work out this problem? Attached below is an example to help. attached is a problem and an example to help

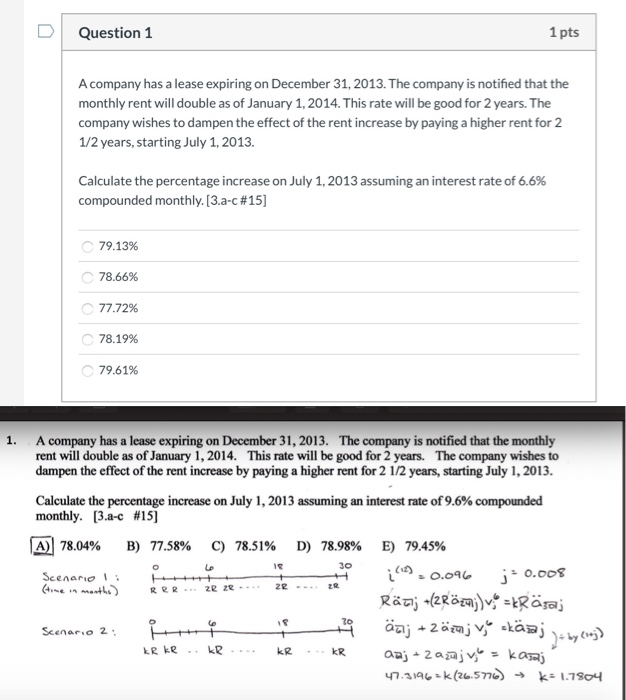

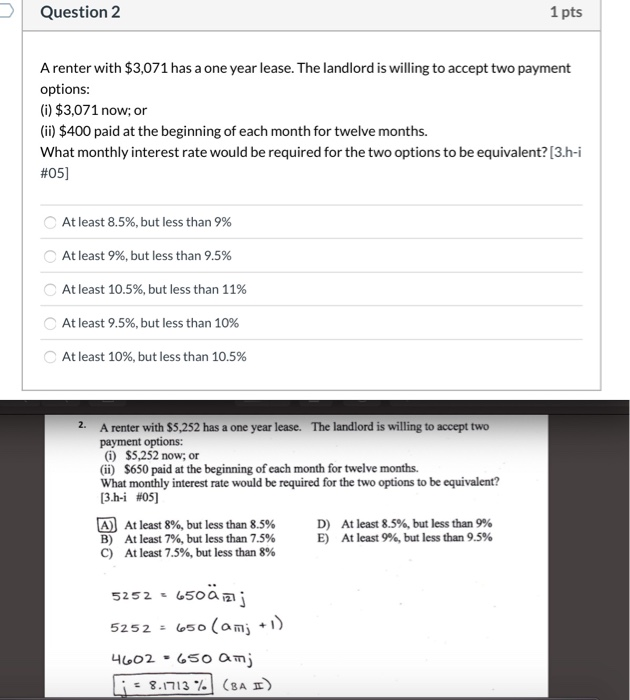

Question 1 1 pts A company has a lease expiring on December 31, 2013. The company is notified that the monthly rent will double as of January 1, 2014. This rate will be good for 2 years. The company wishes to dampen the effect of the rent increase by paying a higher rent for 2 1/2 years, starting July 1, 2013. Calculate the percentage increase on July 1, 2013 assuming an interest rate of 6.6% compounded monthly. (3.a-c #15] 79.13% 78.66% 77.72% 78.19% 79.61% 1. A company has a lease expiring on December 31, 2013. The company is notified that the monthly rent will double as of January 1, 2014. This rate will be good for 2 years. The company wishes to dampen the effect of the rent increase by paying a higher rent for 2 1/2 years, starting July 1, 2013. Calculate the percentage increase on July 1, 2013 assuming an interest rate of 9.6% compounded monthly. [3.a-c #15] A) 78.04% B) 77.58% C) 78.51% D) 78.98% E) 79.45% ().0.096 ; +0.008 Raj +(zRmaj) = kRsaj Scenario 2 + aj + Zzaj v skaj - by (vej) KR KR. KR ... KR . KR aaj + Zazaj v = kazaj 47.3196=k (26.5776) k= 1.7804 CINE A month BBR2R 20 2R - Question 2 1 pts A renter with $3,071 has a one year lease. The landlord is willing to accept two payment options: () $3,071 now; or (ii) $400 paid at the beginning of each month for twelve months. What monthly interest rate would be required for the two options to be equivalent? (3.h-i #05] At least 8.5%, but less than 9% At least 9%, but less than 9.5% At least 10.5%, but less than 11% At least 9.5%, but less than 10% At least 10%, but less than 10.5% 2. A renter with $5,252 has a one year lease. The landlord is willing to accept two payment options: (i) $5,252 now; or (ii) $650 paid at the beginning of each month for twelve months. What monthly interest rate would be required for the two options to be equivalent? [3.h-i #05) A) At least 8%, but less than 8.5% D) At least 8.5%, but less than 9% B) At least 7%, but less than 7.5% E) At least 9%, but less than 9.5% C) At least 7.5%, but less than 8% 5252 - 650 0 2 5252 = 650 (am; +1) 4602650 am F = 8.1713 % (BA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts