Question: can someone please please please help me with this one ? A company owns a water disposal system for produced water in oil fields. This

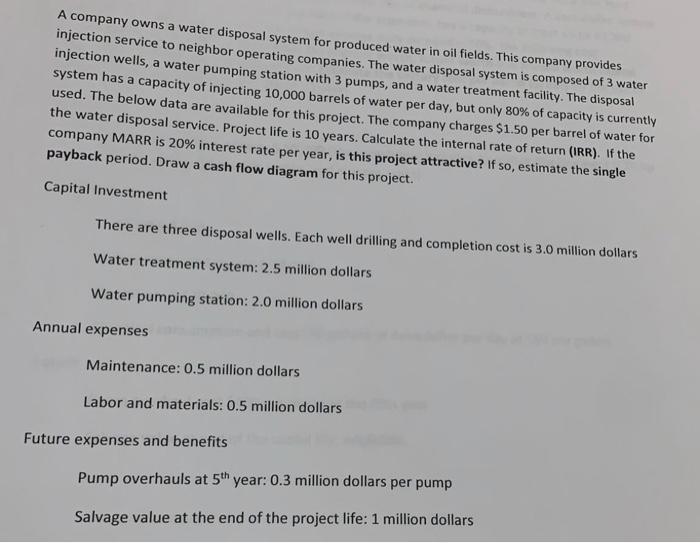

A company owns a water disposal system for produced water in oil fields. This company provides injection service to neighbor operating companies. The water disposal system is composed of 3 water injection wells, a water pumping station with 3 pumps, and a water treatment facility. The disposal system has a capacity of injecting 10,000 barrels of water per day, but only 80% of capacity is currently used. The below data are available for this project. The company charges $1.50 per barrel of water for the water disposal service. Project life is 10 years. Calculate the internal rate of return (IRR). If the company MARR is 20% interest rate per year, is this project attractive? If so, estimate the single payback period. Draw a cash flow diagram for this project. Capital Investment There are three disposal wells. Each well drilling and completion cost is 3.0 million dollars Water treatment system: 2.5 million dollars Water pumping station: 2.0 million dollars Annual expenses Maintenance: 0.5 million dollars Labor and materials: 0.5 million dollars Future expenses and benefits Pump overhauls at 5th year: 0.3 million dollars per pump Salvage value at the end of the project life: 1 million dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts