Question: Can someone please help with these two related multiple choice questions. Question 3 PFM Pic is considering the purchase of a new machine. It has

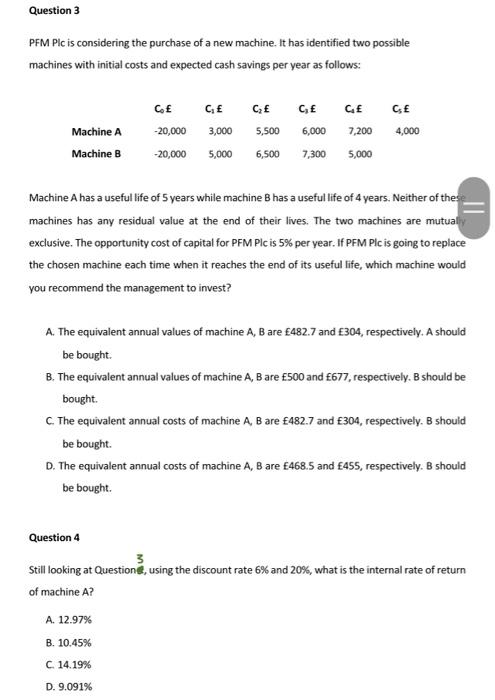

Question 3 PFM Pic is considering the purchase of a new machine. It has identified two possible machines with initial costs and expected cash savings per year as follows: GE CE GE -20,000 -20,000 C, E 6,000 GE 4,000 Machine A Machine B 5,500 GE 7,200 5,000 3,000 5,000 6,500 7,300 Machine A has a useful life of 5 years while machine B has a useful life of 4 years. Neither of these machines has any residual value at the end of their lives. The two machines are mutually exclusive. The opportunity cost of capital for PFM Pic is 5% per year. If PFM Pic is going to replace the chosen machine each time when it reaches the end of its useful life, which machine would you recommend the management to invest? A. The equivalent annual values of machine A, B are 482.7 and 304, respectively. A should be bought B. The equivalent annual values of machine A, B are 500 and 677, respectively. B should be bought C. The equivalent annual costs of machine A, B are 482.7 and 304, respectively. B should be bought D. The equivalent annual costs of machine A, B are 468.5 and 455, respectively. B should be bought Question 4 Still looking at Questions, using the discount rate 6% and 20%, what is the internal rate of return of machine A? A. 12.97% B. 10.45% C. 14.19% D. 9.091%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts