Question: Can someone please help with this question? It has been very complicating. 3. Peter and Blair recently reviewed their future retirement income and expense projections.

Can someone please help with this question? It has been very complicating.

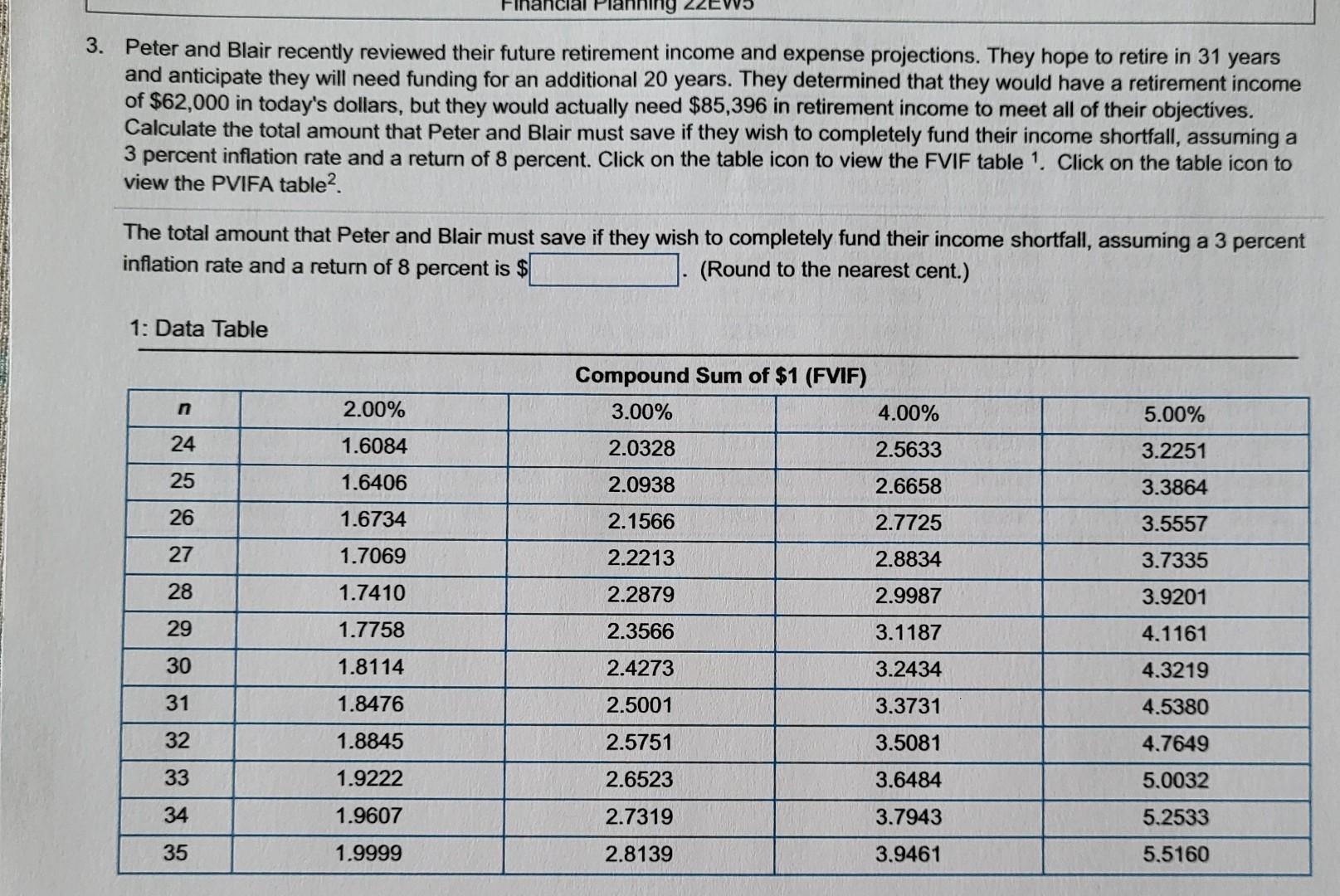

3. Peter and Blair recently reviewed their future retirement income and expense projections. They hope to retire in 31 years and anticipate they will need funding for an additional 20 years. They determined that they would have a retirement income of $62,000 in today's dollars, but they would actually need $85,396 in retirement income to meet all of their objectives. Calculate the total amount that Peter and Blair must save if they wish to completely fund their income shortfall, assuming a 3 percent inflation rate and a return of 8 percent. Click on the table icon to view the FVIF table 1. Click on the table icon to view the PVIFA table. The total amount that Peter and Blair must save if they wish to completely fund their income shortfall, assuming a 3 percent inflation rate and a return of 8 percent is $ (Round to the nearest cent.) 1: Data Table Financ 24 25 26 27 28 29 30 31 32 33 34 35 2.00% 1.6084 1.6406 1.6734 1.7069 1.7410 1.7758 1.8114 1.8476 1.8845 1.9222 1.9607 1.9999 Compound Sum of $1 (FVIF) 3.00% 2.0328 2.0938 2.1566 2.2213 2.2879 2.3566 2.4273 2.5001 2.5751 2.6523 2.7319 2.8139 4.00% 2.5633 2.6658 2.7725 2.8834 2.9987 3.1187 3.2434 3.3731 3.5081 3.6484 3.7943 3.9461 5.00% 3.2251 3.3864 3.5557 3.7335 3.9201 4.1161 4.3219 4.5380 4.7649 5.0032 5.2533 5.5160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts