Question: Can someone please show me how to solve these tax-problems. Thank you. Kent Knobe gifted a car worth $25,000 to Larry Lawson, Kent had an

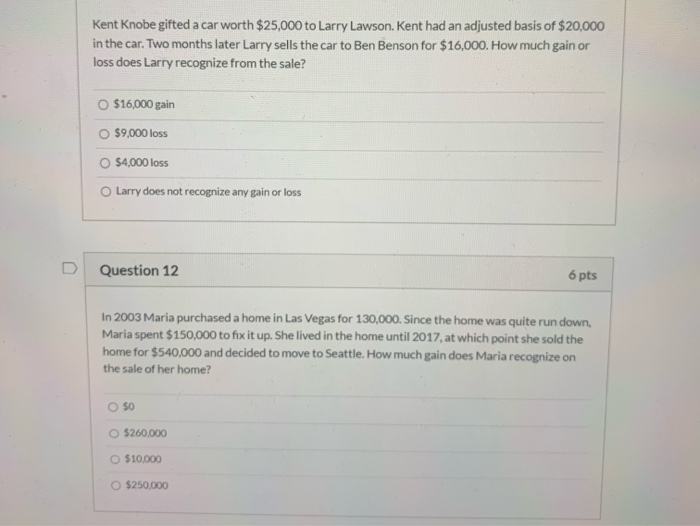

Kent Knobe gifted a car worth $25,000 to Larry Lawson, Kent had an adjusted basis of $20,000 in the car. Two months later Larry sells the car to Ben Benson for $16,000. How much gain or loss does Larry recognize from the sale? $16,000 gain O $9,000 loss 54,000 loss Larry does not recognize any gain or loss Question 12 6 pts In 2003 Maria purchased a home in Las Vegas for 130,000. Since the home was quite run down, Maria spent $150,000 to fix it up. She lived in the home until 2017, at which point she sold the home for $540,000 and decided to move to Seattle. How much gain does Maria recognize on the sale of her home? O 50 $260,000 o $10,000 O $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts