Question: Can someone please help? This is the only information provided Bramble inc. uses LIFO inventory costing. At January 1,2025, inventory was $215,197 at both cost

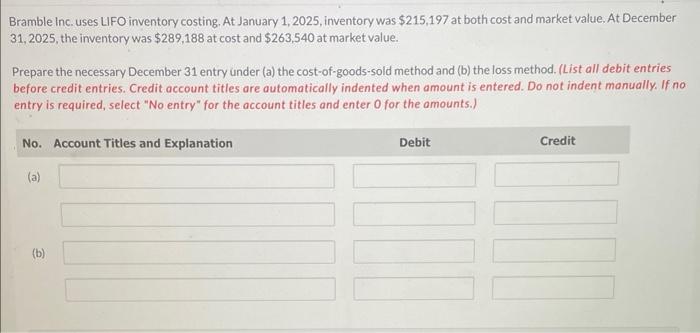

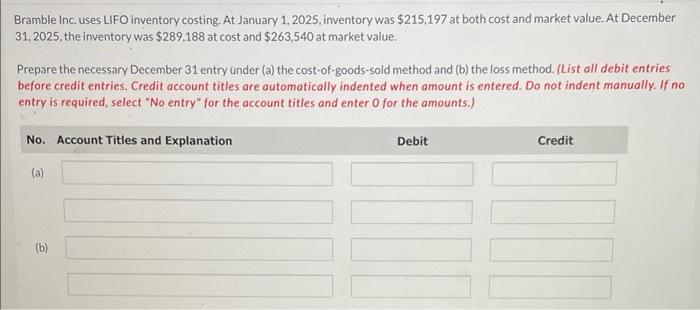

Bramble inc. uses LIFO inventory costing. At January 1,2025, inventory was $215,197 at both cost and market value. At December 31,2025 , the inventory was $289,188 at cost and $263.540 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Bramble Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $215,197 at both cost and market value. At December 31,2025 , the inventory was $289,188 at cost and $263,540 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts